Answered step by step

Verified Expert Solution

Question

1 Approved Answer

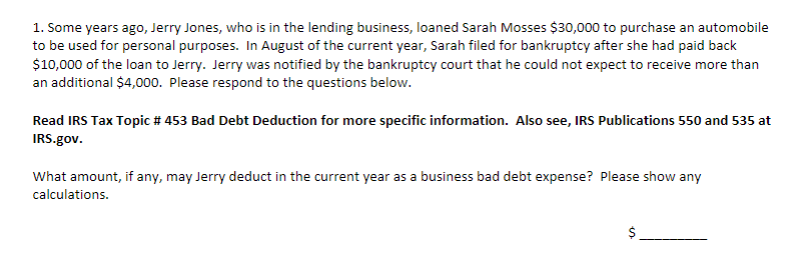

Some years ago, Jerry Jones, who is in the lending business, loaned Sarah Mosses $ 3 0 , 0 0 0 to purchase an automobile

Some years ago, Jerry Jones, who is in the lending business, loaned Sarah Mosses $ to purchase an automobile

to be used for personal purposes. In August of the current year, Sarah filed for bankruptcy after she had paid back

$ of the loan to Jerry. Jerry was notified by the bankruptcy court that he could not expect to receive more than

an additional $ Please respond to the questions below.

Read IRS Tax Topic # Bad Debt Deduction for more specific information. Also see, IRS Publications and at

IRS.gov.

What amount, if any, may Jerry deduct in the current year as a business bad debt expense? Please show any

calculations.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started