Answered step by step

Verified Expert Solution

Question

1 Approved Answer

SOLVE USING GUROBI PHYTON! 13.4 Financing an early retirement scheme The National Agricultural Bank (NAB) decides to establish an early retirement scheme for fifteen employ-

SOLVE USING GUROBI PHYTON!

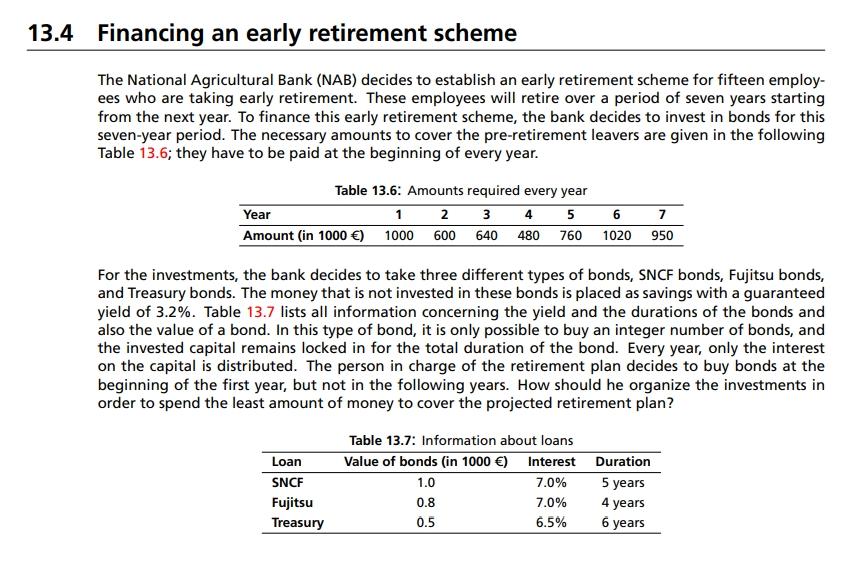

13.4 Financing an early retirement scheme The National Agricultural Bank (NAB) decides to establish an early retirement scheme for fifteen employ- ees who are taking early retirement. These employees will retire over a period of seven years starting from the next year. To finance this early retirement scheme, the bank decides to invest in bonds for this seven-year period. The necessary amounts to cover the pre-retirement leavers are given in the following Table 13.6; they have to be paid at the beginning of every year. Table 13.6: Amounts required every year Year 1 2 3 4 5 6 7 Amount (in 1000 ) 1000 600 640 480 760 1020 950 For the investments, the bank decides to take three different types of bonds, SNCF bonds, Fujitsu bonds, and Treasury bonds. The money that is not invested in these bonds is placed as savings with a guaranteed yield of 3.2%. Table 13.7 lists all information concerning the yield and the durations of the bonds and also the value of a bond. In this type of bond, it is only possible to buy an integer number of bonds, and the invested capital remains locked in for the total duration of the bond. Every year, only the interest on the capital is distributed. The person in charge of the retirement plan decides to buy bonds at the beginning of the first year, but not in the following years. How should he organize the investments in order to spend the least amount of money to cover the projected retirement plan? Loan SNCF Fujitsu Treasury Table 13.7: Information about loans Value of bonds (in 1000 ) Interest Duration 1.0 7.0% 5 years 0.8 7.0% 4 years 0.5 6.5% 6 years 13.4 Financing an early retirement scheme The National Agricultural Bank (NAB) decides to establish an early retirement scheme for fifteen employ- ees who are taking early retirement. These employees will retire over a period of seven years starting from the next year. To finance this early retirement scheme, the bank decides to invest in bonds for this seven-year period. The necessary amounts to cover the pre-retirement leavers are given in the following Table 13.6; they have to be paid at the beginning of every year. Table 13.6: Amounts required every year Year 1 2 3 4 5 6 7 Amount (in 1000 ) 1000 600 640 480 760 1020 950 For the investments, the bank decides to take three different types of bonds, SNCF bonds, Fujitsu bonds, and Treasury bonds. The money that is not invested in these bonds is placed as savings with a guaranteed yield of 3.2%. Table 13.7 lists all information concerning the yield and the durations of the bonds and also the value of a bond. In this type of bond, it is only possible to buy an integer number of bonds, and the invested capital remains locked in for the total duration of the bond. Every year, only the interest on the capital is distributed. The person in charge of the retirement plan decides to buy bonds at the beginning of the first year, but not in the following years. How should he organize the investments in order to spend the least amount of money to cover the projected retirement plan? Loan SNCF Fujitsu Treasury Table 13.7: Information about loans Value of bonds (in 1000 ) Interest Duration 1.0 7.0% 5 years 0.8 7.0% 4 years 0.5 6.5% 6 yearsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started