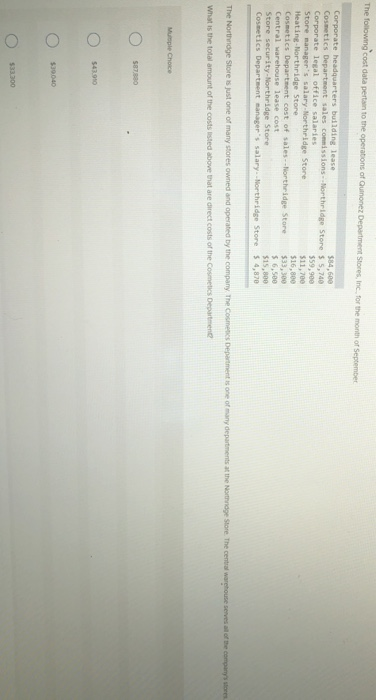

some pictures uploaded more then once

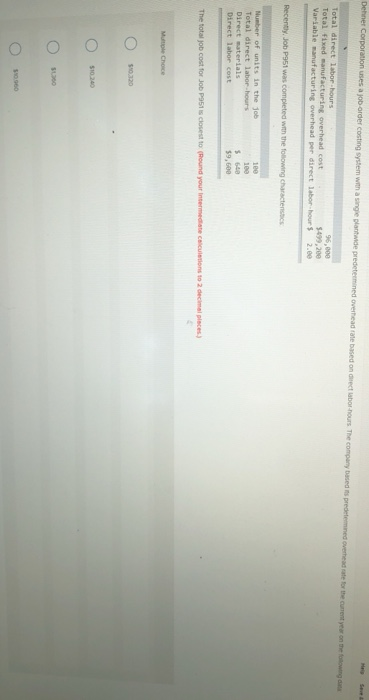

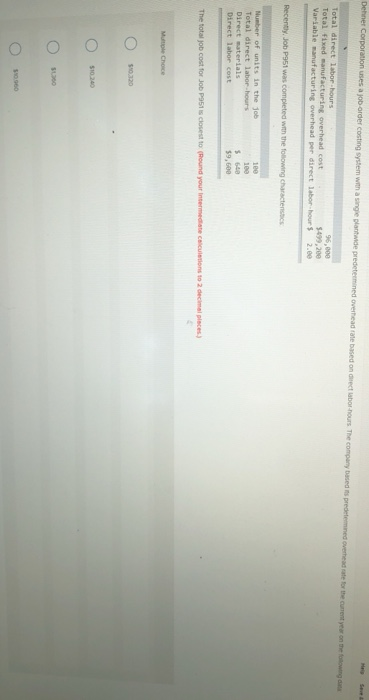

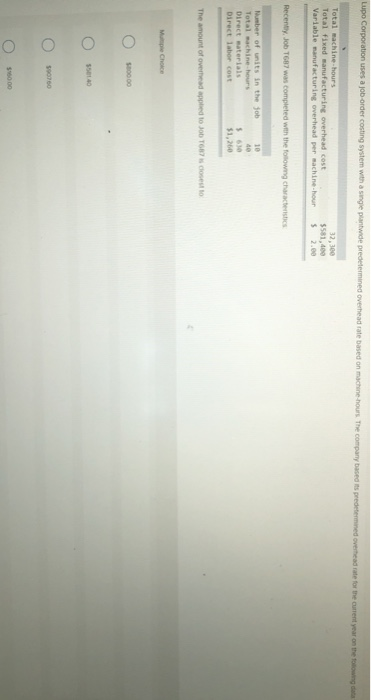

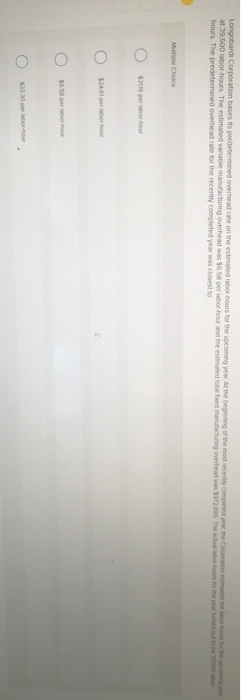

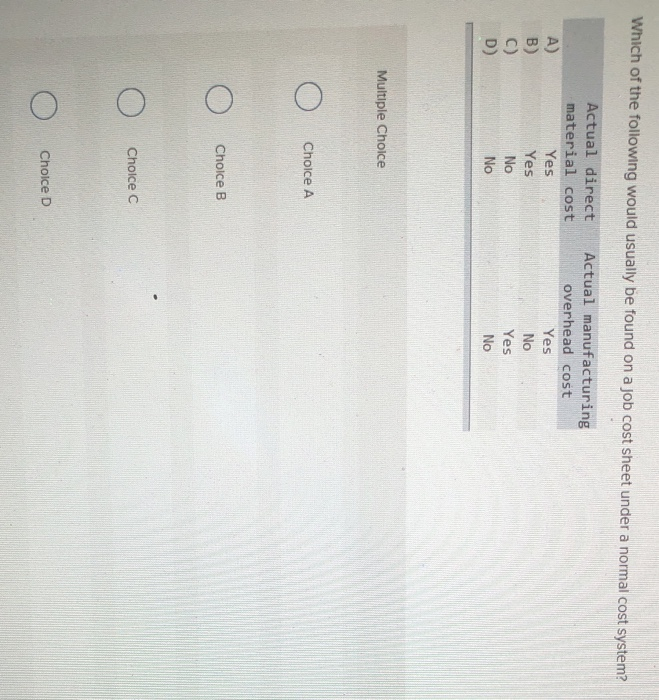

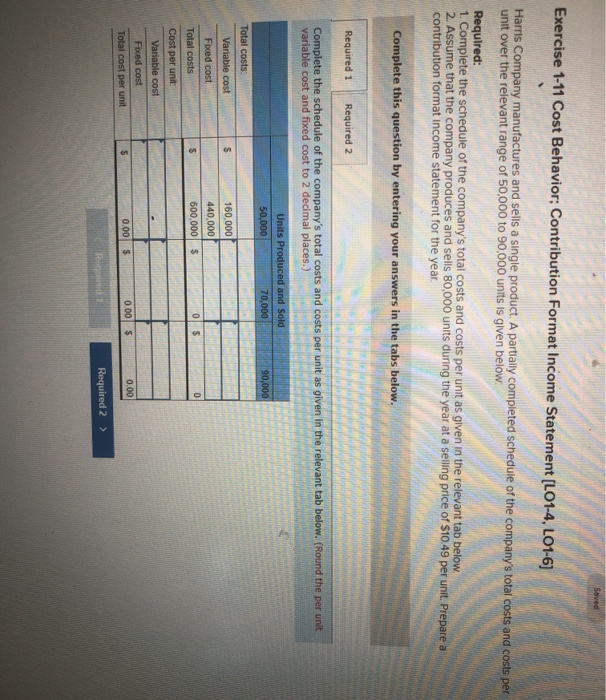

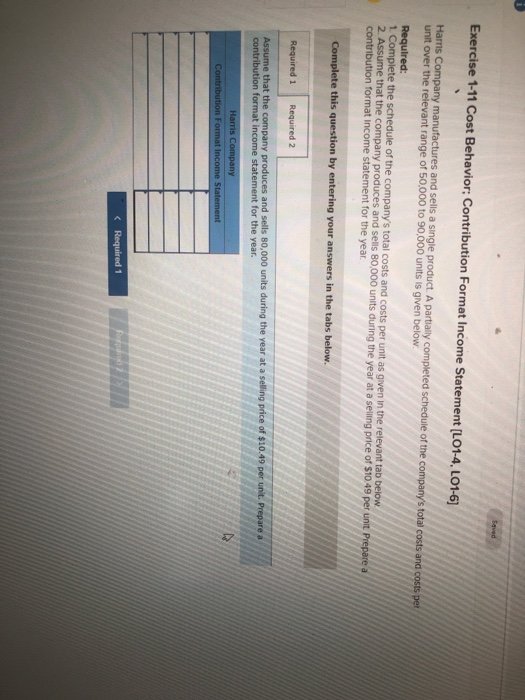

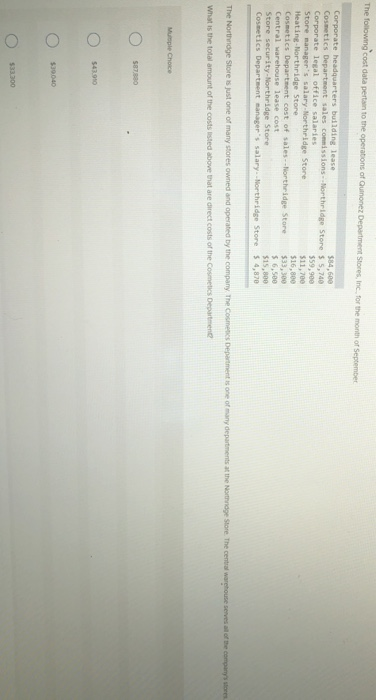

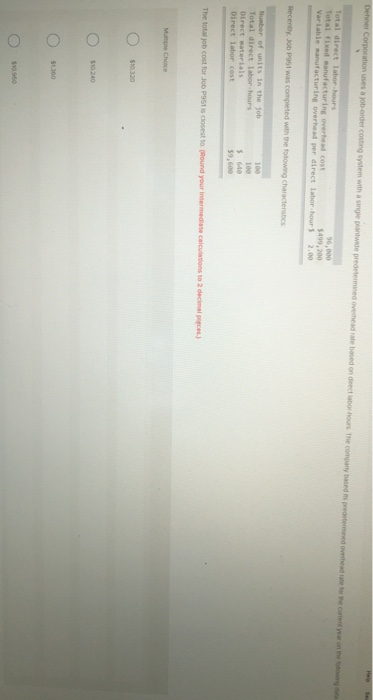

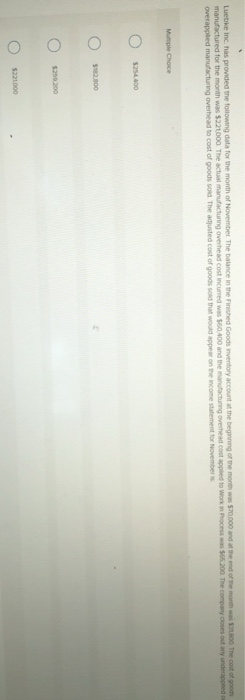

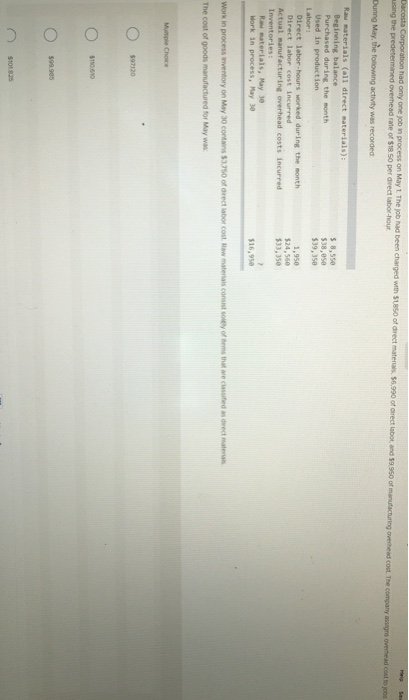

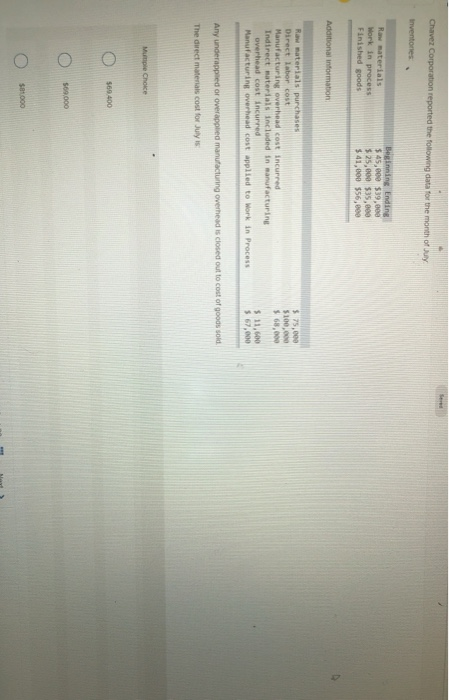

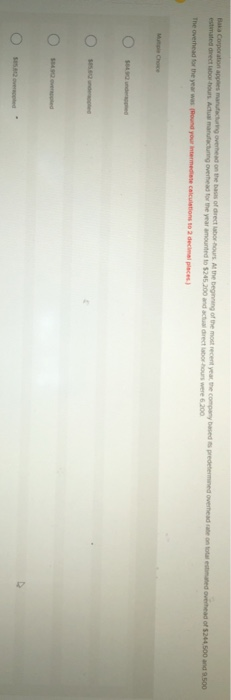

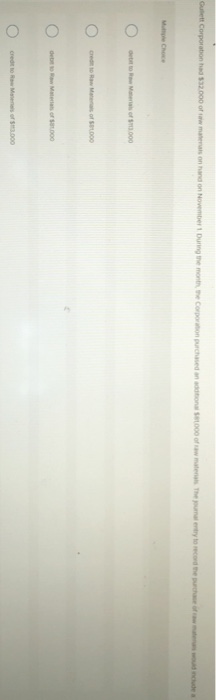

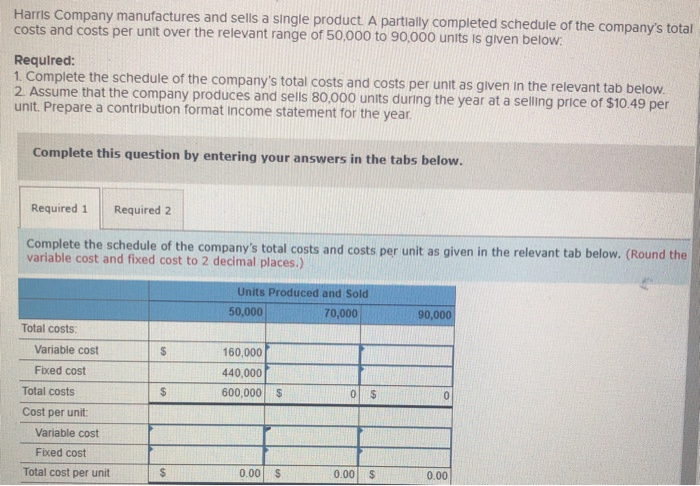

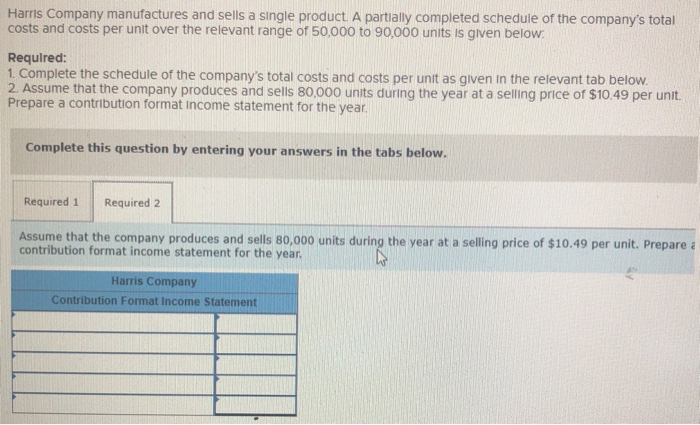

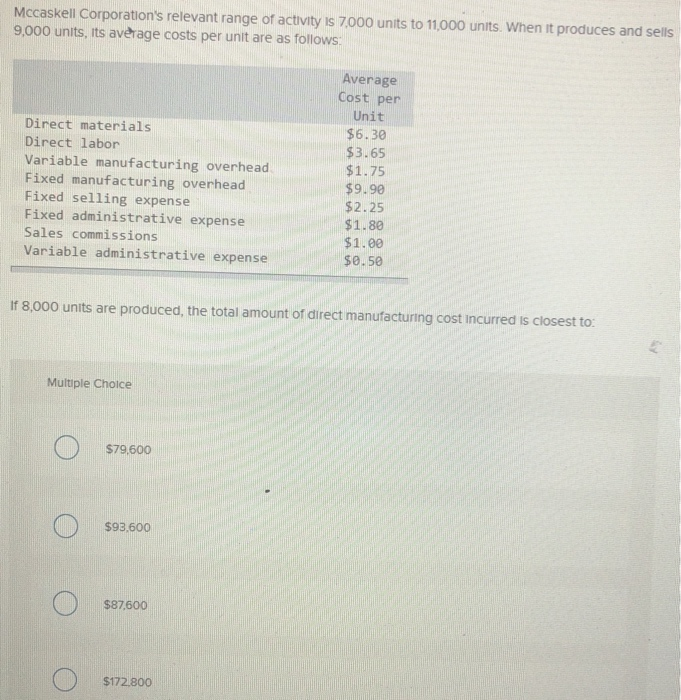

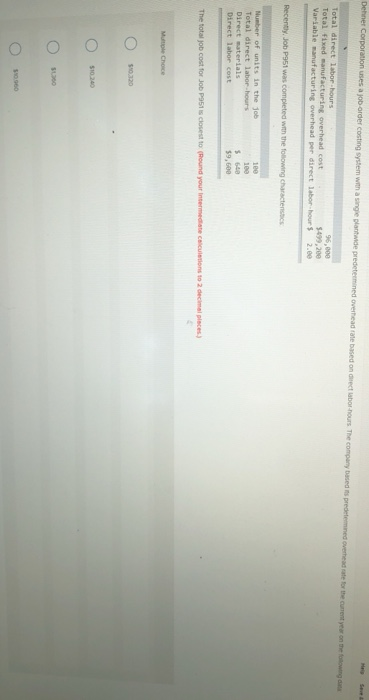

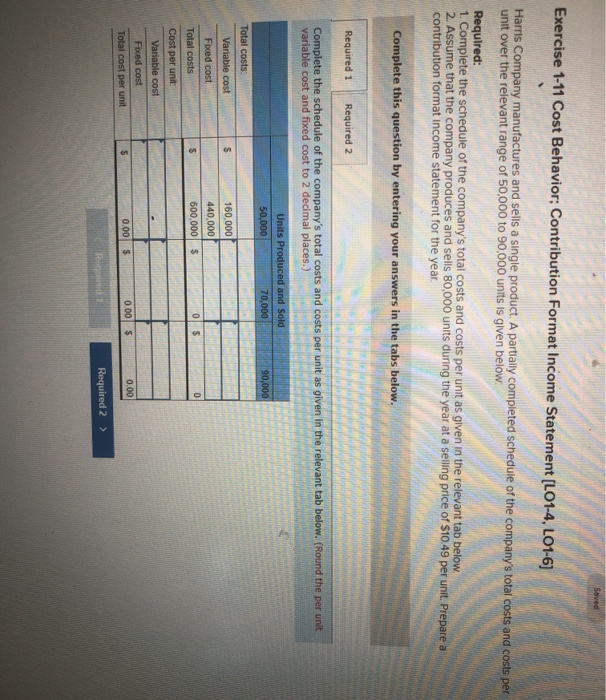

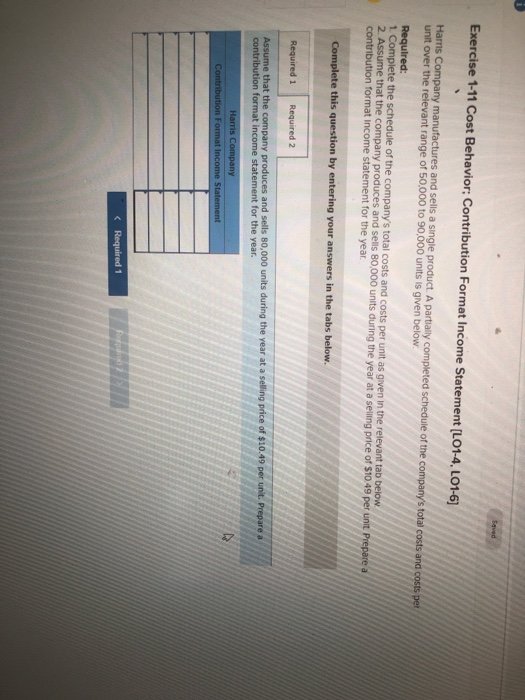

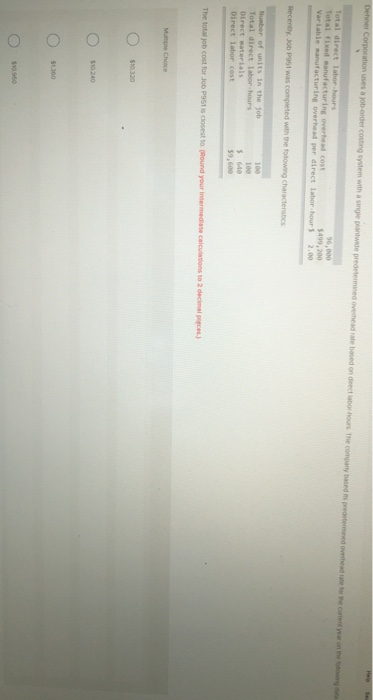

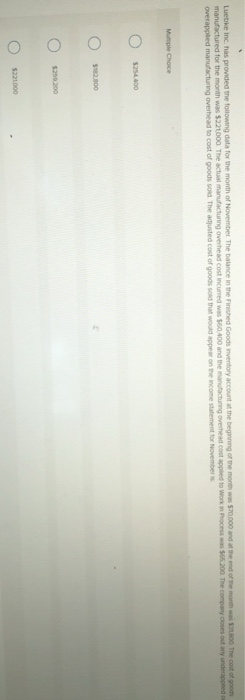

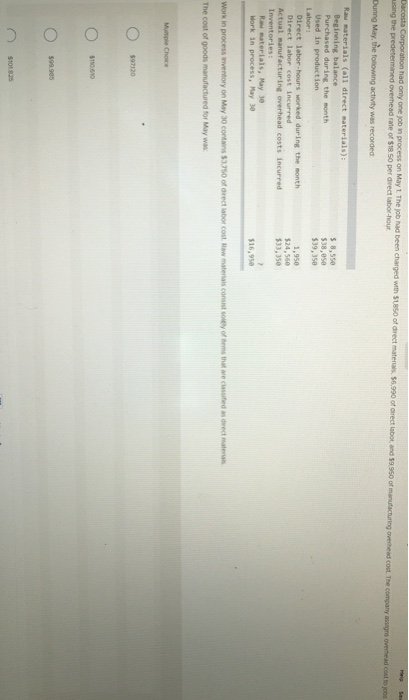

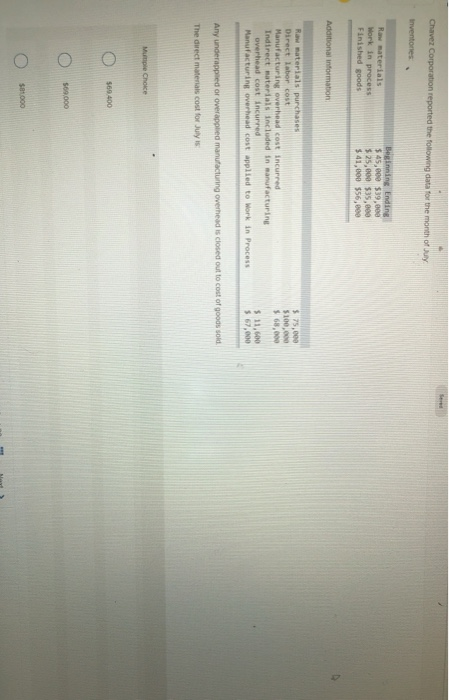

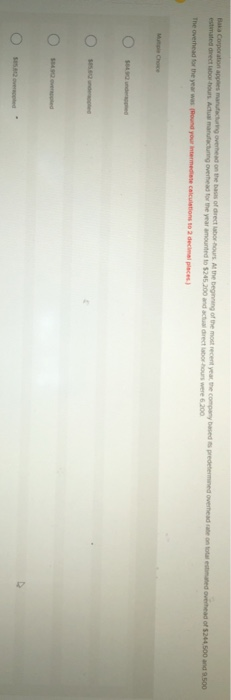

Dehner Corporation uses a job order costing system with a single plante pretened overade based on decorus Theory based pr e d d o cumento Total direct labor. hours 50,000 Total Fixed manufacturing overhead cost Variable manufacturing overhead per direct labor-hour $ 2.ee Recently, Job P951 was completed with the following characters Number of units in the job Total direct labor. hours Direct materials Direct labor cost The total job cost for Job P9 closest to (Round your inte M e Choice Oo oo Lupo Corporation uses a job-order costing system with a single panwide predetermined overhead rate based on machine-hoursThe company based its predetermined overhead rate for the current year on the town data Total machine hours Total fixed manufacturing overhead cost Variable manufacturing overhead per sachine.hour 5 2 .00 Recenty. Job T687 was completed with the focowg characteristics Number of units in the job Total machine-hours Direct materials Direct labor cost $1,260 The amount of overed applied to Job T6B7 Gosest to M e Choice Oo oo Longobardi Corporation bases its predetermined overhead rate on the estimated or hours for the upcoming Yer Althe beginning of the most recen t ed to at 39,500 bor hours. The estimated variable manufacturing overhead was $6 per bor hour and the estimated to redu cing overhead was 92.095 The c hours. The predetermined overhead rate for the recently completed year was closest to co m e o n house v erted to M e Choice U S perborou o o O S40 per bor hour O S60 Deborhout C 33.30 petoro Which of the following would usually be found on a job cost sheet under a normal cost system? Actual direct material cost Actual manufacturing overhead cost Yes Yes Yes No No Yes No No Multiple Choice o Choice A o Choice B o Choice C o Choice D Exercise 1-11 Cost Behavior; Contribution Format Income Statement (LO1-4, LO1-6] Harris Company manufactures and sells a single product. A partially completed schedule of the company's total costs and costs per unit over the relevant range of 50,000 to 90,000 units is given below Required: 1. Complete the schedule of the company's total costs and costs per unit as given in the relevant tab below. 2. Assume that the company produces and sells 80,000 units during the year at a selling price of $10.49 per unit. Prepare a contribution format income statement for the year Complete this question by entering your answers in the tabs below. Required 1 Required 2 LLLLLL PORT Complete the schedule of the company's total costs and costs per unit as given in the relevant tab below. (Round the per unit variable cost and fixed cost to 2 decimal places.) Units Produced and Sold 50,000 70,000 S 90,000 s 160,000 440,000 600,000 $ $ 0 $ Total costs: Variable cost Fixed cost Total costs Cost per unit Variable cost Fibed cost Total cost per unit 0.00 $ 0.00 $ 0.00 Required 2 > Exercise 1-11 Cost Behavior; Contribution Format Income Statement (L01-4, L01-6] Harris Company manufactures and sells a single product. A partially completed schedule of the company's total costs and costs per unit over the relevant range of 50,000 to 90,000 units is given below Required: 1. Complete the schedule of the company's total costs and costs per unit as given in the relevant tab below 2. Assume that the company produces and sells 80,000 units during the year at a selling price of $10.49 per unit Prepare a contribution format income statement for the year. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Assume that the company produces and sells 80,000 units during the year at a selling price of $10.49 per unit. Prepare a contribution format income statement for the year. Harris Company Contribution Format Income Statement Exercise 1-11 Cost Behavior; Contribution Format Income Statement (L01-4, L01-6] Harris Company manufactures and sells a single product. A partially completed schedule of the company's total costs and costs per unit over the relevant range of 50,000 to 90,000 units is given below Required: 1. Complete the schedule of the company's total costs and costs per unit as given in the relevant tab below 2. Assume that the company produces and sells 80,000 units during the year at a selling price of $10.49 per unit Prepare a contribution format income statement for the year. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Assume that the company produces and sells 80,000 units during the year at a selling price of $10.49 per unit. Prepare a contribution format income statement for the year. Harris Company Contribution Format Income Statement