Answered step by step

Verified Expert Solution

Question

1 Approved Answer

some specific questions: a) I was told that we can not use the geometric gradient present worth that assumes i=g because the value comes out

some specific questions:

a) I was told that we can not use the geometric gradient present worth that assumes i=g because the value comes out to her salary being around 2 million dollars, which is unrealistic. But I don't know where we get i from then?

b)what do we do about the PERPETUAL withdrawls... how do we know what to use for n

Please do c-e also.

Finally, please right out the math rather than using excel.

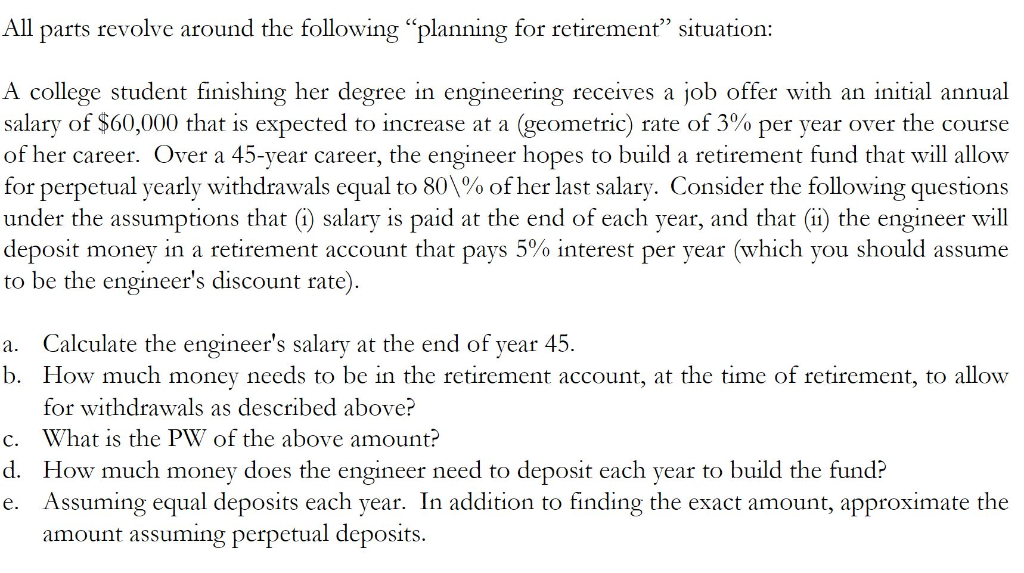

All parts revolve around the following "planning for retirement" situation A college student finishing her degree in engineering receives a job offer with an initial annual salary of $60,000 that is expected to increase at a geometric) rate of 3% per year over the course of her career. Over a 45-year career, the engineer hopes to build a retirement fund that will allow for perpetual yearly withdrawals equal to 80% ofher last salary. Consider the following questions under the assumptions that salary is paid at the end of each year, and that (i) the engineer will deposit money in a retirement account that pays 5% interest per year (which you should assume to be the engineer's discount rate) a. Calculate the engineer's salary at the end of year 45. b. How much money needs to be in the retirement account, at the time of retirement, to allow for withdrawals as described above? What is the PW of the above amount? How much money does the engineer need to deposit each year to build the fund? Assuming equal deposits each year. In addition to finding the exact amount, approximate the amount assuming perpetual deposits c. d. e. All parts revolve around the following "planning for retirement" situation A college student finishing her degree in engineering receives a job offer with an initial annual salary of $60,000 that is expected to increase at a geometric) rate of 3% per year over the course of her career. Over a 45-year career, the engineer hopes to build a retirement fund that will allow for perpetual yearly withdrawals equal to 80% ofher last salary. Consider the following questions under the assumptions that salary is paid at the end of each year, and that (i) the engineer will deposit money in a retirement account that pays 5% interest per year (which you should assume to be the engineer's discount rate) a. Calculate the engineer's salary at the end of year 45. b. How much money needs to be in the retirement account, at the time of retirement, to allow for withdrawals as described above? What is the PW of the above amount? How much money does the engineer need to deposit each year to build the fund? Assuming equal deposits each year. In addition to finding the exact amount, approximate the amount assuming perpetual deposits c. d. eStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started