Answered step by step

Verified Expert Solution

Question

1 Approved Answer

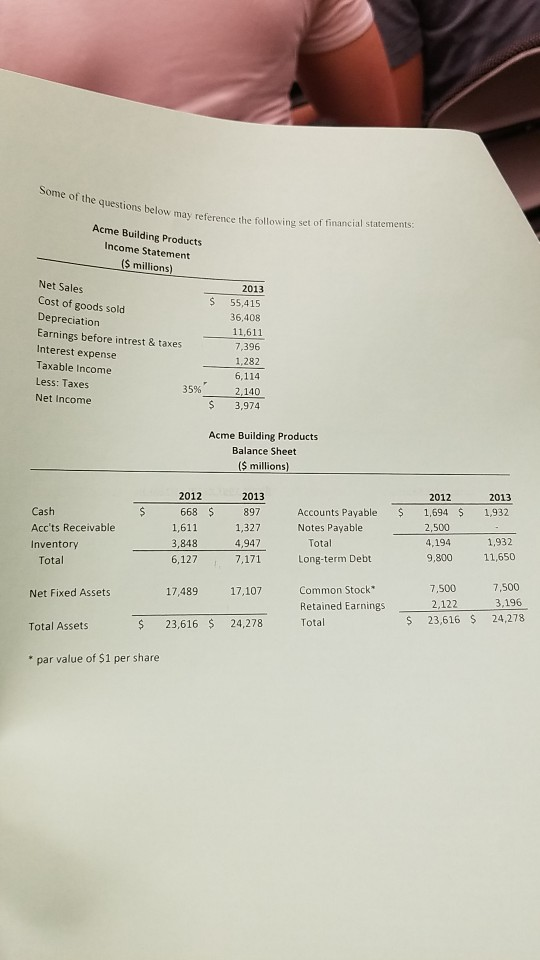

Some of the questions below may reference t ow may reference the following set of financial statements Acme Building Products Income Statement (S millions) 2013

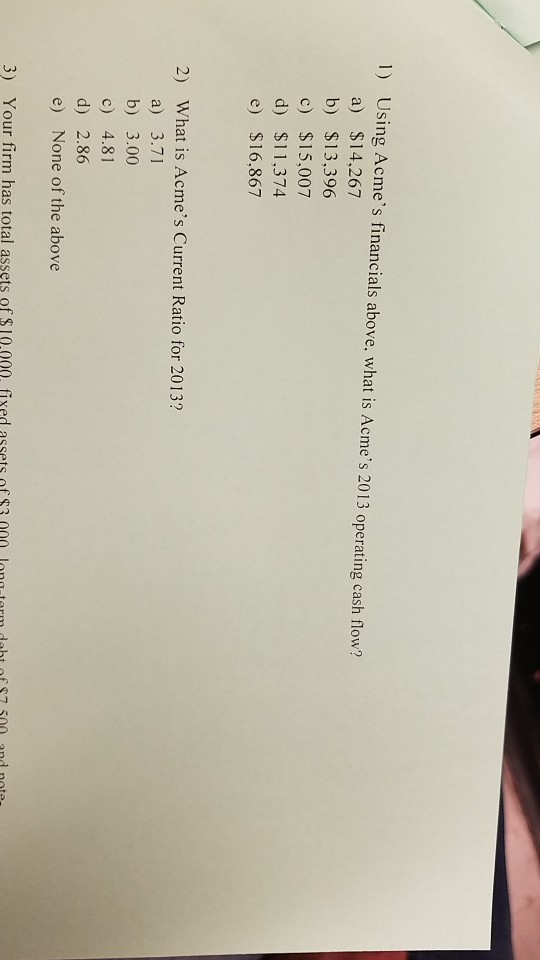

Some of the questions below may reference t ow may reference the following set of financial statements Acme Building Products Income Statement (S millions) 2013 Net Sales $ 55,415 Cost of goods sold 36,408 Depreciation 11,611 Earnings before intrest & taxes Interest expense 7,396 1,282 Taxable Income 6,114 Less: Taxes 35% 2.140 Net Income S 3,974 Acme Building Products Balance Sheet $ millions) 2013 2012 2013 2012 S 668 S 897 Accounts Payable $ 1,6945 1,932 Cash 2,500 1,611 1,327 Notes Payable 4,947 7,171 1,932 Acc'ts Receivable 4,194 Total 3,848 11,650 9,800 Inventory Long-term Debt 6,127 Total 7,500 7,500 17.489 1707Comon Seode 17,107 3,196 17,489 2,122 Net Fixed Assets Retained Earnings $23,616 24,278 23,616 24,278 Total Total Assets * par value of $1 per share 1) Using Acme's financials above. what is Acme's 2013 operating cash flow? a) $14,267 b) $13,396 c) $15,007 d) $11,374 e) $16.867 2) What is Acme's Current Ratio for 2013? a) 3.71 b) 3.00 c) 4.81 d) 2.86 e) None of the above 3) Your firm has total assets of $10.000. fixed assets o3ns torm dabt of 97 500 and pote

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started