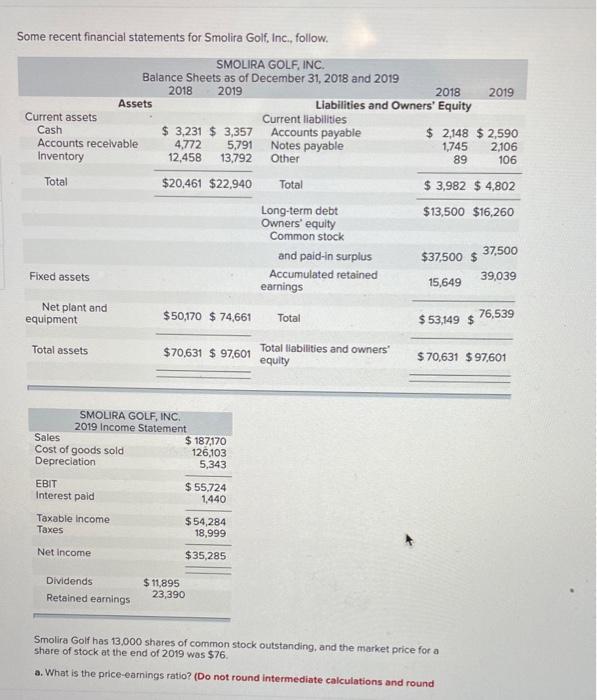

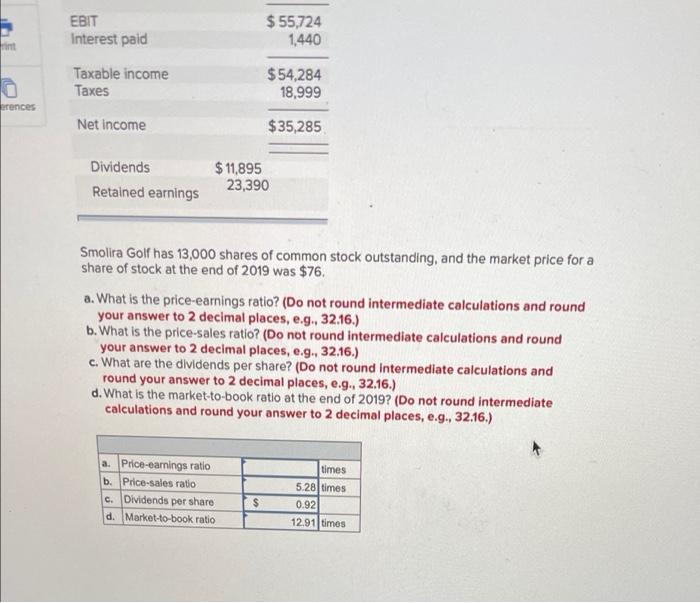

Some recent financial statements for Smolira Golf, Inc., follow, SMOLIRA GOLF, INC Balance Sheets as of December 31, 2018 and 2019 2018 2019 2018 2019 Assets Liabilities and Owners' Equity Current assets Current liabilities Cash $ 3,231 $ 3,357 Accounts payable $ 2,148 $ 2,590 Accounts recelvable 4,772 5,791 Notes payable 1,745 2,106 Inventory 12,458 13,792 Other 89 106 Total $20.461 $22.940 Total $ 3,982 $ 4,802 Long-term debt $13,500 $16,260 Owners' equity Common stock and paid-in surplus $37,500 $ 37,500 Fixed assets Accumulated retained earnings 15,649 39,039 Net plant and equipment $50,170 $ 74,661 Total $ 53,149 $ 76,539 Total assets $70,631 $ 97,601 Total liabilities and owners equity $ 70,631 $ 97,601 SMOLIRA GOLF, INC. 2019 Income Statement Sales $ 187,170 Cost of goods sold 126,103 Depreciation 5,343 EBIT Interest paid $ 55,724 1,440 Taxable income Taxes $54,284 18,999 Net Income $35,285 Dividends Retained earnings $ 11,895 23,390 Smolira Golf has 13,000 shares of common stock outstanding, and the market price for a share of stock at the end of 2019 was $76. a. What is the price-earnings ratio? (Do not round intermediate calculations and round EBIT Interest paid $ 55,724 1.440 ht Taxable income Taxes $54,284 18,999 rences Net income $35,285 Dividends Retained earnings $ 11,895 23,390 Smolira Golf has 13,000 shares of common stock outstanding, and the market price for a share of stock at the end of 2019 was $76. a. What is the price-earnings ratio? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. What is the price-sales ratio? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) c. What are the dividends per share? (Do not round Intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) d. What is the market-to-book ratio at the end of 2019? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) a. Price-earnings ratio b. Price-sales ratio c. Dividends per share d. Market-to-book ratio times 5.28 times 0.92 12.91 times $