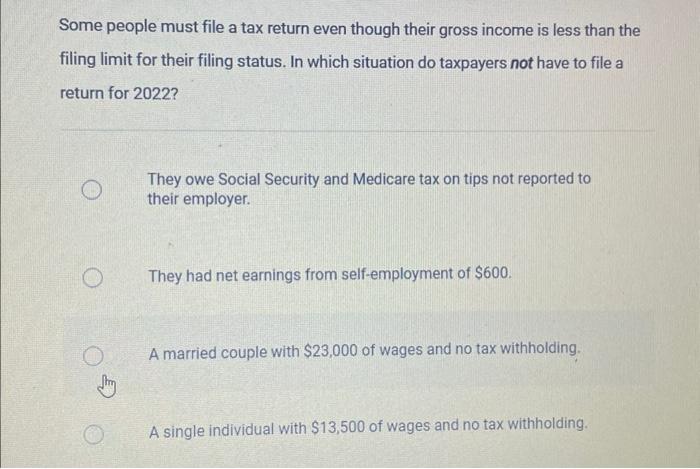

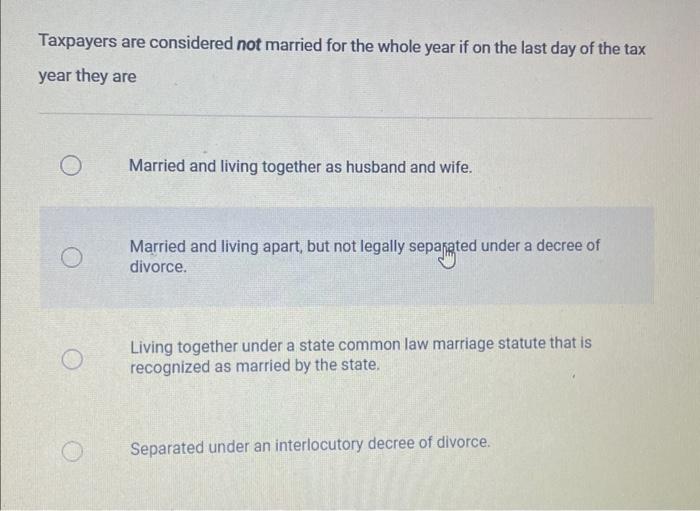

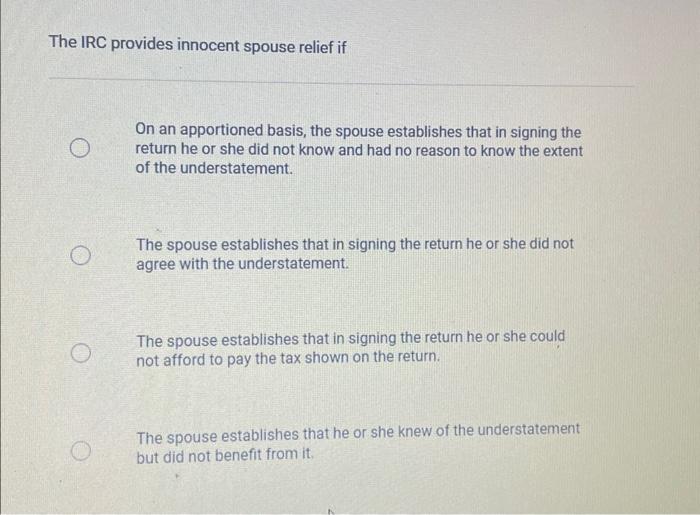

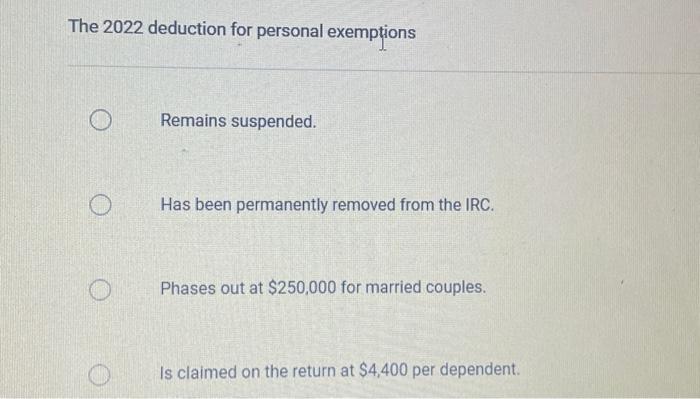

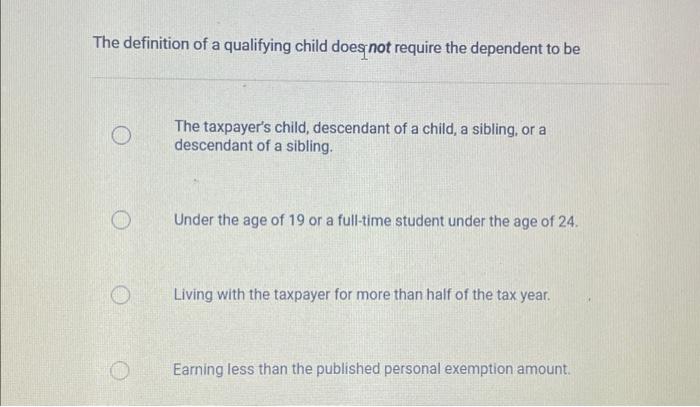

Some people must file a tax return even though their gross income is less than the filing limit for their filing status. In which situation do taxpayers not have to file a return for 2022? They owe Social Security and Medicare tax on tips not reported to their employer. They had net earnings from self-employment of $600. A married couple with $23,000 of wages and no tax withholding. A single individual with $13,500 of wages and no tax withholding. Taxpayers are considered not married for the whole year if on the last day of the tax year they are Married and living together as husband and wife. Married and living apart, but not legally separated under a decree of divorce. Living together under a state common law marriage statute that is recognized as married by the state. Separated under an interlocutory decree of divorce. The IRC provides innocent spouse relief if On an apportioned basis, the spouse establishes that in signing the return he or she did not know and had no reason to know the extent of the understatement. The spouse establishes that in signing the return he or she did not agree with the understatement. The spouse establishes that in signing the return he or she could not afford to pay the tax shown on the return. The spouse establishes that he or she knew of the understatement but did not benefit from it. The 2022 deduction for personal exemptions Remains suspended. Has been permanently removed from the IRC. Phases out at $250,000 for married couples. Is claimed on the return at $4,400 per dependent. The definition of a qualifying child does not require the dependent to be The taxpayer's child, descendant of a child, a sibling, or a descendant of a sibling. Under the age of 19 or a full-time student under the age of 24. Living with the taxpayer for more than half of the tax year. Earning less than the published personal exemption amount. Some people must file a tax return even though their gross income is less than the filing limit for their filing status. In which situation do taxpayers not have to file a return for 2022? They owe Social Security and Medicare tax on tips not reported to their employer. They had net earnings from self-employment of $600. A married couple with $23,000 of wages and no tax withholding. A single individual with $13,500 of wages and no tax withholding. Taxpayers are considered not married for the whole year if on the last day of the tax year they are Married and living together as husband and wife. Married and living apart, but not legally separated under a decree of divorce. Living together under a state common law marriage statute that is recognized as married by the state. Separated under an interlocutory decree of divorce. The IRC provides innocent spouse relief if On an apportioned basis, the spouse establishes that in signing the return he or she did not know and had no reason to know the extent of the understatement. The spouse establishes that in signing the return he or she did not agree with the understatement. The spouse establishes that in signing the return he or she could not afford to pay the tax shown on the return. The spouse establishes that he or she knew of the understatement but did not benefit from it. The 2022 deduction for personal exemptions Remains suspended. Has been permanently removed from the IRC. Phases out at $250,000 for married couples. Is claimed on the return at $4,400 per dependent. The definition of a qualifying child does not require the dependent to be The taxpayer's child, descendant of a child, a sibling, or a descendant of a sibling. Under the age of 19 or a full-time student under the age of 24. Living with the taxpayer for more than half of the tax year. Earning less than the published personal exemption amount