Answered step by step

Verified Expert Solution

Question

1 Approved Answer

someone already tried to help me with a previous question I posted but it didnt really line up well. hopefully the 2 will combine to

someone already tried to help me with a previous question I posted but it didnt really line up well. hopefully the 2 will combine to give me a decent grade. thanks.

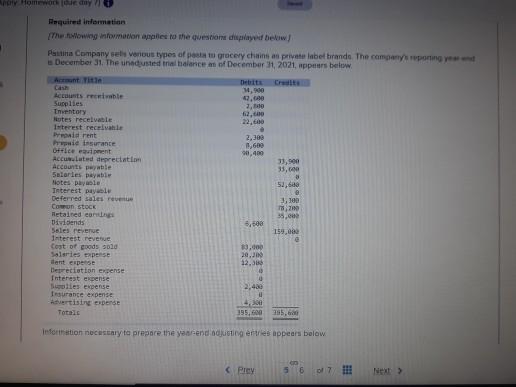

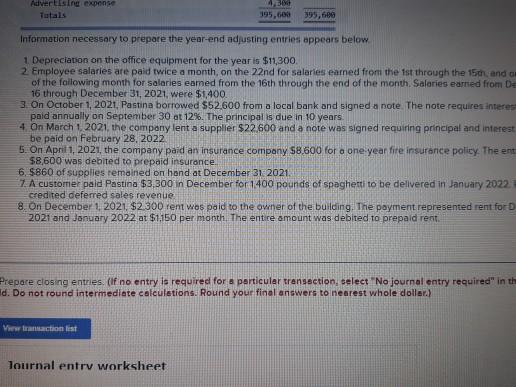

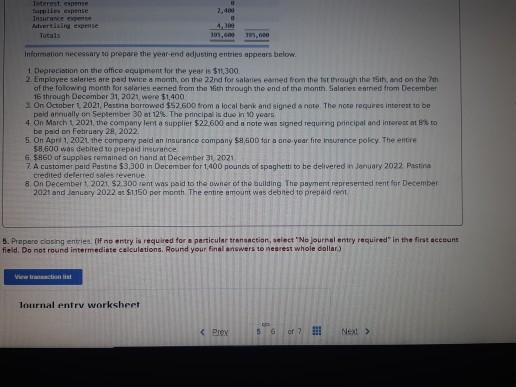

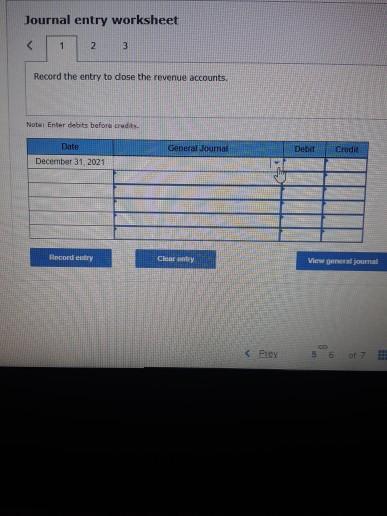

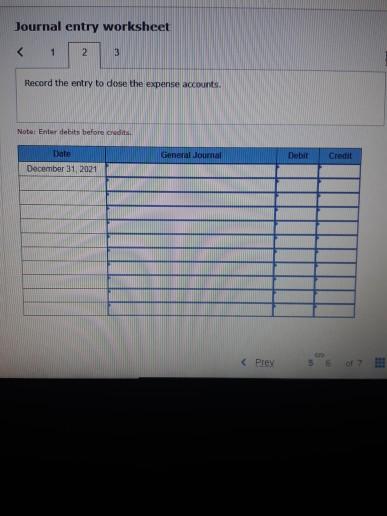

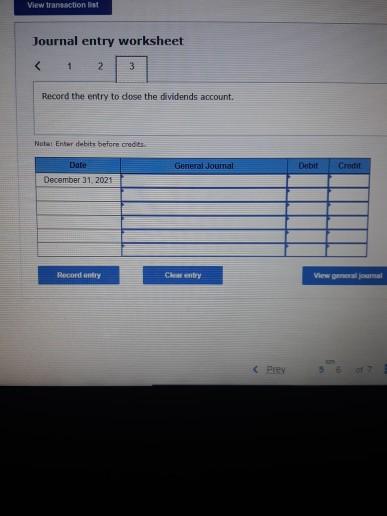

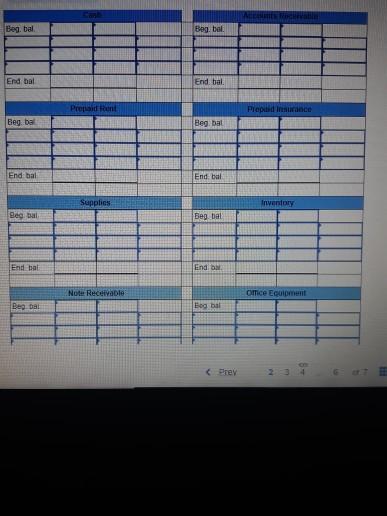

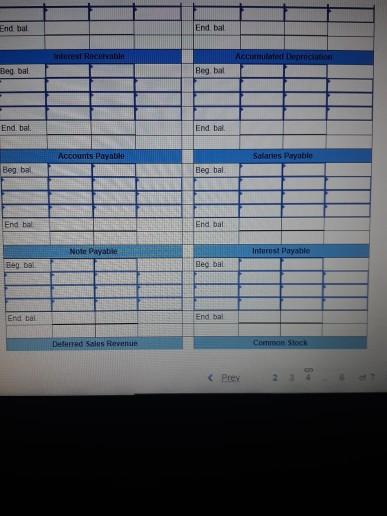

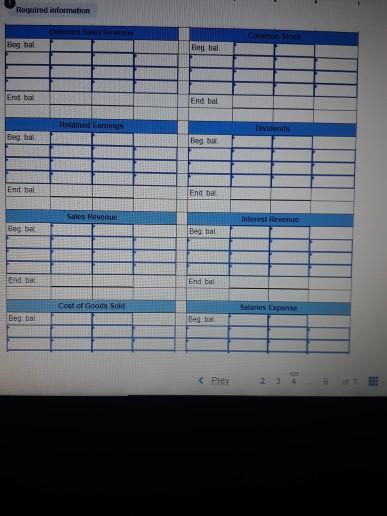

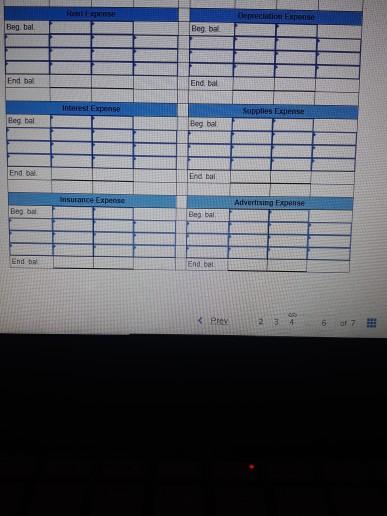

Romwony nurante Required information The owng information males to the questione chiplayed below Paulina Company selvenous types of post to grocery chains as private label brande. The company porno December 31. The unadjusted trial balance of December 31, 2021, appears below hant C Accounts . Supplies 2,600 Inventory 2,10 Notes recente 22.00 Interest receive Pri rent 2,300 1,600 Office 90,400 Accounts le Accumulated depreciation 33,900 33,640 5alories payable Notes Payole 51, Interest Delu Deferred sales revenue 3,300 Comun stock 700 Retained and 35.000 Dividends 8,600 Soles revenue 159.000 Interest revenue Cost of Coods sod 13.00 Salaries sense 20. 12.30 Depreciation expense Interest expense Suoties expense Insurance expense Advertising expende 300 Totalt 195,00 285,6 Hent expense Information nocetary to prepare the yarend adjusting entries appears below 5 6 of 7 !!! Advertisin ponse Tatals 195,600 395,60 Information necessary to prepare the year-end adjusting entries appears below 1. Depreciation on the office equipment for the year is $11,300 2. Employee salaries are paid twice a month on the 22nd for salaries earned from the 1st through the 15th, and a of the following month for salaries eamed from the 16th through the end of the month Salaries earned from De 16 through December 31, 2021 were $1,400 3. On October 1, 2021, Pastina borrowed $52.600 from a local bank and signed a note The note requires interes paid annually on September 30 at 12%. The principal is due in 10 years 4 On March 12021, the company lent a supplier $22.600 and a note was signed requiring principal and interest be paid on February 28, 2022 5. On Apni 1, 2021, the company paid an insurance company 58.600 for a one year fire insurance policy. The ent $8,600 was debited to prepaid insurance 6. $860 of supplies remained on hand at December 31 2021. 7. A customer paid Pastina $3,300 in December for 1400 pounds of spaghetti to be delivered in January 2022 credited deferred sales revenue 8. On December 1, 2021, $2.300 rent wos paid to the owner of the building. The payment represented rent for 2021 and January 2022 at $1150 per month The entire amount was debited to prepaid rent Prepare closing entries. (If no entry is required for a particular transaction, select "No journal entry required" in th d. Do not round intermediate calculations. Round your final answers to nearest whole dollar.) Www traction ist Tournal entry worksheet TO tuin een Thu 2.40 4. Tutus . Information necessary to prepare the year and adjusting entries appears below. 1 Depreciation on the office equipment for the year is $11.300 2. Employee salenes are pad twice a month on the 22nd for salaries eamed from the through thes, and on the of the following month for salaries eerned from the 16th through the end of the month Salariet emned from December 16 through December 31, 2021 were $1,400 On October 1 2021. Postha bartowed $S2600 from a local bank and signed a note The not requres interest to be paid annually on September 30 at 12%. The principali duo in 10 years 4 on March 12021. the company lent a supplier $22.600 and a note was signed tequiring principal and interest to be paid on February 28, 2022 5. On Apr 1, 2021the company paid an insurance company S8,60p for a one year fire Insurance policy. The entire 58.600 was debited to prepaid insurance 6 $860 of Supplies remained on hand at December 3i 2021 7. A customer pald Paste $3,300 in December for 1.400 pounds of spaghetti to be delivered in January 2022 Rastina credited delerred sales revenue 8 On December 2021 $2.30 tent was paid to the owner of the building The payment represented tent for December 2021 and January 2022 at $1150 por month The entire amount was debted to prepaid rent 5. Prapere closing if no entry is required for a particular transaction, select "No journal entry required in the first account field. Do not round intermediate calculations. Round your final answers to nearest whole dollar) Tournal entry worksheet Gor Next > Journal entry worksheetStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started