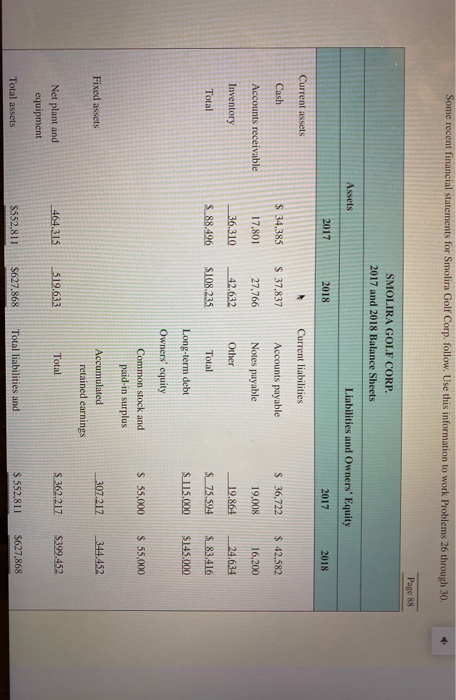

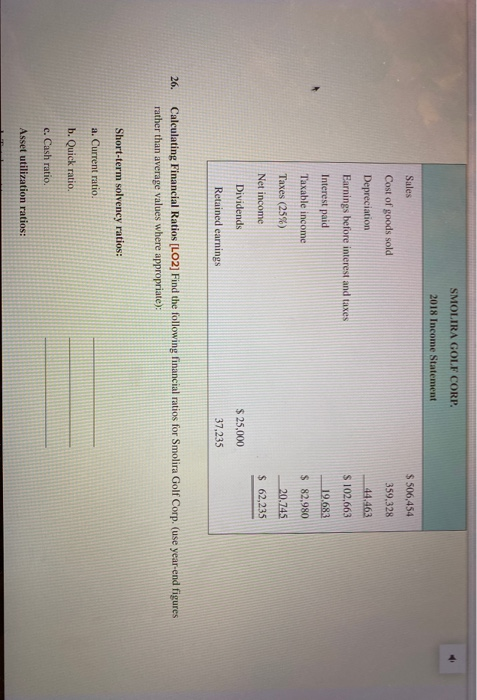

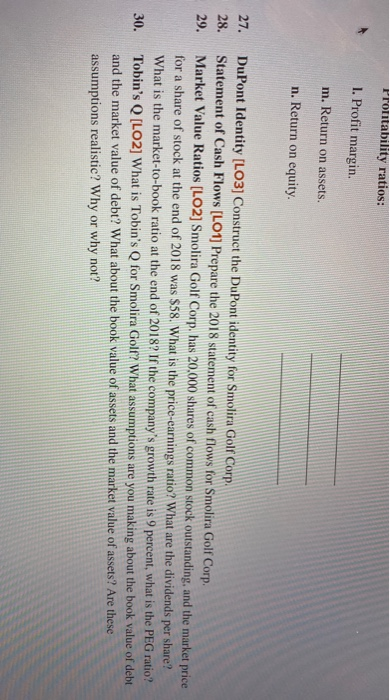

Some recent financial statements for Smolina Golf Corp. follow. Use this information to work Problems 26 through 30 Page 88 Assets 2017 SMOLIRA GOLF CORP. 2017 and 2018 Balance Sheets Liabilities and Owners' Equity 2018 2017 Current liabilities $ 37,837 Accounts payable $ 36,722 27,766 Notes payable 19.008 2018 Current INCES Cash $ 42,582 $ 34,385 17.801 Accounts receivable Inventory Other 19.864 36,310 $ 88.496 42.632 $108.235 16,200 24.634 $. 83.416 $145.000 Total Total $ 75.594 $ 115,000 Long-term debt Owners' equity $ 55,000 $ 55,000 Common stock and paid-in surplus Fixed assets Accumulated retained earnings 307.212 344.452 464.315 519.633 Total S 362.212 Net plant and equipment $399,452 Total assets S552,811 $627.868 Total liabilities and S 552,811 5627.868 SMOLIRA GOLF CORP. 2018 Income Statement Sales $ 506,454 Cost of goods sold 359,328 Depreciation 44.463 Earnings before interest and S 102.663 Interest paid 19.683 Taxable income Taxes (25%) $ 82,980 20.745 $ 62,235 Net income Dividends $ 25,000 37.235 Retained earnings 26. Calculating Financial Ratios [LO2] Find the following financial ratios for Smolira Golf Corp. (use year-end figures rather than average values where appropriate): Short-term solvency ratios: a. Current ratio. b. Quick ratio. c. Cash ratio. Asset utilization ratios: Short-term solvency ratios: a. Current ratio. b. Quick ratio. c. Cash ratio. Asset utilization ratios d. Total asset turnover. e. Inventory turnover. f. Receivables turnover. Long-term solvency rati g. Total debt ratio. h. Debt-equity rati i. Equity multiplier j. Times interest earned ratio k. Cash coverage ratio Profitability ratios 1. Profit margin Margin. m. Return on assets. Return on equity rroritability ratios: 1. Profit margin. m. Return on assets. n. Return on equity. 28. DuPont Identity [LO3] Construct the DuPont identity for Smolira Golf Corp. Statement of Cash Flows [LO1] Prepare the 2018 statement of cash flows for Smolira Golf Corp. Market Value Ratios (LO2] Smolira Golf Corp, has 20,000 shares of common stock outstanding, and the market price for a share of stock at the end of 2018 was $58. What is the price-earnings ratio? What are the dividends per share? What is the market-to-book ratio at the end of 2018? If the company's growth rate is 9 percent, what is the PEG ratio? Tobin's Q [LO2] What is Tobin's Q for Smolira Golf? What assumptions are you making about the book value of debt and the market value of debt? What about the book value of assets and the market value of assets? Are these assumptions realistic? Why or why not? 30