Answered step by step

Verified Expert Solution

Question

1 Approved Answer

someone help me out with this questions. thanks in advance (d) As the manager of a small equity fund, you are worried that the recent

someone help me out with this questions. thanks in advance

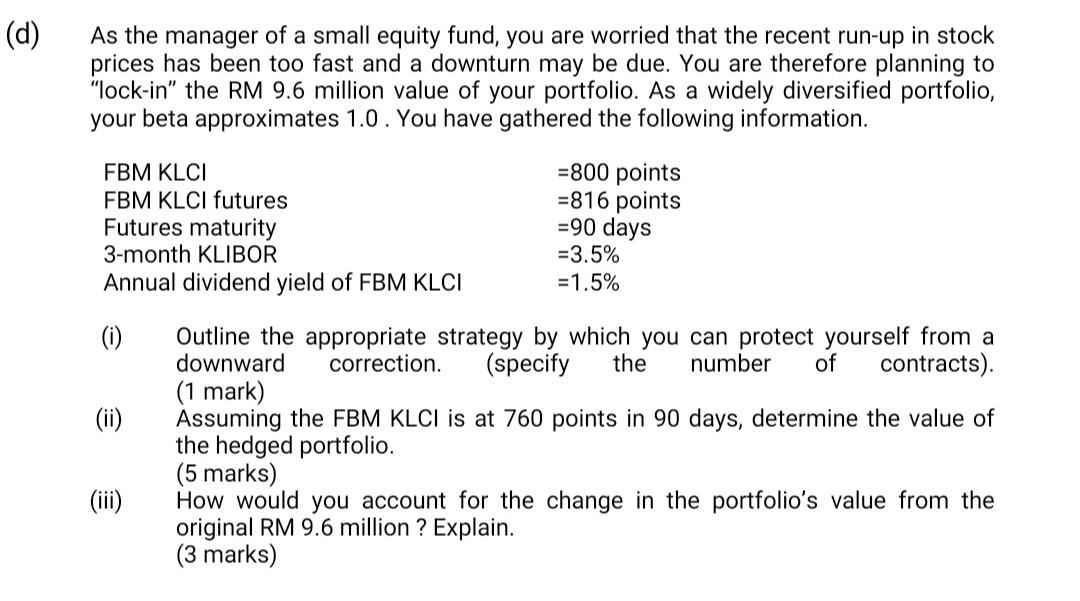

(d) As the manager of a small equity fund, you are worried that the recent run-up in stock prices has been too fast and a downturn may be due. You are therefore planning to "lock-in" the RM 9.6 million value of your portfolio. As a widely diversified portfolio, your beta approximates 1.0. You have gathered the following information. FBM KLCI FBM KLCI futures =800 points =816 points =90 days Futures maturity 3-month KLIBOR =3.5% Annual dividend yield of FBM KLCI =1.5% (i) Outline the appropriate strategy by which you can protect yourself from a downward correction. (specify the number of contracts). (1 mark) (ii) Assuming the FBM KLCI is at 760 points in 90 days, determine the value of the hedged portfolio. (5 marks) (iii) How would you account for the change in the portfolio's value from the original RM 9.6 million ? ExplainStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started