Answered step by step

Verified Expert Solution

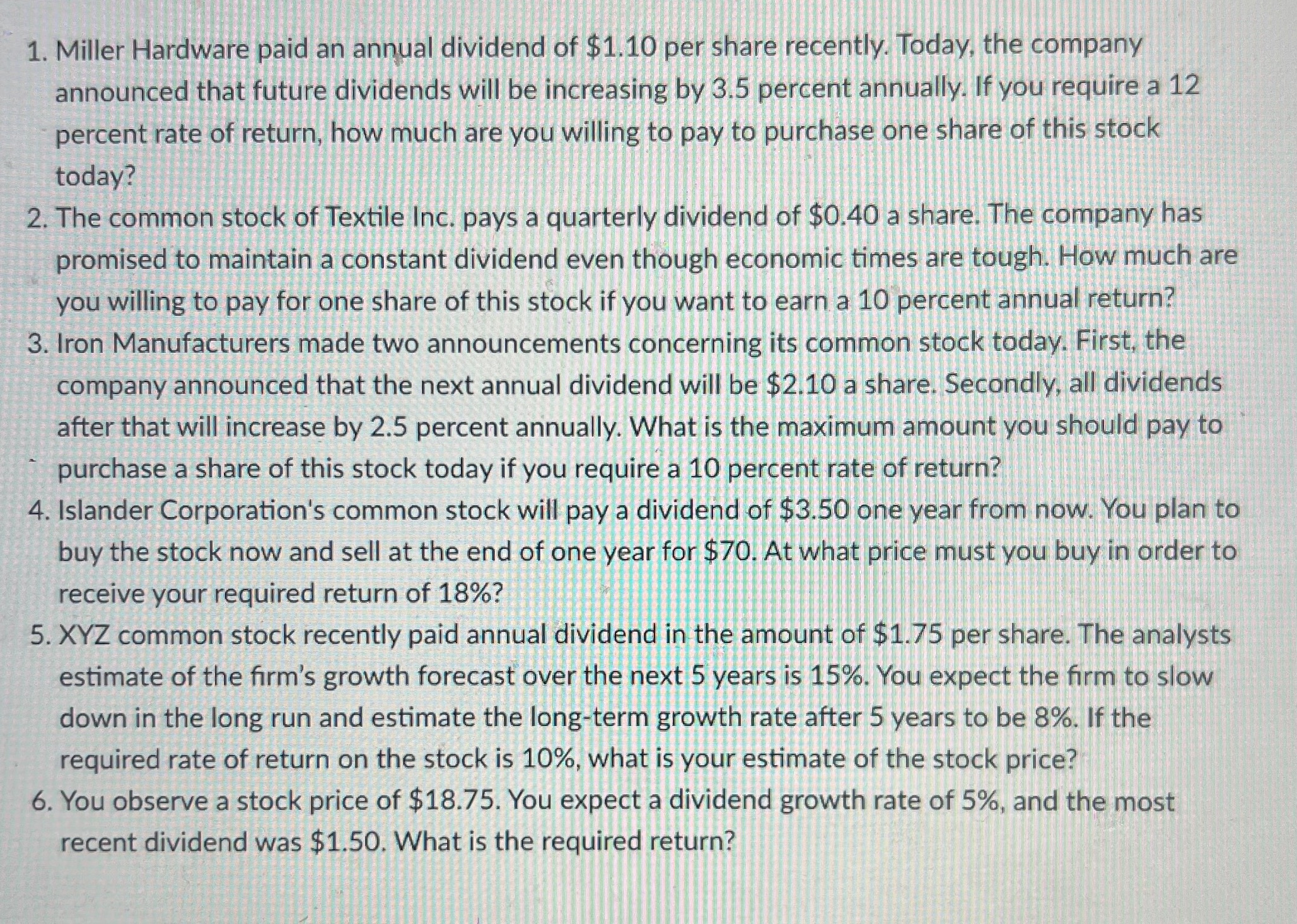

Question

1 Approved Answer

Solving in excel..... Miller Hardware paid an annual dividend of $ 1 . 1 0 per share recently. Today, the company announced that future dividends

Solving in excel.....

Miller Hardware paid an annual dividend of $ per share recently. Today, the company

announced that future dividends will be increasing by percent annually. If you require a

percent rate of return, how much are you willing to pay to purchase one share of this stock

today?

The common stock of Textile Inc. pays a quarterly dividend of $ a share. The company has

promised to maintain a constant dividend even though economic times are tough. How much are

you willing to pay for one share of this stock if you want to earn a percent annual return?

Iron Manufacturers made two announcements concerning its common stock today. First, the

company announced that the next annual dividend will be $ a share. Secondly, all dividends

after that will increase by percent annually. What is the maximum amount you should pay to

purchase a share of this stock today if you require a percent rate of return?

Islander Corporation's common stock will pay a dividend of $ one year from now. You plan to

buy the stock now and sell at the end of one year for $ At what price must you buy in order to

receive your required return of

XYZ common stock recently paid annual dividend in the amount of $ per share. The analysts

estimate of the firm's growth forecast over the next years is You expect the firm to slow

down in the long run and estimate the longterm growth rate after years to be If the

required rate of return on the stock is what is your estimate of the stock price?

You observe a stock price of $ You expect a dividend growth rate of and the most

recent dividend was $ What is the required return?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started