Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Someone answrr plaese. 16. Today is January 1st, 2018 (T 0). You take out a 30 year fully amortizing mortgage of $300,000 Payments are made

Someone answrr plaese.

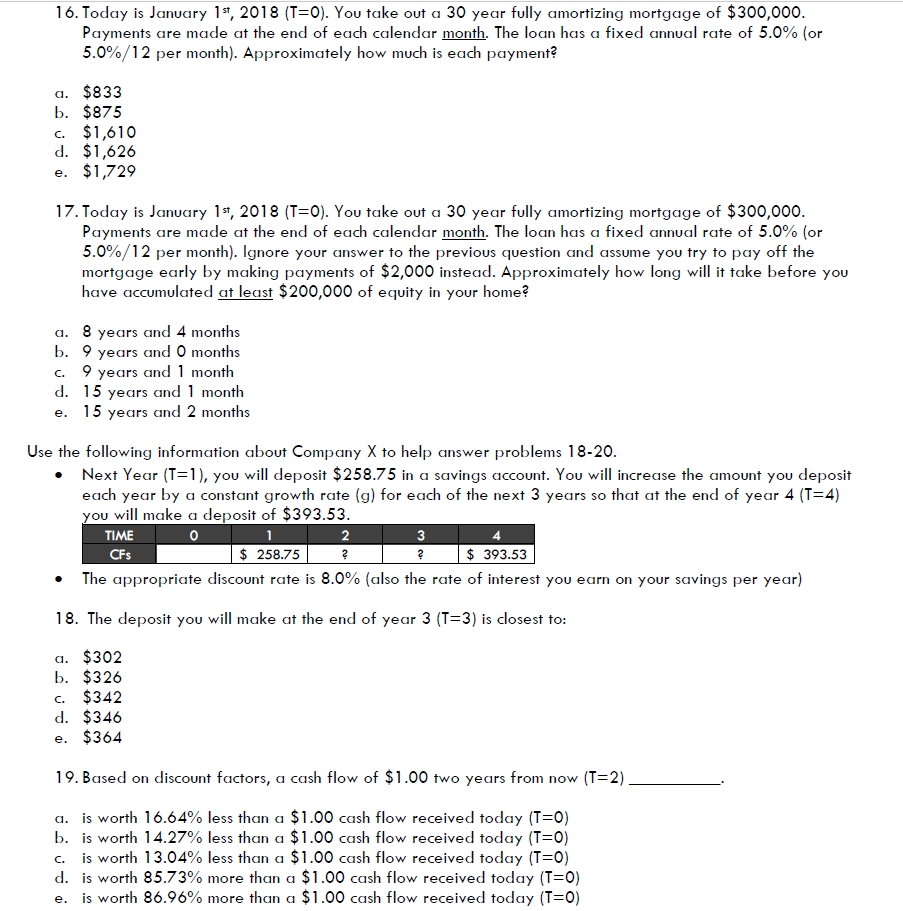

16. Today is January 1st, 2018 (T 0). You take out a 30 year fully amortizing mortgage of $300,000 Payments are made at the end of each calendar month. The loan has a fixed annual rate of 5.0% (or 5.0%/ 12 per month). Approximately how much is each payment? a. $833 b. $875 c. $1,610 d. $1,626 e. $1,729 17. Today is January 1st, 2018 (T 0). You take out a 30 year fully amortizing mortgage of $300,000 Payments are made at the end of each calendar month. The loan has a fixed annual rate of 5.0% (or 5.0%/12 per month). Ignore your answer to the previous question and assume you try to pay off the mortgage early by making payments of $2,000 instead. Approximately how long will it take before you have accumulated at least $200,000 of equity in your home? a. 8 years and 4 months b. 9 years and O months c. 9 years and 1 month d. 15 years and 1 month e. 15 years and 2 months Use the following information about Company X to help answer problems 18-20 . Next Year (T1), you will deposit $258.75 in a savings account. You wi increase the amount you deposit each year by a constant growth rate (g) for each of the next 3 years so that at the end of year 4 (T 4) you will make a deposit of $393.53 2 3 TIME CFs $ 258.75 $ 393.53 The appropriate discount rate is 8.0% (also the rate of interest you earn on your savings per year) 8. The deposit you will make at the end of year 3 (T-3) is closest to: a. $302 b. $326 c. $342 d. $346 e. $364 19. Based on discount factors, a cash flow of $1.00 two years from now ( 2) a. is worth 16.64% less than a $1.00 cash flow received today (-0) b, is worth 14.27% less than a $1.00 cash flow received today (-0) c. is worth 13.04% less than a $1.00 cash flow received today (-0) d. is worth 85.73% more than a $1.00 cash flow received today (-0) e. is worth 86.96% more than a $1.00 cash flow received today (-0)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started