Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Some of the first and second journal entries are coming out wrong! Can you please help me out going over each of them for me!!!

Some of the first and second journal entries are coming out wrong!

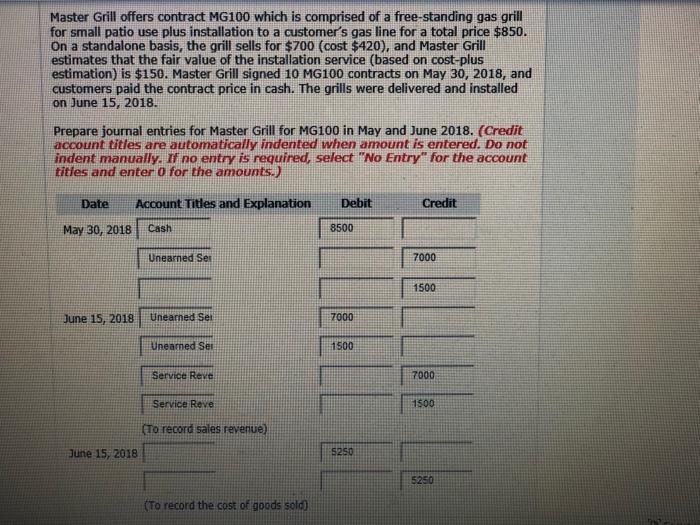

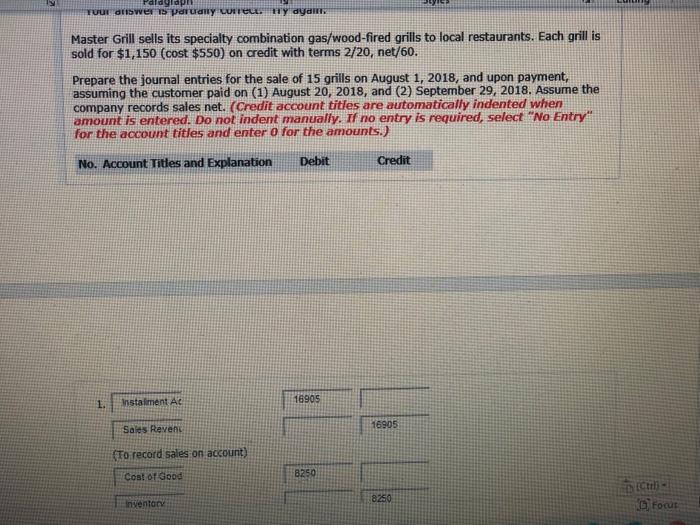

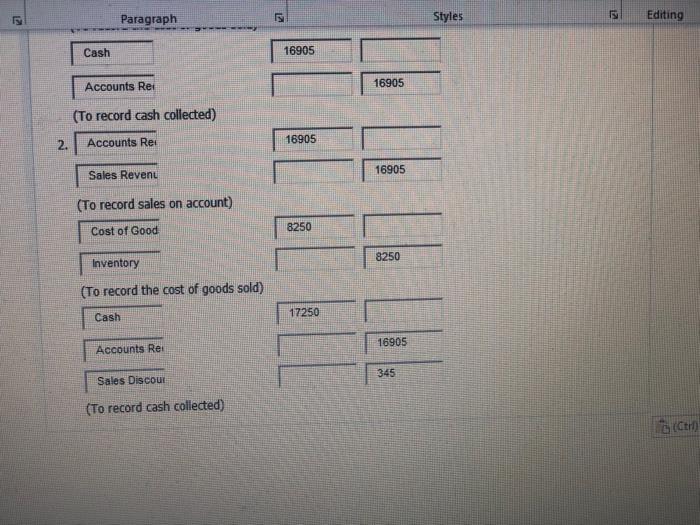

Master Grill offers contract MG100 which is comprised of a free-standing gas grill for small patio use plus installation to a customer's gas line for a total price $850. On a standalone basis, the grill sells for $700 (cost $420), and Master Grill estimates that the fair value of the installation service (based on cost-plus estimation) is $150. Master Grill signed 10 MG100 contracts on May 30, 2018, and customers paid the contract price in cash. The grills were delivered and installed on June 15, 2018. Prepare journal entries for Master Grill for MG100 in May and June 2018. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account tities and enter o for the amounts.) Date Account Titles and Explanation Debit Credit May 30, 2018 Cash 8500 Unearned Ses 7000 1500 June 15, 2018 Unearned Set 7000 Unearned Sei 1500 Service Reve 7000 Service Reve 1500 (To record sales revenue) June 15, 2018 5250 5250 (To record the cost of goods sold) radglap TUUT answers peruany wore. Hy ayam Master Grill sells its specialty combination gas/wood-fired grills to local restaurants. Each grill is sold for $1,150 (cost $550) on credit with terms 2/20, net/60. Prepare the journal entries for the sale of 15 grills on August 1, 2018, and upon payment, assuming the customer paid on (1) August 20, 2018, and (2) September 29, 2018. Assume the company records sales net. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) No. Account Titles and Explanation Debit Credit 1. Instalment at 16905 16905 Sales Revenc To record sales on account) Cost of Good B250 8250 buh Focus Inventory LE Paragraph Styles Editing Cash 16905 Accounts Rei 16905 (To record cash collected) 2. 16905 Accounts Res Sales Revenu 16905 (To record sales on account) of Good 8250 8250 Inventory (To record the cost of goods sold) Cash 17250 16905 Accounts Re 345 Sales Discour (To record cash collected) Can you please help me out going over each of them for me!!!

Thank you!!!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started