Answered step by step

Verified Expert Solution

Question

1 Approved Answer

SOMEONE HAS GIVEN A WRONG ANSWER BEFORE. PLEASE PROVIDE A CORRECT SOLUTION ONLY IF YOU ARE SURE 5. The following table provides characteristics of four

SOMEONE HAS GIVEN A WRONG ANSWER BEFORE. PLEASE PROVIDE A CORRECT SOLUTION ONLY IF YOU ARE SURE

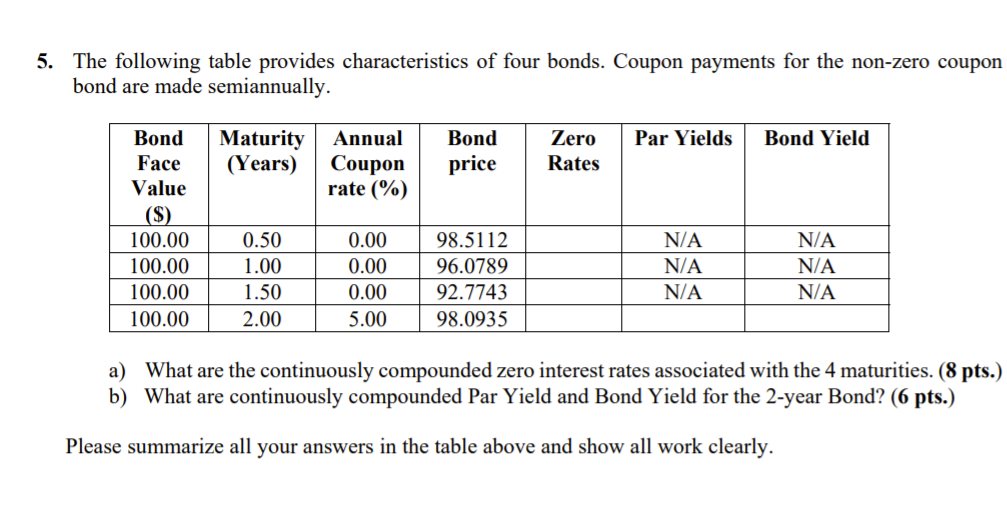

5. The following table provides characteristics of four bonds. Coupon payments for the non-zero coupon bond are made semiannually. Par Yields Bond Yield Maturity (Years) Annual Coupon rate (%) Bond price Zero Rates Bond Face Value ($) 100.00 100.00 100.00 100.00 0.50 1.00 1.50 2.00 0.00 0.00 0.00 5.00 98.5112 96.0789 92.7743 98.0935 N/A NA N/A N/A N/A N/A a) What are the continuously compounded zero interest rates associated with the 4 maturities. (8 pts.) b) What are continuously compounded Par Yield and Bond Yield for the 2-year Bond? (6 pts.) Please summarize all your answers in the table above and show all work clearly. 5. The following table provides characteristics of four bonds. Coupon payments for the non-zero coupon bond are made semiannually. Par Yields Bond Yield Maturity (Years) Annual Coupon rate (%) Bond price Zero Rates Bond Face Value ($) 100.00 100.00 100.00 100.00 0.50 1.00 1.50 2.00 0.00 0.00 0.00 5.00 98.5112 96.0789 92.7743 98.0935 N/A NA N/A N/A N/A N/A a) What are the continuously compounded zero interest rates associated with the 4 maturities. (8 pts.) b) What are continuously compounded Par Yield and Bond Yield for the 2-year Bond? (6 pts.) Please summarize all your answers in the table above and show all work clearlyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started