Answered step by step

Verified Expert Solution

Question

1 Approved Answer

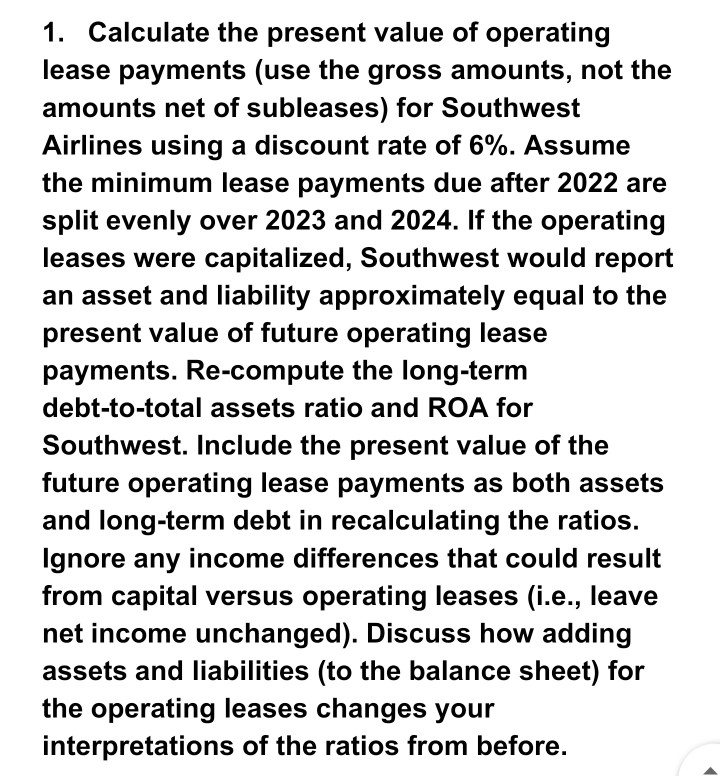

solve using most recent southwest 10K 1. Calculate the present value of operating lease payments (use the gross amounts, not the amounts net of subleases)

solve using most recent southwest 10K

1. Calculate the present value of operating lease payments (use the gross amounts, not the amounts net of subleases) for Southwest Airlines using a discount rate of 6%. Assume the minimum lease payments due after 2022 are split evenly over 2023 and 2024. If the operating leases were capitalized, Southwest would report an asset and liability approximately equal to the present value of future operating lease payments. Re-compute the long-term debt-to-total assets ratio and ROA for Southwest. Include the present value of the future operating lease payments as both assets and long-term debt in recalculating the ratios. lgnore any income differences that could result from capital versus operating leases (i.e., leave net income unchanged). Discuss how adding assets and liabilities (to the balance sheet) for the operating leases changes your interpretations of the ratios from before. 1. Calculate the present value of operating lease payments (use the gross amounts, not the amounts net of subleases) for Southwest Airlines using a discount rate of 6%. Assume the minimum lease payments due after 2022 are split evenly over 2023 and 2024. If the operating leases were capitalized, Southwest would report an asset and liability approximately equal to the present value of future operating lease payments. Re-compute the long-term debt-to-total assets ratio and ROA for Southwest. Include the present value of the future operating lease payments as both assets and long-term debt in recalculating the ratios. lgnore any income differences that could result from capital versus operating leases (i.e., leave net income unchanged). Discuss how adding assets and liabilities (to the balance sheet) for the operating leases changes your interpretations of the ratios from beforeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started