some problems have 2 pictures just for the one problem to make it easier to read.

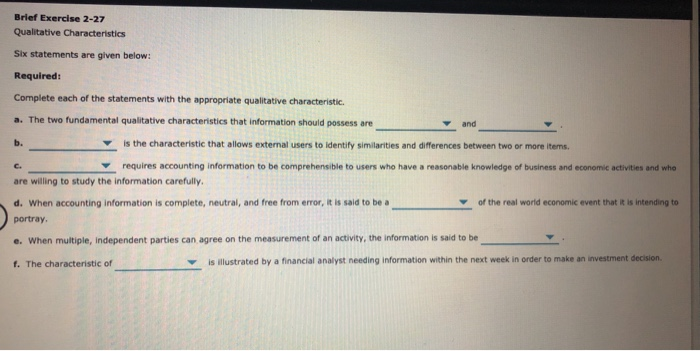

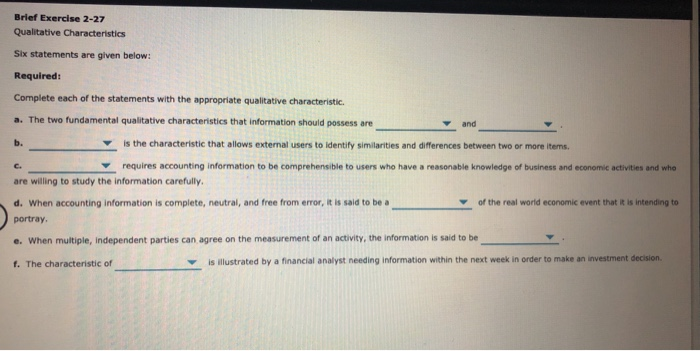

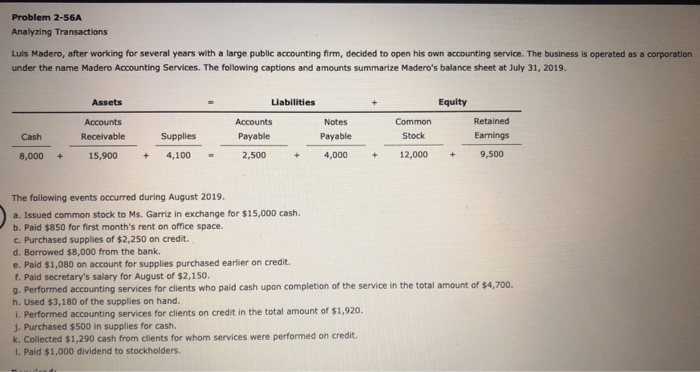

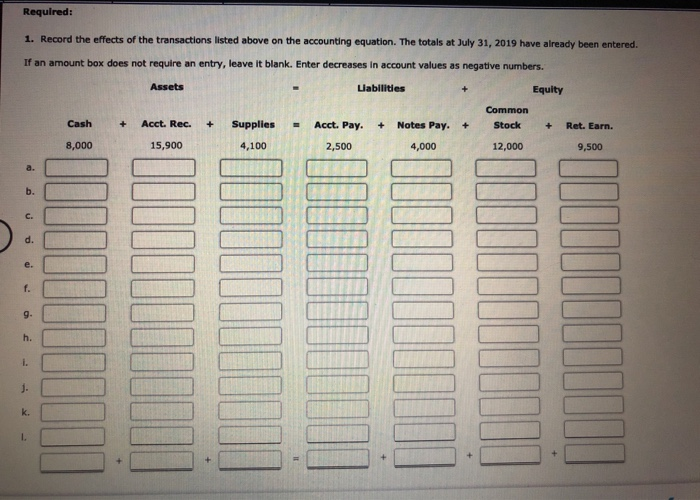

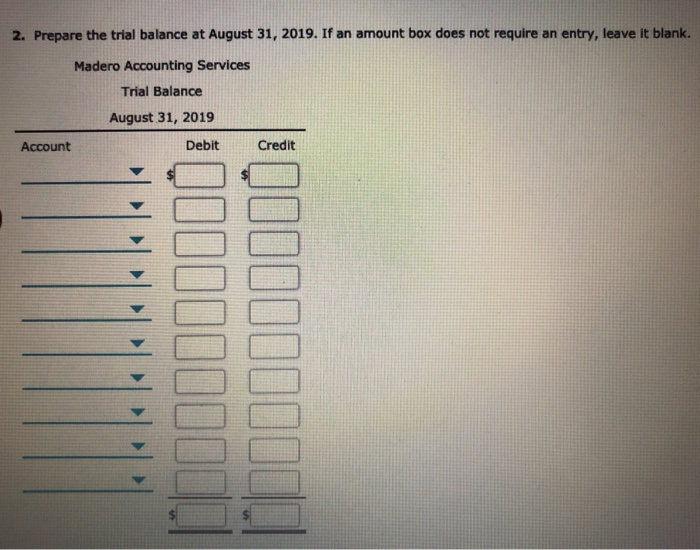

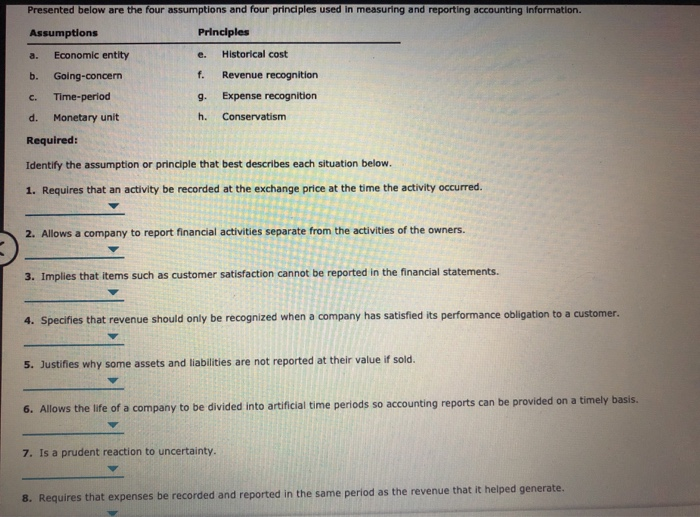

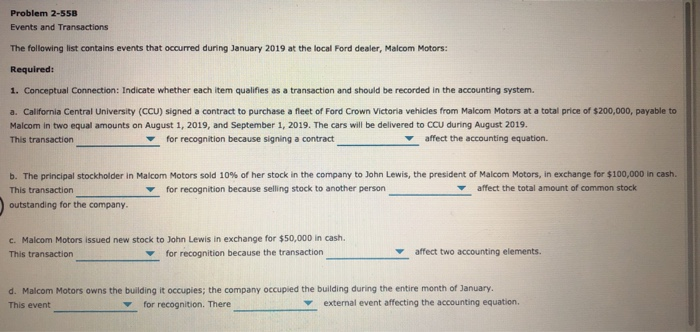

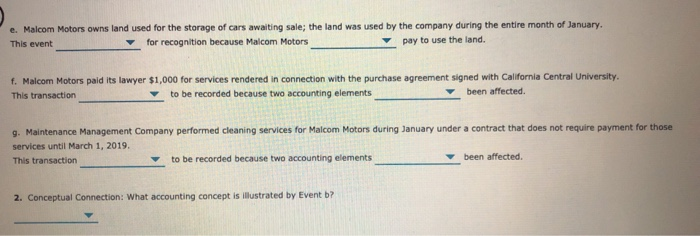

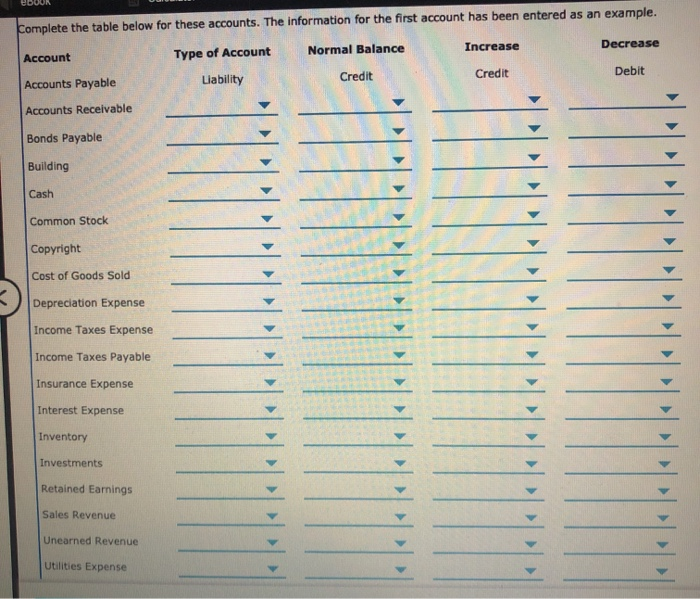

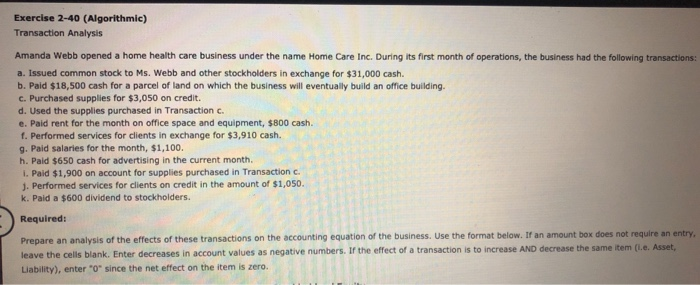

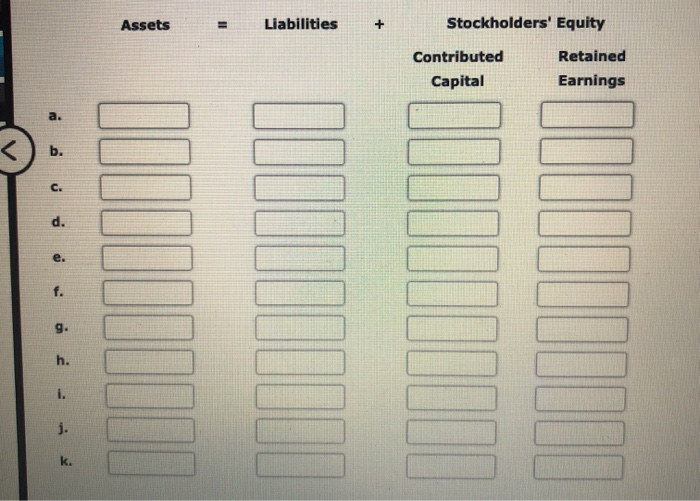

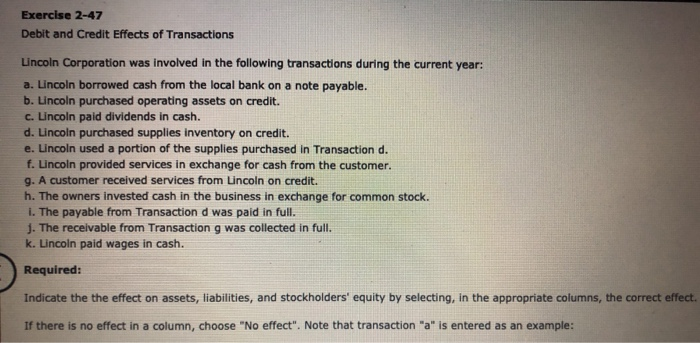

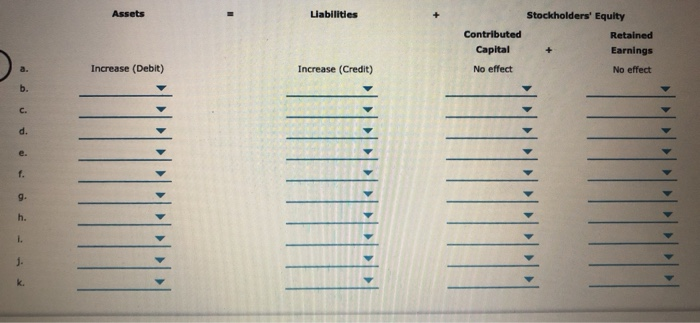

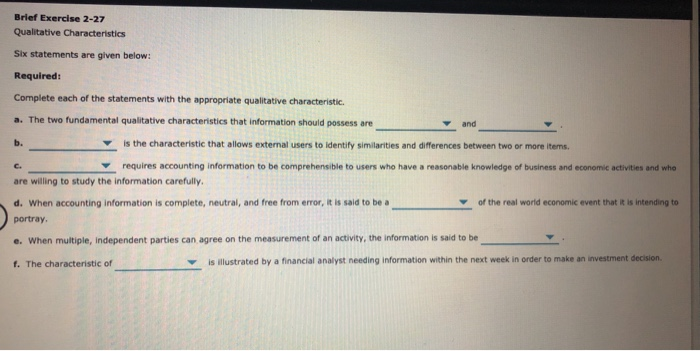

Brief Exercise 2-27 Qualitative Characteristics Six statements are given below: Required: Complete each of the statements with the appropriate qualitative characteristic. a. The two fundamental qualitative characteristics that information should possess are is the characteristic that allows external users to identily similarities and differences between two or more Items requires accounting information to be comprehensible to users who have a reasonable knowledge of business and economic activities and who are willing to study the information carefully. of the real world economic event that it is intending to d. When accounting information is complete, neutral, and free from error, it is said to be a portray. and b. C. e. When multiple, independent parties can agree on the measurement of an activity, the information is said to be f. The characteristic of is illustrated by a financial analyst needing information within the next week in order to make an investment decision Problem 2-56A Analyzing Transactions Luis Madero, after working for several years with a large public accounting firm, decided to open his own accounting service. The business is operated as a corporation under the name Madero Accounting Services. The following captions and amounts summarize Madero's balance sheet at July 31, 2019. Assets Equity Liabilities Accounts Payable 2,500 + Accounts Receivable 15,900 Common Stock Cash Notes Payable 4,000 Retained Earnings Supplies 4,100 8,000 + + 12,000 + 9,500 The following events occurred during August 2019. a. Issued common stock to Ms. Garriz in exchange for $15,000 cash. b. Paid $850 for first month's rent on office space. c. Purchased supplies of $2,250 on credit. d. Borrowed $8,000 from the bank. e. Paid $1,080 on account for supplies purchased earlier on credit. f. Paid secretary's salary for August of $2,150. g. Performed accounting services for clients who paid cash upon completion of the service in the total amount of $4,700. h. Used $3,180 of the supplies on hand. 1. Performed accounting services for clients on credit in the total amount of $1,920. 1. Purchased $500 in supplies for cash. k. Collected $1,290 cash from clients for whom services were performed on credit. 1. Paid $1,000 dividend to stockholders. Required: 1. Record the effects of the transactions listed above on the accounting equation. The totals at July 31, 2019 have already been entered. If an amount box does not require an entry, leave it blank. Enter decreases in account values as negative numbers. Assets Liabilities Equity Cash Common Stock Acct. Rec. + Supplies Acct. Pay. + Notes Pay. + + Ret. Earn. 8,000 15,900 4,100 2,500 4,000 12,000 9,500 a. b. c. d. e. f. 9. h. i. 1. k. 2. Prepare the trial balance at August 31, 2019. If an amount box does not require an entry, leave it blank. Madero Accounting Services Trial Balance August 31, 2019 Account Debit Credit Q000100 Qolll|||00| e. c. g. Presented below are the four assumptions and four principles used in measuring and reporting accounting Information. Assumptions Principles a. Economic entity Historical cost b. Going-concern f. Revenue recognition Time-period Expense recognition d. Monetary unit h. Conservatism Required: Identify the assumption or principle that best describes each situation below. 1. Requires that an activity be recorded at the exchange price at the time the activity occurred. 2. Allows a company to report financial activities separate from the activities of the owners. 3. Implies that items such as customer satisfaction cannot be reported in the financial statements. 4. Specifies that revenue should only be recognized when a company has satisfied its performance obligation to a customer. 5. Justifies why some assets and liabilities are not reported at their value if sold. 6. Allows the life of a company to be divided into artificial time periods so accounting reports can be provided on a timely basis. 7. Is a prudent reaction to uncertainty. 8. Requires that expenses be recorded and reported in the same period as the revenue that it helped generate. Problem 2-55B Events and Transactions The following list contains events that occurred during January 2019 at the local Ford dealer, Malcom Motors: Required: 1. Conceptual Connection: Indicate whether each item qualifies as a transaction and should be recorded in the accounting system. a. California Central University (CCU) signed a contract to purchase a fleet of Ford Crown Victoria vehicles from Malcom Motors at a total price of $200,000, payable to Malcom in two equal amounts on August 1, 2019, and September 1, 2019. The cars will be delivered to CCU during August 2019. This transaction for recognition because signing a contract affect the accounting equation. b. The principal stockholder in Malcom Motors sold 10% of her stock in the company to John Lewis, the president of Malcom Motors, in exchange for $100,000 in cash. This transaction for recognition because selling stock to another person affect the total amount of common stock outstanding for the company. c. Malcom Motors issued new stock to John Lewis in exchange for $50,000 in cash. This transaction for recognition because the transaction affect two accounting elements. d. Malcom Motors owns the building it occupies; the company occupied the building during the entire month of January. This event for recognition. There external event affecting the accounting equation. e. Malcom Motors owns land used for the storage of cars awaiting sale; the land was used by the company during the entire month of January This event for recognition because Malcom Motors pay to use the land. f. Malcom Motors paid its lawyer $1,000 for services rendered in connection with the purchase agreement signed with California Central University. This transaction to be recorded because two accounting elements been affected. 9. Maintenance Management Company performed cleaning services for Malcom Motors during January under a contract that does not require payment for those services until March 1, 2019 This transaction to be recorded because two accounting elements been affected. 2. Conceptual Connection: What accounting concept is illustrated by Event b? eDOUN Complete the table below for these accounts. The information for the first account has been entered as an example. Increase Normal Balance Decrease Account Type of Account Credit Credit Debit Liability Accounts Payable Accounts Receivable Bonds Payable Building Cash Common Stock Copyright Cost of Goods Sold Depreciation Expense Income Taxes Expense Income Taxes Payable Insurance Expense Interest Expense Inventory Investments Retained Earnings Sales Revenue Unearned Revenue Utilities Expense Assets Liabilities + Stockholders' Equity Contributed Capital Retained Earnings b. podl||||||| LITIJIIIIII llllllllll blllllIIIII k. Exercise 2-47 Debit and Credit Effects of Transactions Lincoln Corporation was involved in the following transactions during the current year: a. Lincoln borrowed cash from the local bank on a note payable. b. Lincoln purchased operating assets on credit. c. Lincoln paid dividends in cash. d. Lincoln purchased supplies inventory on credit. e. Lincoln used a portion of the supplies purchased in Transaction d. f. Lincoln provided services in exchange for cash from the customer. 9. A customer received services from Lincoln on credit. h. The owners invested cash in the business in exchange for common stock. I. The payable from Transaction d was paid in full. 1. The receivable from Transaction g was collected in full. k. Lincoln paid wages in cash. Required: Indicate the the effect on assets, liabilities, and stockholders' equity by selecting, in the appropriate columns, the correct effect. If there is no effect in a column, choose "No effect". Note that transaction "a" is entered as an example: Assets Liabilities Stockholders' Equity Contributed Retained Capital + Earnings Increase (Debit) Increase (Credit) No effect No effect b. C. d. 1. g. h. I. 1