Question

Solvency Blitz Ltd is a local bakery that, in accordance with its last audited financial statements, has the following assets and liabilities. Blitzs directors wish

Solvency

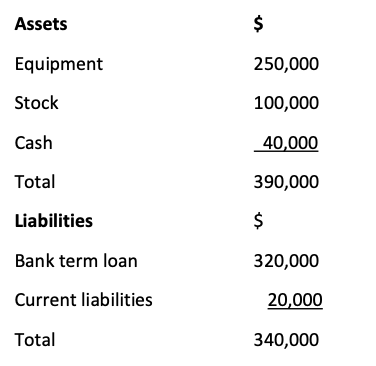

Blitz Ltd is a local bakery that, in accordance with its last audited financial statements, has the following assets and liabilities.

Blitzs directors wish to pay the shareholders a dividend totaling $30,000, to be financed by bank overdraft. Though not noted in the above accounts, a disgruntled former employee has lodged a personal grievance against Blitz claiming $25,000. The companys lawyer has advised that the former employee has a strong case, and the claim is likely to be at least partially successful.

Bernie is a director and shareholder of Blitz.

TASK

Answer the following questions. Support your answers by reference to relevant provisions in the Companies Act 1993.

a) Outline the legal test that must be applied to determine whether the directors may authorise the distribution.

b) Explain and apply the law to the relevant facts to determine whether the payment of the dividend may be authorised.

c) If payment of the dividend was permissible, explain what the directors need to do to action it.

d) What liability might Bernie bear as a director and as a shareholder if he votes for a distribution when the company is currently solvent but would no longer be solvent at the time the distribution is made.

\begin{tabular}{lr} Assets & \multicolumn{1}{l}{$} \\ Equipment & 250,000 \\ Stock & 100,000 \\ Cash & 40,000 \\ Total & 390,000 \\ Liabilities & $ \\ Bank term loan & 320,000 \\ Current liabilities & 20,000 \\ Total & 340,000 \end{tabular} \begin{tabular}{lr} Assets & \multicolumn{1}{l}{$} \\ Equipment & 250,000 \\ Stock & 100,000 \\ Cash & 40,000 \\ Total & 390,000 \\ Liabilities & $ \\ Bank term loan & 320,000 \\ Current liabilities & 20,000 \\ Total & 340,000 \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started