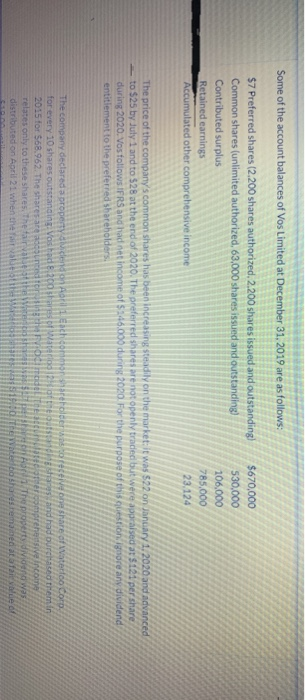

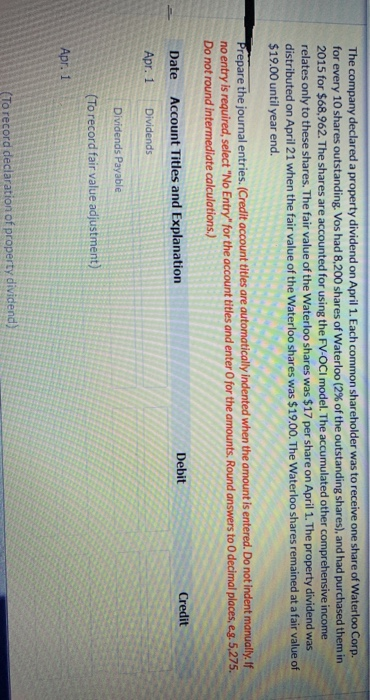

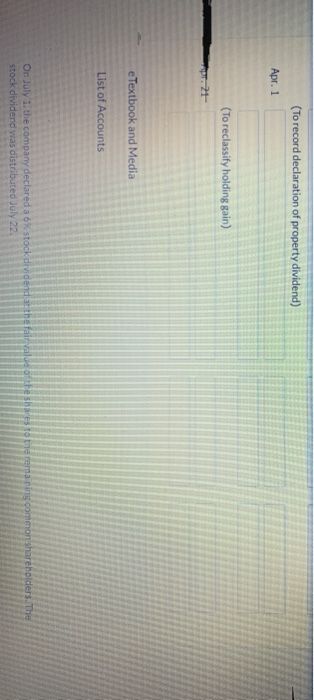

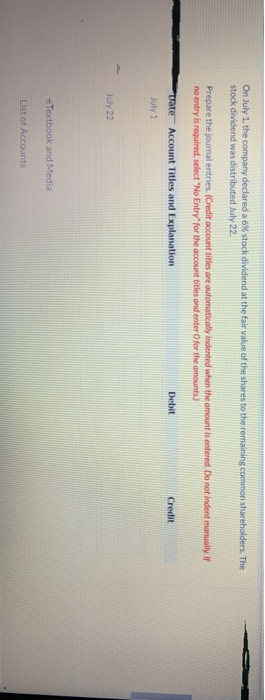

Some of the account balances of Vos Limited at December 31, 2019 are as follows: $7 Preferred shares (2.200 shares authorized. 2.200 shares issued and outstanding) Common shares (unlimited authorized, 63,000 shares issued and outstanding) Contributed surplus Retained earnings Accumulated other comprehensive income $670,000 530,000 106,000 785,000 23.124 The price of the company's common shares has been increasing steadily on the market. It was $22 on January 1, 2020 and advanced to $25 by July 1 and to 528 at the end of 2020. The preferred shares are not openly traded but were appraised at $121 per share during 2020. Vos follows IFRS and had net income of 246.000 during 2020 For the purpose of this question, ignore any dividend entitlement to the preferred shareholders. The company declared a property vided on A l Eich Correfolder for every 10 shares outstanding: Vos had 8.200 stars of Waterloo 2015 for $68.962. The shares are not relates only to these shares. The first the distributed on April 21 when the first 1 to receive one share of Waterloo Coro and had burchased them in prehensive income et med at a falue of The company declared a property dividend on April 1. Each common shareholder was to receive one share of Waterloo Corp. for every 10 shares outstanding. Vos had 8,200 shares of Waterloo (2% of the outstanding shares), and had purchased them in 2015 for $68,962. The shares are accounted for using the FV-OCI model. The accumulated other comprehensive income relates only to these shares. The fair value of the Waterloo shares was $17 per share on April 1. The property dividend was distributed on April 21 when the fair value of the Waterloo shares was $19.00. The Waterloo shares remained at a fair value of $19.00 until year end. Prepare the journal entries. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts. Round answers to decimal places, e.g. 5,275. Do not round intermediate calculations.) Debit Credit Date Account Titles and Explanation Apr. 1 Dividends Dividends Payable (To record fair value adjustment) Apr. 1 (To record declaration of property dividend) (To record declaration of property dividend) Apr. 1 (To reclassify holding gain) T. 2 e Textbook and Media List of Accounts On July 1. the company declared a 6% stock dividend at the fair valuesbares to tie romaring common shareholders. The stock dividend was distributed July 22 On July 1, the company declared a 6% stock dividend at the fair value of the shares to the remaining common shareholders. The stock dividend was distributed July 22 Prepare the journal entries. (Credit account titles are automatically indented when the amount is entered. Do not Indent manually. If no entry is required, select "No Entry for the account titles and enter for the amounts Date Account Titles and Explanation Debit Credit July 1 July 22 e Textbook and Media List of Accounts A shareholder, in an effort to persuade Vos to expand into her city, donated to the company a plot of land with an appraised value of $44,000. Prepare the journal entry. (Credit account titles are automatically Indented when the amount is entered. Do not indent manually. If no untry is required, select "No Entry for the account titles and enter for the amounts.) Account Titles and Explanation Credit Debit e Textbook and Media List of Accounts Prepare the shareholders' equity section of Vos's SFP at December 31, 2020. (Round answers to decimal places, eg. 5,275. Do not round intermediate calculations.) Vos Limited Shareholders' Equity December 31, 2020 Some of the account balances of Vos Limited at December 31, 2019 are as follows: $7 Preferred shares (2.200 shares authorized. 2.200 shares issued and outstanding) Common shares (unlimited authorized, 63,000 shares issued and outstanding) Contributed surplus Retained earnings Accumulated other comprehensive income $670,000 530,000 106,000 785,000 23.124 The price of the company's common shares has been increasing steadily on the market. It was $22 on January 1, 2020 and advanced to $25 by July 1 and to 528 at the end of 2020. The preferred shares are not openly traded but were appraised at $121 per share during 2020. Vos follows IFRS and had net income of 246.000 during 2020 For the purpose of this question, ignore any dividend entitlement to the preferred shareholders. The company declared a property vided on A l Eich Correfolder for every 10 shares outstanding: Vos had 8.200 stars of Waterloo 2015 for $68.962. The shares are not relates only to these shares. The first the distributed on April 21 when the first 1 to receive one share of Waterloo Coro and had burchased them in prehensive income et med at a falue of The company declared a property dividend on April 1. Each common shareholder was to receive one share of Waterloo Corp. for every 10 shares outstanding. Vos had 8,200 shares of Waterloo (2% of the outstanding shares), and had purchased them in 2015 for $68,962. The shares are accounted for using the FV-OCI model. The accumulated other comprehensive income relates only to these shares. The fair value of the Waterloo shares was $17 per share on April 1. The property dividend was distributed on April 21 when the fair value of the Waterloo shares was $19.00. The Waterloo shares remained at a fair value of $19.00 until year end. Prepare the journal entries. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts. Round answers to decimal places, e.g. 5,275. Do not round intermediate calculations.) Debit Credit Date Account Titles and Explanation Apr. 1 Dividends Dividends Payable (To record fair value adjustment) Apr. 1 (To record declaration of property dividend) (To record declaration of property dividend) Apr. 1 (To reclassify holding gain) T. 2 e Textbook and Media List of Accounts On July 1. the company declared a 6% stock dividend at the fair valuesbares to tie romaring common shareholders. The stock dividend was distributed July 22 On July 1, the company declared a 6% stock dividend at the fair value of the shares to the remaining common shareholders. The stock dividend was distributed July 22 Prepare the journal entries. (Credit account titles are automatically indented when the amount is entered. Do not Indent manually. If no entry is required, select "No Entry for the account titles and enter for the amounts Date Account Titles and Explanation Debit Credit July 1 July 22 e Textbook and Media List of Accounts A shareholder, in an effort to persuade Vos to expand into her city, donated to the company a plot of land with an appraised value of $44,000. Prepare the journal entry. (Credit account titles are automatically Indented when the amount is entered. Do not indent manually. If no untry is required, select "No Entry for the account titles and enter for the amounts.) Account Titles and Explanation Credit Debit e Textbook and Media List of Accounts Prepare the shareholders' equity section of Vos's SFP at December 31, 2020. (Round answers to decimal places, eg. 5,275. Do not round intermediate calculations.) Vos Limited Shareholders' Equity December 31, 2020