someone check if the answer is correct,

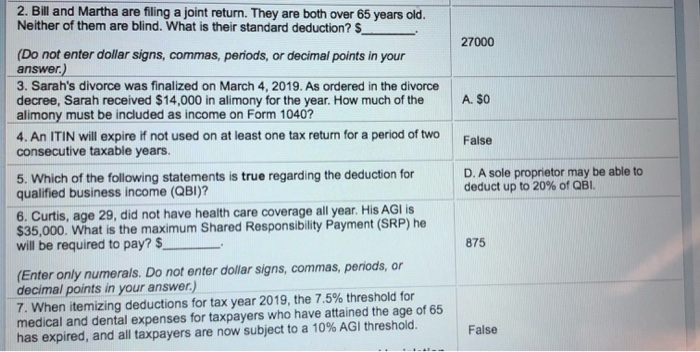

2. Bill and Martha are filing a joint return. They are both over 65 years old. Neither of them are blind. What is their standard deduction? $ 27000 (Do not enter dollar signs, commas, periods, or decimal points in your answer.) 3. Sarah's divorce was finalized on March 4, 2019. As ordered in the divorce decree, Sarah received $14,000 in alimony for the year. How much of th alimony must be included as income on Form 1040? 4. An ITIN will expire if not used on at least one tax return for a period of two consecutive taxable years. A. $0 False D. A sole proprietor may be able to deduct up to 20% of QBI. 5. Which of the following statements is true regarding the deduction for qualified business income (QBI)? 6. Curtis, age 29, did not have health care coverage all year. His AGI IS $35,000. What is the maximum Shared Responsibility Payment (SRP) he will be required to pay? $_ 875 (Enfer only numerals. Do not enter dollar signs, commas, periods, or decimal points in your answer.) 7. When itemizing deductions for tax year 2019, the 7.5% threshold for medical and dental expenses for taxpayers who have attained the age of 65 has expired, and all taxpayers are now subject to a 10% AGI threshold. False 2. Bill and Martha are filing a joint return. They are both over 65 years old. Neither of them are blind. What is their standard deduction? $ 27000 (Do not enter dollar signs, commas, periods, or decimal points in your answer.) 3. Sarah's divorce was finalized on March 4, 2019. As ordered in the divorce decree, Sarah received $14,000 in alimony for the year. How much of th alimony must be included as income on Form 1040? 4. An ITIN will expire if not used on at least one tax return for a period of two consecutive taxable years. A. $0 False D. A sole proprietor may be able to deduct up to 20% of QBI. 5. Which of the following statements is true regarding the deduction for qualified business income (QBI)? 6. Curtis, age 29, did not have health care coverage all year. His AGI IS $35,000. What is the maximum Shared Responsibility Payment (SRP) he will be required to pay? $_ 875 (Enfer only numerals. Do not enter dollar signs, commas, periods, or decimal points in your answer.) 7. When itemizing deductions for tax year 2019, the 7.5% threshold for medical and dental expenses for taxpayers who have attained the age of 65 has expired, and all taxpayers are now subject to a 10% AGI threshold. False