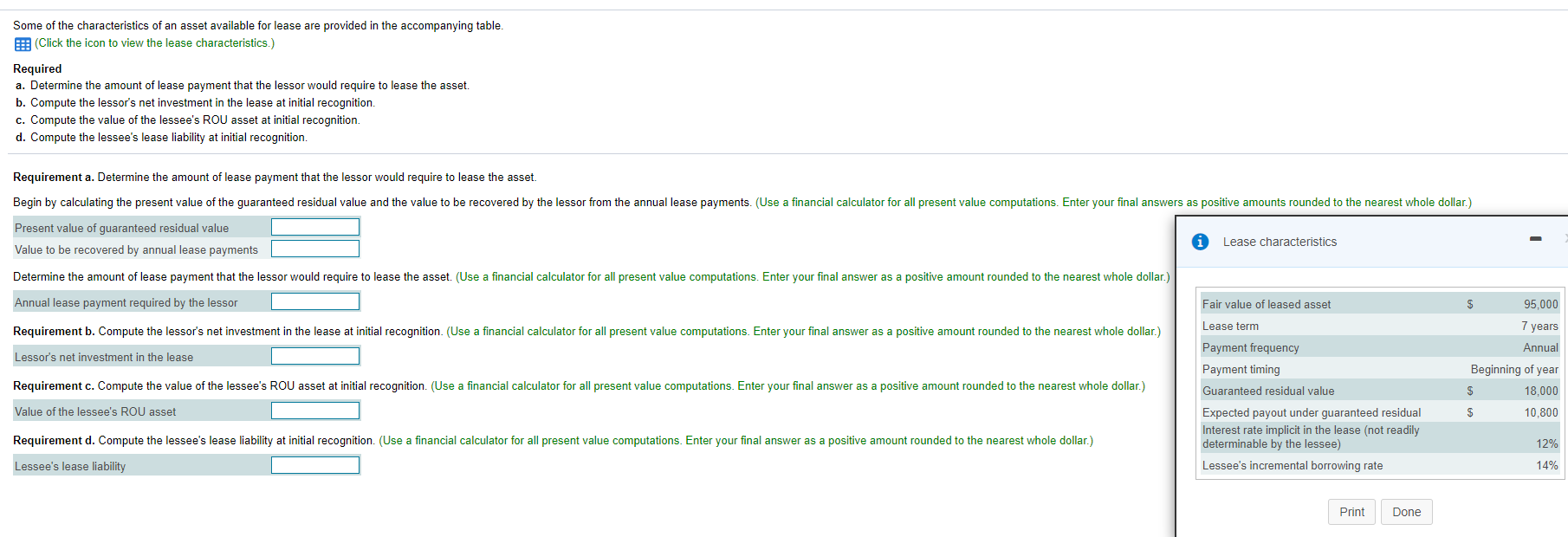

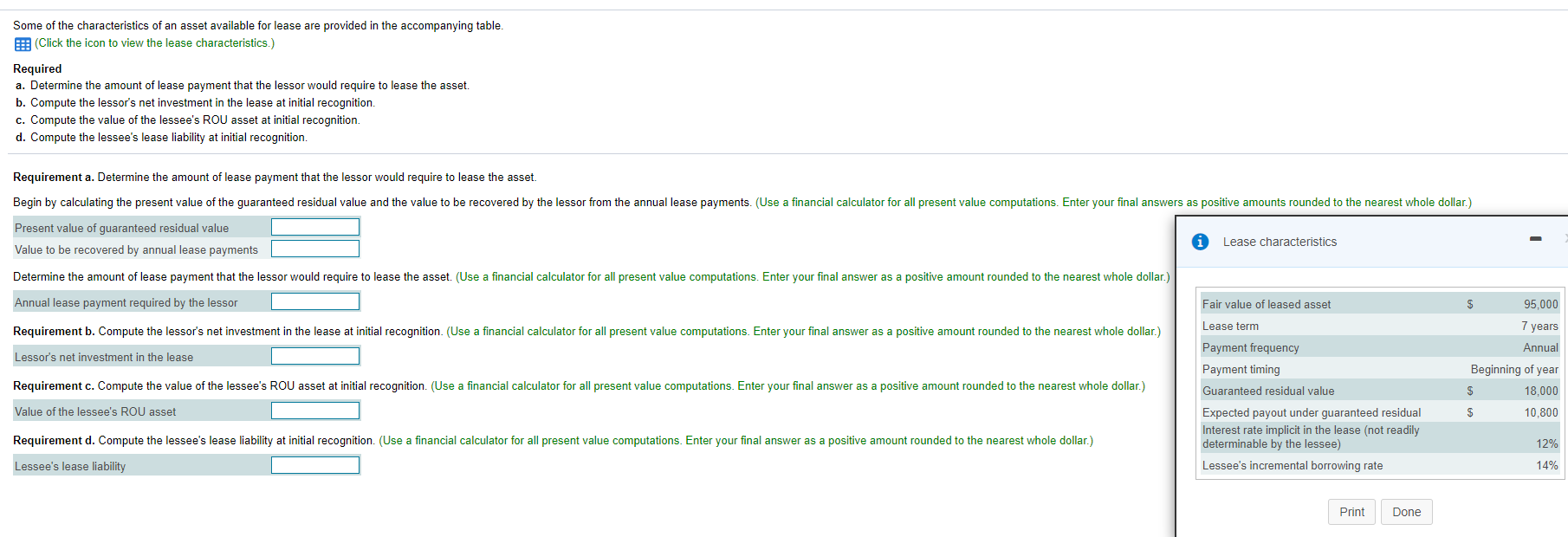

Some of the characteristics of an asset available for lease are provided in the accompanying table. Click the icon to view the lease characteristics.) Required a. Determine the amount of lease payment that the lessor would require to lease the asset. b. Compute the lessor's net investment in the lease at initial recognition c. Compute the value of the lessee's ROU asset at initial recognition d. Compute the lessee's lease liability at initial recognition. Requirement a. Determine the amount of lease payment that the lessor would require to lease the asset. Begin by calculating the present value of the guaranteed residual value and the value to be recovered by the lessor from the annual lease payments. (Use a financial calculator for all present value computations. Enter your final answers as positive amounts rounded to the nearest whole dollar.) Present value of guaranteed residual value Value to be recovered by annual lease payments Lease characteristics Determine the amount of lease payment that the lessor would require to lease the asset. (Use a financial calculator for all present value computations. Enter your final answer as a positive amount rounded to the nearest whole dollar.) Annual lease payment required by the lessor Fair value of leased asset $ 95,000 Lease term Requirement b. Compute the lessor's net investment in the lease at initial recognition. (Use a financial calculator for all present value computations. Enter your final answer as a positive amount rounded to the nearest whole dollar.) Lessor's net investment in the lease Requirement c. Compute the value of the lessee's ROU asset at initial recognition. (Use a financial calculator for all present value computations. Enter your final answer as a positive amount rounded to the nearest whole dollar.) 7 years Annual Beginning of year $ 18,000 $ 10,800 Payment frequency Payment timing Guaranteed residual value Expected payout under guaranteed residual Interest rate implicit in the lease (not readily determinable by the lessee) Lessee's incremental borrowing rate Value of the lessee's ROU asset Requirement d. Compute the lessee's lease liability at initial recognition. (Use a financial calculator for all present value computations. Enter your final answer as a positive amount rounded to the nearest whole dollar.) 12% Lessee's lease liability 14% Print Done Some of the characteristics of an asset available for lease are provided in the accompanying table. Click the icon to view the lease characteristics.) Required a. Determine the amount of lease payment that the lessor would require to lease the asset. b. Compute the lessor's net investment in the lease at initial recognition c. Compute the value of the lessee's ROU asset at initial recognition d. Compute the lessee's lease liability at initial recognition. Requirement a. Determine the amount of lease payment that the lessor would require to lease the asset. Begin by calculating the present value of the guaranteed residual value and the value to be recovered by the lessor from the annual lease payments. (Use a financial calculator for all present value computations. Enter your final answers as positive amounts rounded to the nearest whole dollar.) Present value of guaranteed residual value Value to be recovered by annual lease payments Lease characteristics Determine the amount of lease payment that the lessor would require to lease the asset. (Use a financial calculator for all present value computations. Enter your final answer as a positive amount rounded to the nearest whole dollar.) Annual lease payment required by the lessor Fair value of leased asset $ 95,000 Lease term Requirement b. Compute the lessor's net investment in the lease at initial recognition. (Use a financial calculator for all present value computations. Enter your final answer as a positive amount rounded to the nearest whole dollar.) Lessor's net investment in the lease Requirement c. Compute the value of the lessee's ROU asset at initial recognition. (Use a financial calculator for all present value computations. Enter your final answer as a positive amount rounded to the nearest whole dollar.) 7 years Annual Beginning of year $ 18,000 $ 10,800 Payment frequency Payment timing Guaranteed residual value Expected payout under guaranteed residual Interest rate implicit in the lease (not readily determinable by the lessee) Lessee's incremental borrowing rate Value of the lessee's ROU asset Requirement d. Compute the lessee's lease liability at initial recognition. (Use a financial calculator for all present value computations. Enter your final answer as a positive amount rounded to the nearest whole dollar.) 12% Lessee's lease liability 14% Print Done