Question

SOLVE USING EXEL - MUST PRIVE STEP BY STEP AND FORMULAS AND FINANCIAL CALCULATOR STEPS Question1: Assume the market model where you are regressing Ri

SOLVE USING EXEL - MUST PRIVE STEP BY STEP AND FORMULAS AND FINANCIAL CALCULATOR STEPS

Question1:

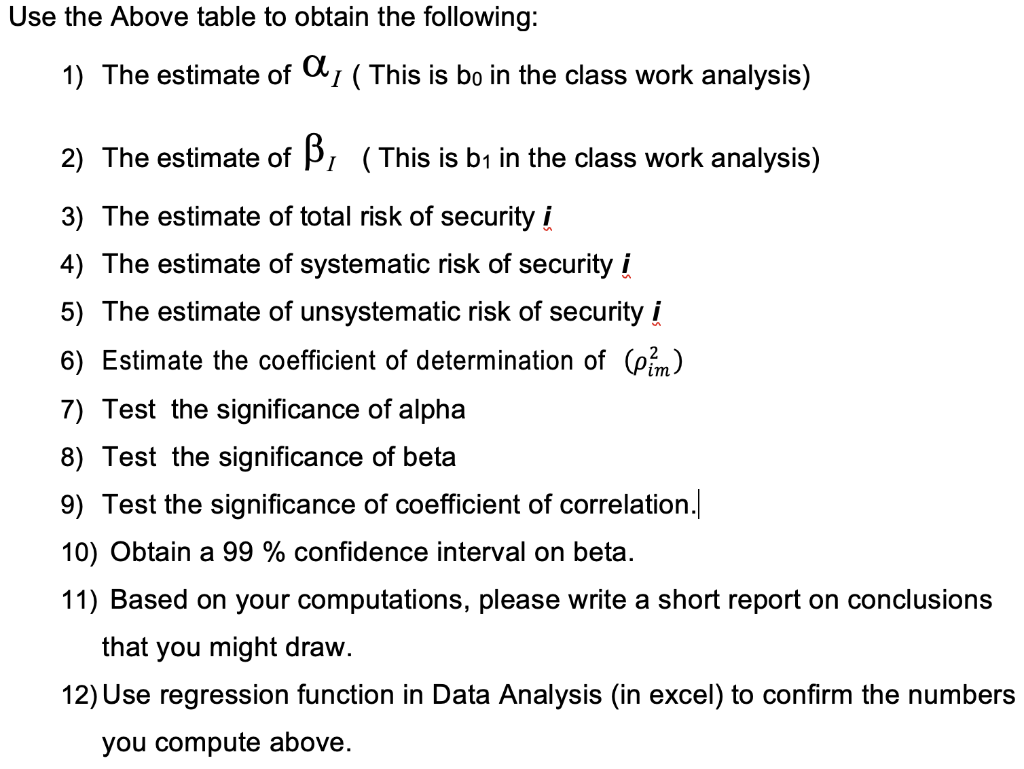

Assume the market model where you are regressing Ri (dependent variable) over Rm (independent variable).

Use excel spreadsheet to do the computations for following exercise.

| Year | Ri | Rm |

| 2010 | 0.148 | 0.168 |

| 2011 | 0.045 | 0.052 |

| 2012 | 0.333 | 0.351 |

| 2013 | 0.203 | 0.224 |

| 2014 | 0.288 | 0.3 |

| 2015 | 0.092 | 0.105 |

| 2016 | 0.038 | 0.068 |

| 2017 | 0.131 | 0.142 |

| 2018 | 0.016 | 0.028 |

| 2019 | -0.13 | -0.1 |

Question 2:

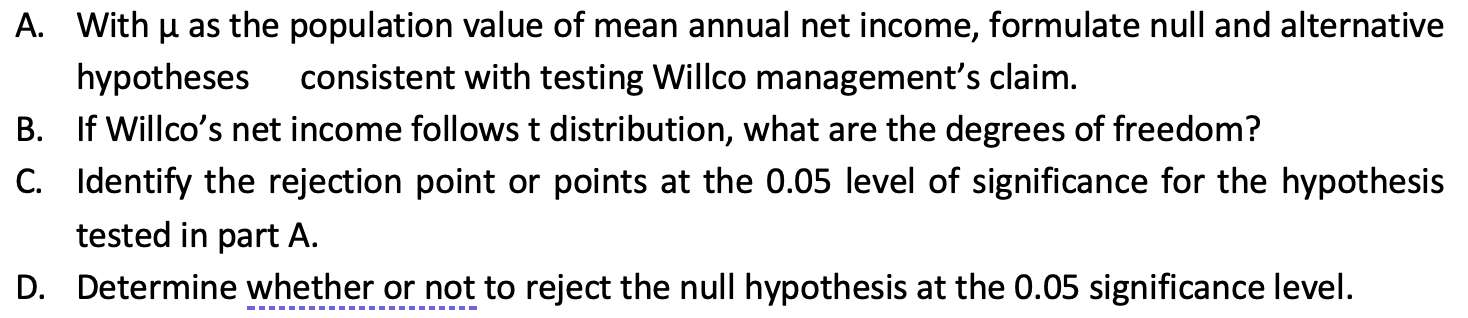

Willco is a manufacturer in a mature cyclical industry. During the most recent industry cycle, its net income averaged $30 million per year with a standard deviation of $10 million (n = 6 observations). Management claims that Willcos performance during the most recent cycle results from new approaches and that we can dismiss profitability expectations based on its average or normalized earnings of $24 million per year in prior cycles.

SOLVE USING EXEL - MUST PRIVE STEP BY STEP AND FORMULAS AND FINANCIAL CALCULATOR STEPS

Use the Above table to obtain the following: 1) The estimate of Al ( This is bo in the class work analysis) 2) The estimate of B. (This is b1 in the class work analysis) 3) The estimate of total risk of security i 4) The estimate of systematic risk of security i 5) The estimate of unsystematic risk of security i 6) Estimate the coefficient of determination of (Pim) 7) Test the significance of alpha 8) Test the significance of beta 9) Test the significance of coefficient of correlation. 10) Obtain a 99 % confidence interval on beta. 11) Based on your computations, please write a short report on conclusions that you might draw. 12) Use regression function in Data Analysis in excel) to confirm the numbers you compute above. A. With u as the population value of mean annual net income, formulate null and alternative hypotheses consistent with testing Willco management's claim. B. If Willco's net income follows t distribution, what are the degrees of freedom? C. Identify the rejection point or points at the 0.05 level of significance for the hypothesis tested in part A. D. Determine whether or not to reject the null hypothesis at the 0.05 significance level

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started