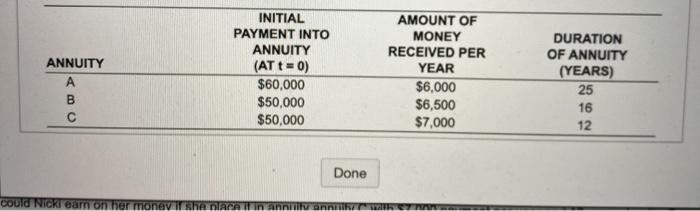

(Solving for r with annuities) Nick Johnson, a sophomore mechanical engineering student, receives a call from an insurance agent, who believes that Nicki is an older woman ready to retire from teaching. He talks to her about several annuities that she could buy that would guarantee her an annual fixed income. The annuities are as follows in the popup window If Nicki could eam 9 percent on her money by placing it in a savings account, should she place it instead in any of the annuities? Which ones, if any? Why? a. What rate of return could Nicki eam on her money if she place it in annuity Ajith $6,000 payment per year and 25 years duration? [% (Round to two decimal places.) If Nicki could earn 9 percent on her money by placing it in a savings account, should she place it instead in annuity A? (Select the best choice below.) O A Yos. Nicki should place her money in annulty A because the expected rate of return on the annuity is greater than the one on the savings account OB. No, Nicki should not place her money in annuity Abecause the expected rate of return on the annuity is smaller than the one on the savings account. b. What rate of return could Nicki cam on her money if she place it in annuity annuity with $6,500 payment per your and 16 years duration? 0% (Round to two decimal places) If Nicki could eam percont on her money by placing it in a savings account, should the place it instead in annuity B? (Select the best choice below.) O A Yos. Nicki should place her money in annuity B because the expected rate of return on the annuity is greater than the one on the savings account. OB. No. Nicki should not place her money in annuilty B because the expected rate of return on the annuity is smaller than the one on the savings account. c. What rate of return could Nicki carn on her money if she place it in annuity annuity C with $7.000 payment per year and 12 years duration? % (Round to two decimal places) 1 0 H ANNUITY B INITIAL PAYMENT INTO ANNUITY (AT t = 0) $60,000 $50,000 $50,000 AMOUNT OF MONEY RECEIVED PER YEAR $6,000 $6,500 $7,000 DURATION OF ANNUITY (YEARS) 25 16 12 Done COUID NICKI Gam on her money ir A DATA linnnnni annak