Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Some fixed income instruments, mortgages are an example, have constant cash flow. What would be the price or value of a security paying $25,000 per

Some fixed income instruments, mortgages are an example, have constant cash flow. What would be the price or value of a security paying $25,000 per year for four years in the uncertain interest rate environment described above?

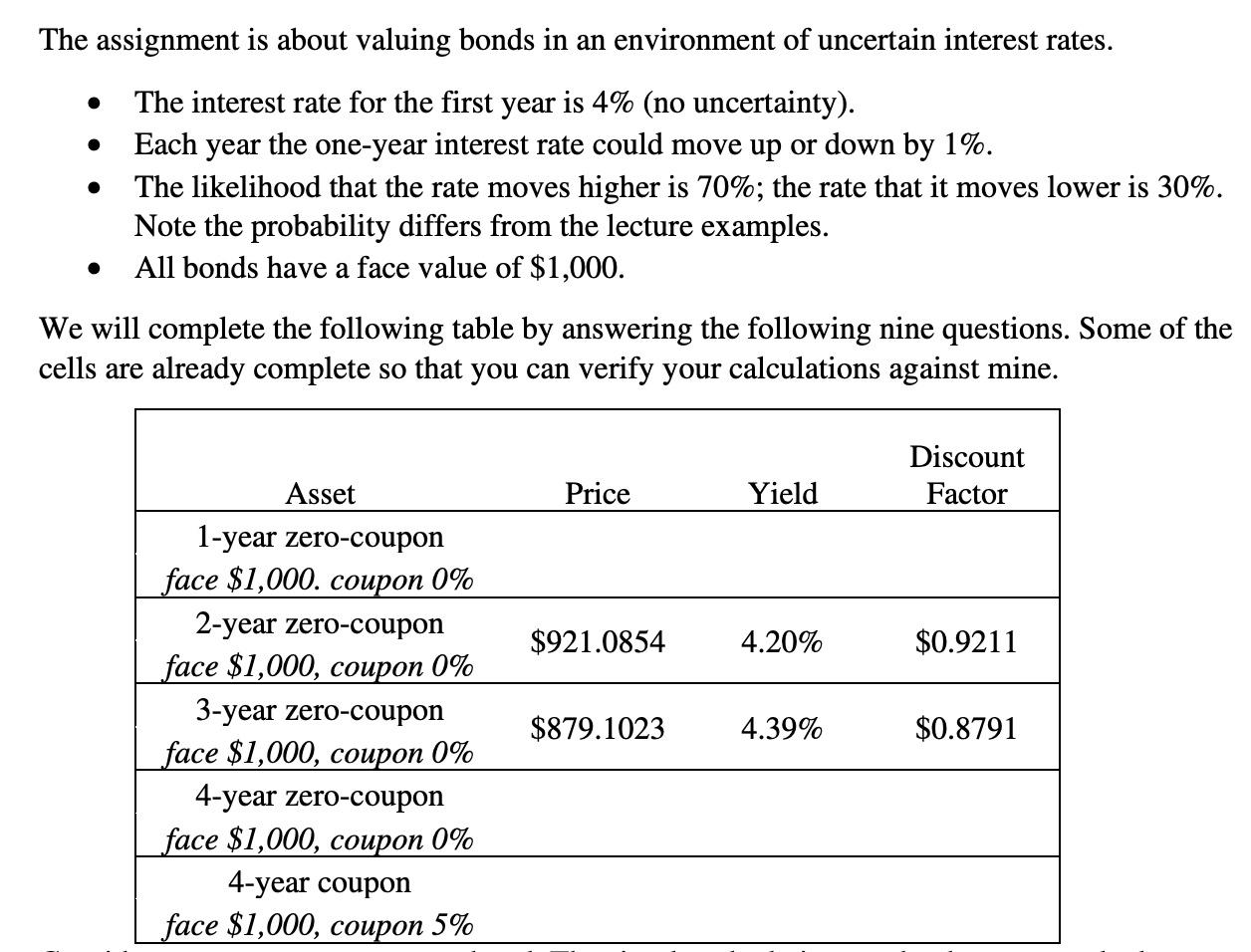

The assignment is about valuing bonds in an environment of uncertain interest rates. - The interest rate for the first year is 4% (no uncertainty). - Each year the one-year interest rate could move up or down by 1%. - The likelihood that the rate moves higher is 70%; the rate that it moves lower is 30%. Note the probability differs from the lecture examples. - All bonds have a face value of $1,000. We will complete the following table by answering the following nine questions. Some of the cells are already complete so that you can verify your calculations against mine. The assignment is about valuing bonds in an environment of uncertain interest rates. - The interest rate for the first year is 4% (no uncertainty). - Each year the one-year interest rate could move up or down by 1%. - The likelihood that the rate moves higher is 70%; the rate that it moves lower is 30%. Note the probability differs from the lecture examples. - All bonds have a face value of $1,000. We will complete the following table by answering the following nine questions. Some of the cells are already complete so that you can verify your calculations against mine

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started