Answered step by step

Verified Expert Solution

Question

1 Approved Answer

someone help me with the questions. thanks in advance A. A Japanese bank expects to lend 10 million to a Spanish firm. If the negotiations

someone help me with the questions. thanks in advance

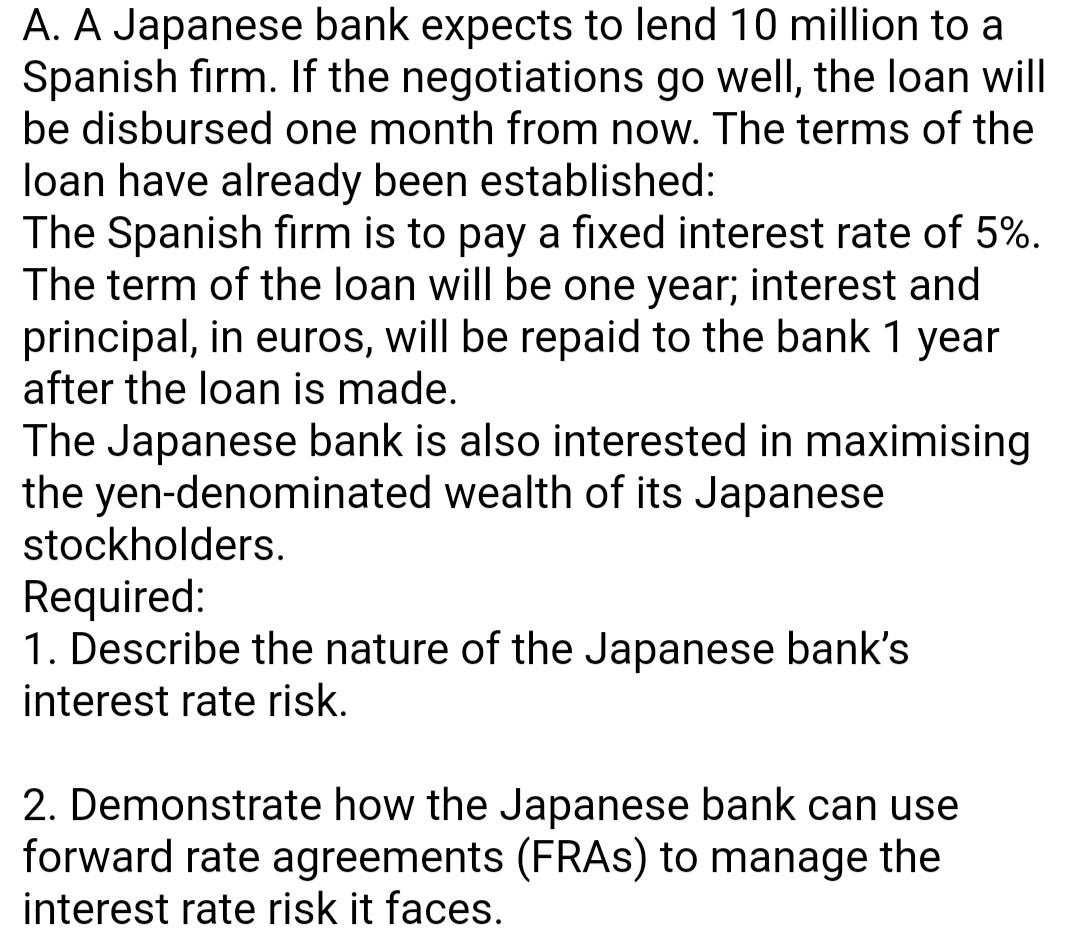

A. A Japanese bank expects to lend 10 million to a Spanish firm. If the negotiations go well, the loan will be disbursed one month from now. The terms of the loan have already been established: The Spanish firm is to pay a fixed interest rate of 5%. The term of the loan will be one year; interest and principal, in euros, will be repaid to the bank 1 year after the loan is made. The Japanese bank is also interested in maximising the yen-denominated wealth of its Japanese stockholders. Required: 1. Describe the nature of the Japanese bank's interest rate risk. 2. Demonstrate how the Japanese bank can use forward rate agreements (FRAS) to manage the interest rate risk it facesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started