Answered step by step

Verified Expert Solution

Question

1 Approved Answer

solve without excel c) Gloria wants to give her newly-born daughter an annuity that provides payments of $5,000 per year, starting on her 21st birthday.

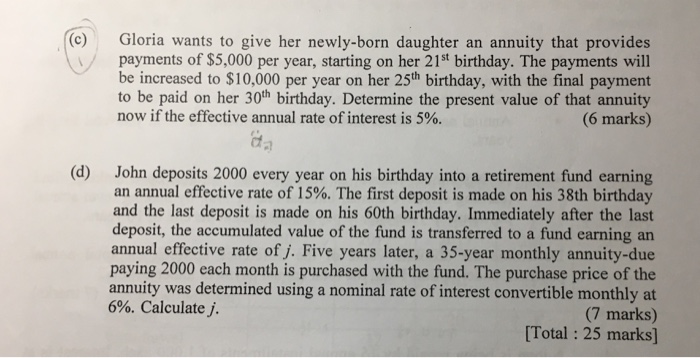

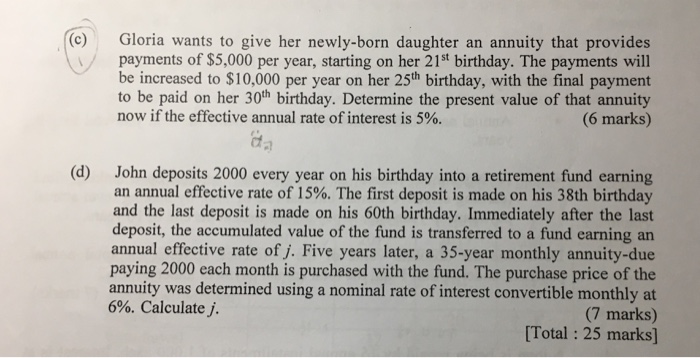

solve without excel c) Gloria wants to give her newly-born daughter an annuity that provides payments of $5,000 per year, starting on her 21st birthday. The payments will be increased to $10,000 per year on her 25th birthday, with the final payment to be paid on her 30th birthday. Determine the present value of that annuity (6 marks) now if the effective annual rate of interest is 5%. (d) John deposits 2000 every year on his birthday into a retirement fund earning an annual effective rate of 15%. The first deposit is made on his 38th birthday and the last deposit is made on his 60th birthday. Immediately after the last deposit, the accumulated value of the fund is transferred to a fund earning an annual effective rate of j. Five years later, a 35-year monthly annuity-due paying 2000 each month is purchased with the fund. The purchase price of the annuity was determined using a nominal rate of interest convertible monthly at (7 marks) [Total : 25 marks] 6%. Calculate

solve without excel c) Gloria wants to give her newly-born daughter an annuity that provides payments of $5,000 per year, starting on her 21st birthday. The payments will be increased to $10,000 per year on her 25th birthday, with the final payment to be paid on her 30th birthday. Determine the present value of that annuity (6 marks) now if the effective annual rate of interest is 5%. (d) John deposits 2000 every year on his birthday into a retirement fund earning an annual effective rate of 15%. The first deposit is made on his 38th birthday and the last deposit is made on his 60th birthday. Immediately after the last deposit, the accumulated value of the fund is transferred to a fund earning an annual effective rate of j. Five years later, a 35-year monthly annuity-due paying 2000 each month is purchased with the fund. The purchase price of the annuity was determined using a nominal rate of interest convertible monthly at (7 marks) [Total : 25 marks] 6%. Calculate

solve without excel

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started