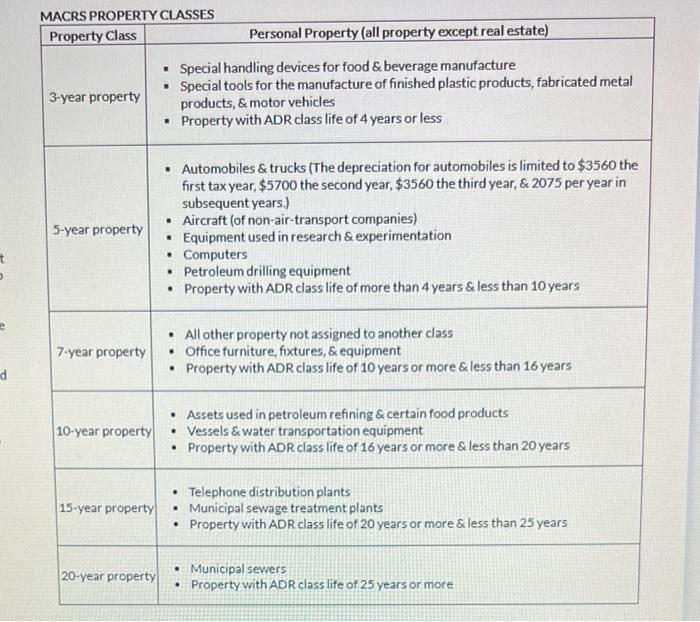

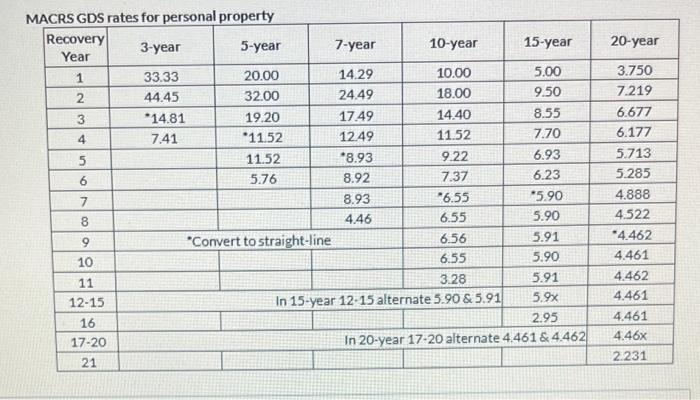

Some enterprising SWOSU students have launched a business 3D printing small models of their instructors with subtle 'enhancements! It's been a hit! Now they're recruiting students at other schools to launch additional locations. Rather than driving or flying commercially to each location, they've decided to purchase a used airplane to help grow the business: plane.png You believe you can negotiate the purchase price of this plane down to $969,000.00. It will cost you $36,000.00 to transport the plane from Illinois to Oklahoma, and an additional $3,369 to have it inspected and serviced prior to it being ready for use. You expect this plane to be useful for your business for at least 14 years. At that point, you believe you'll be able to sell the plane for $244,000.00. The business is wildly successful and has grown for three years. You no longer need to recruit other schools, so you've decided to sell the plane at the end of your third year. While the business is booming, the market for used planes isn't. You're only able to sell it for $164,000.00. What are your net proceeds from the sale of the plane, assuming that this business pays taxes at the current corporate rate of 21.0% ? (answer in dollars, rounded to the nearest penny. For example, if your answer is $123.456.78 you should enter 123456.78.) d MACRS PROPERTY CLASSES Property Class 3-year property 5-year property 7-year property 10-year property 15-year property 20-year property Personal Property (all property except real estate) Special handling devices for food & beverage manufacture Special tools for the manufacture of finished plastic products, fabricated metal products, & motor vehicles Property with ADR class life of 4 years or less Automobiles & trucks (The depreciation for automobiles is limited to $3560 the first tax year, $5700 the second year, $3560 the third year, & 2075 per year in subsequent years.) Aircraft (of non-air-transport companies) Equipment used in research & experimentation Computers Petroleum drilling equipment Property with ADR class life of more than 4 years & less than 10 years All other property not assigned to another class Office furniture, fixtures, & equipment Property with ADR class life of 10 years or more & less than 16 years Assets used in petroleum refining & certain food products Vessels & water transportation equipment Property with ADR class life of 16 years or more & less than 20 years Telephone distribution plants Municipal sewage treatment plants Property with ADR class life of 20 years or more & less than 25 years Municipal sewers Property with ADR class life of 25 years or more MACRS GDS rates for personal property Recovery Year 3-year 5-year 1 33.33 20.00 2 44.45 32.00 *14.81 19.20 7.41 11.52 11.52 5.76 "Convert to straight-line 3 4 5 6 7 8 9 10 11 12-15 16 17-20 21 7-year 10-year 14.29 10.00 24.49 18.00 17.49 14.40 12.49 11.52 *8.93 9.22 8.92 7.37 8.93 *6.55 4.46 6.55 6.56 6.55 3.28 In 15-year 12-15 alternate 5.90 & 5.91 15-year 5.00 9.50 8.55 7.70 6.93 6.23 *5.90 5.90 5.91 5.90 5.91 5.9x 2.95 In 20-year 17-20 alternate 4.461 & 4.462 20-year 3.750 7.219 6.677 6.177 5.713 5.285 4.888 4.522 *4.462 4.461 4.462 4.461 4.461 4.46x 2.231