Answered step by step

Verified Expert Solution

Question

1 Approved Answer

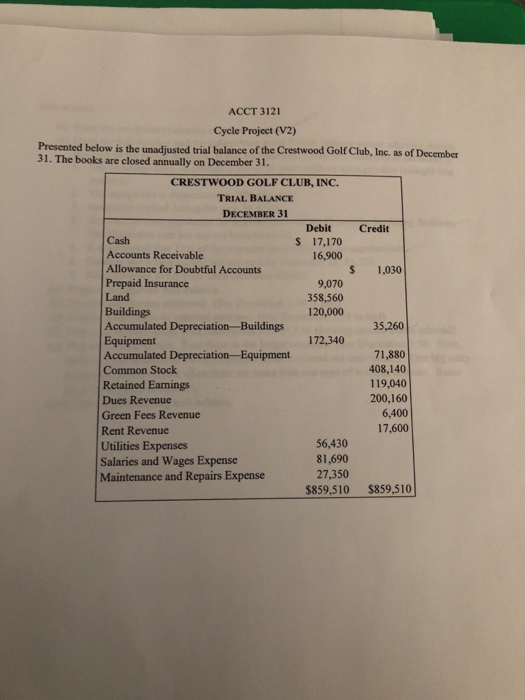

Someone please help me my numbers arent coming out correctly heeeeelp!!! Instructions (a) Enter the unadjusted balances in ledger account (b) From the trial balance

Someone please help me my numbers arent coming out correctly heeeeelp!!!

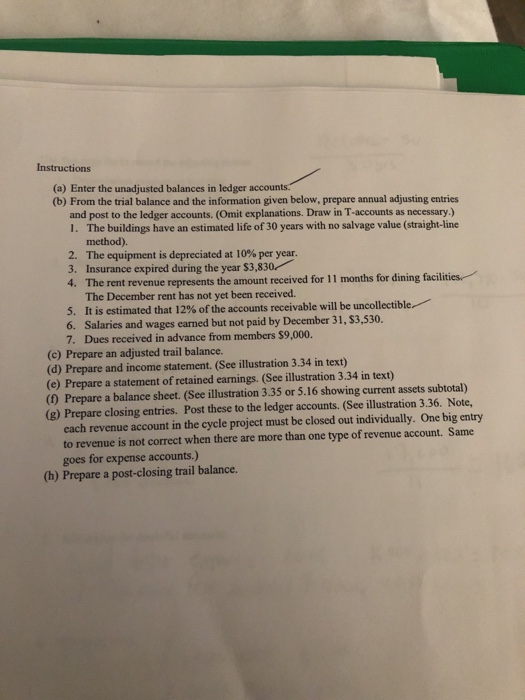

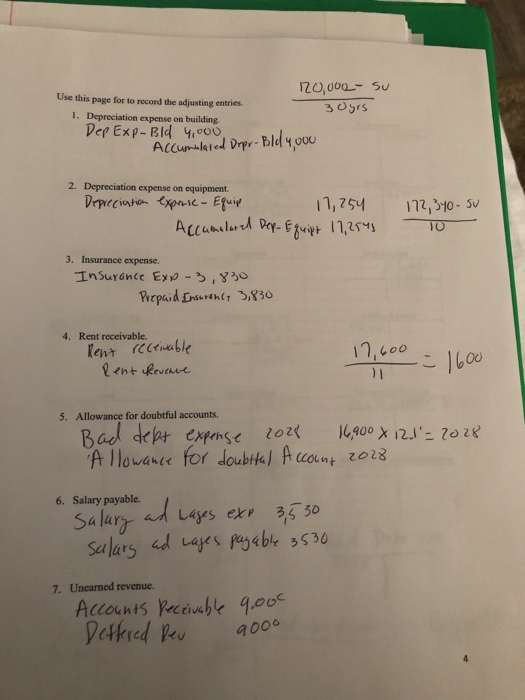

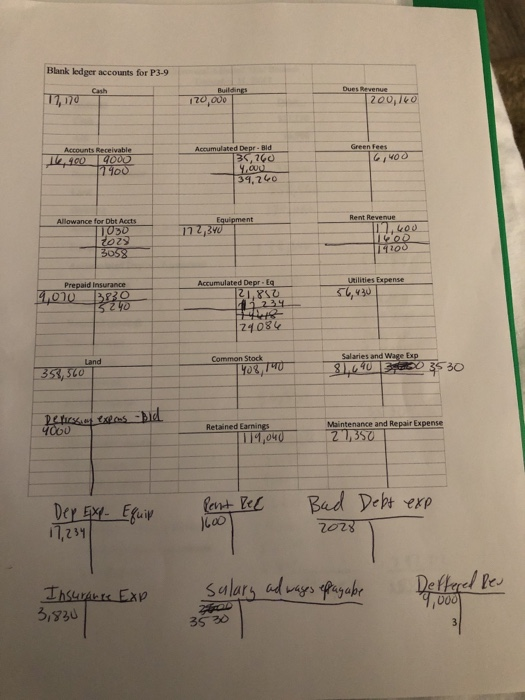

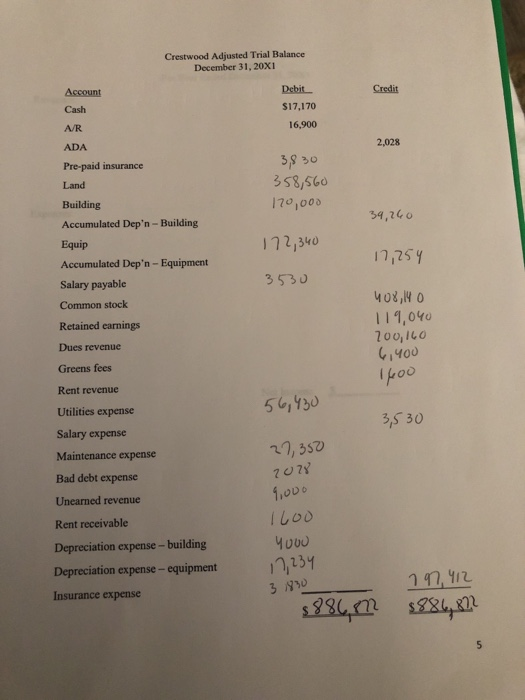

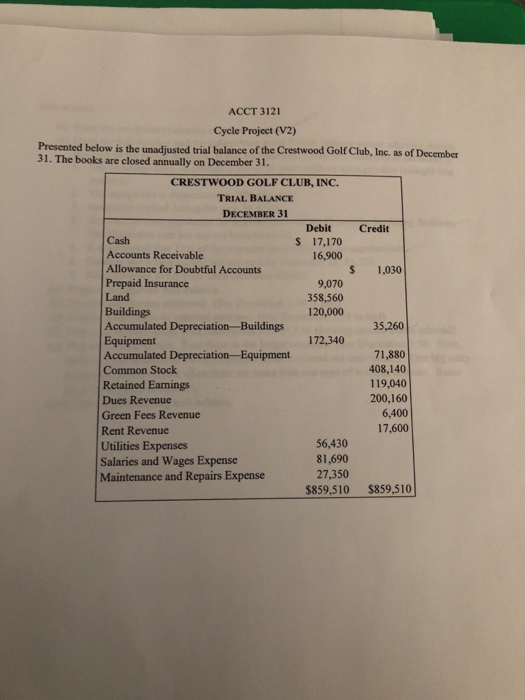

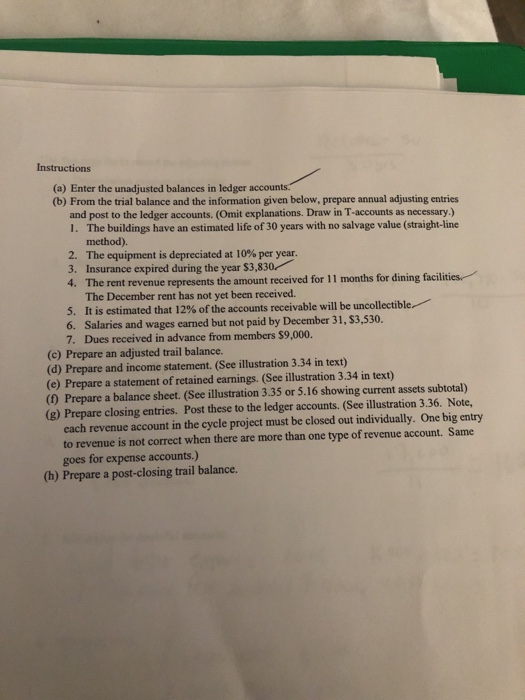

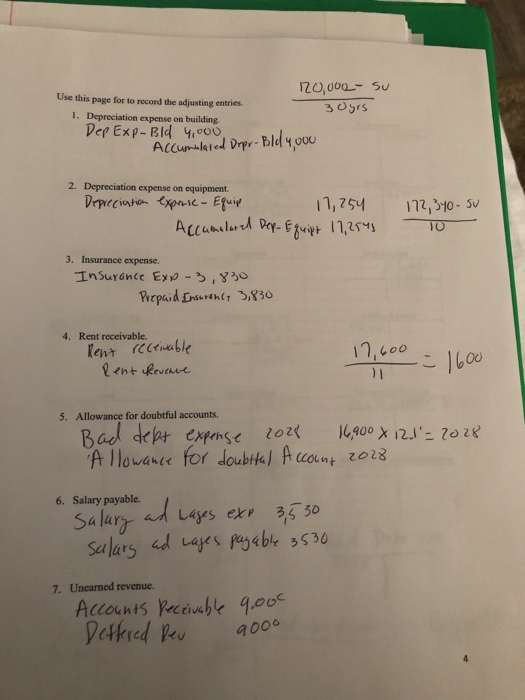

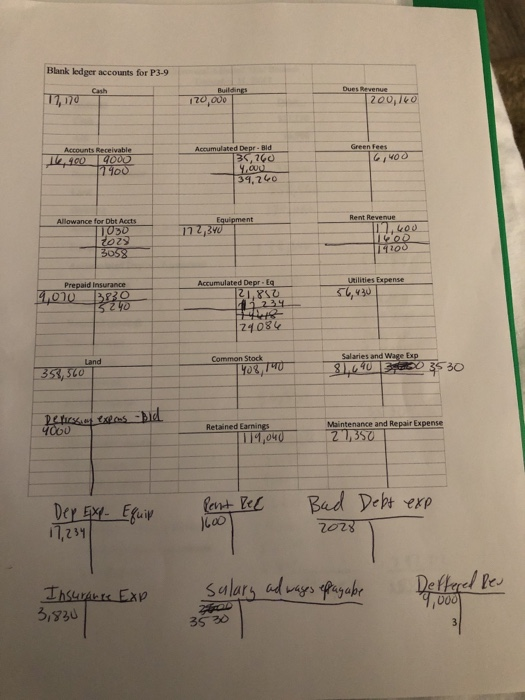

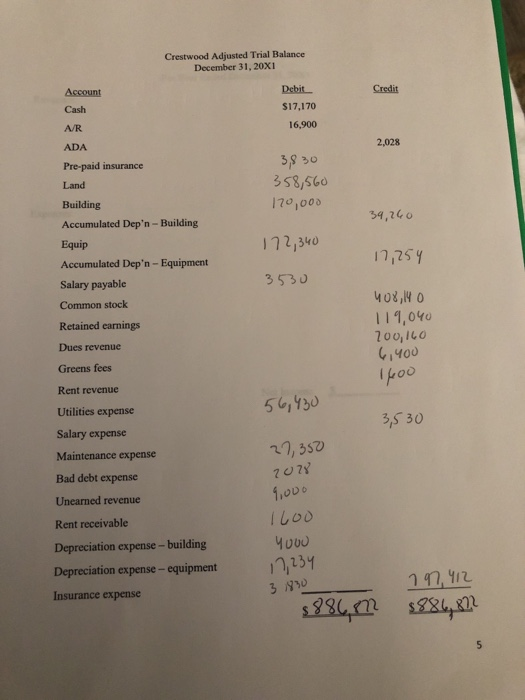

Instructions (a) Enter the unadjusted balances in ledger account (b) From the trial balance and the information given below, prepare annual adjusting entries and post to the ledger accounts. (Omit explanations. Draw in T-accounts as necessary.) I. The buildings have an estimated life of 30 years with no salvage value (straight-line method). 2. The equipment is depreciated at 10% per year. 3. Insurance expired during the year $3,830 4 The rent t revenue represents the amount received for 11 months for dining facilities represents The December rent has not yet been received. 5. It is estimated that 12% of the accounts receivable will be uncon 6. Salaries and wages earned but not paid by December 31, s3,530. 7. Dues received in advance from members $9,000. (c) Prepare an adjusted trail balance. (d) Prepare and income statement. (See illustration 3.34 in text) (e) Prepare a statement of retained earnings. (See illustration 3.34 in text) (0 Prepare a balance sheet. (See illustration 3.35 or 5.16 showing current assets subtotal) (g) Prepare closing entries. Post these to the ledger accounts. (See illustration 3.36. Note, each revenue account in the cycle project must be closed out individually. One big entry to revenue is not correct when there are more than one type of revenue account. Same goes for expense accounts.) (h) Prepare a post-closing trail balance Use this page for to record the adjusting entries. 1. Depreciation expense on building. Der Exp- Bld 4000 20,000-Su 3 ors 2 Depreciation expense on equipment. 3. Insurance expense. 4. Rent receivable. ,100 lent Reveawe 5. Allowance for doubtful accounts. zo28 ovarer for 6. Salary payable. 7. Unearned revenue. Accounts Pecivahe qoo Blank ledger accounts for P3-9 Cash 200,lko ated Depr-Bld 31,2G0 Allowance for Dbt Accts Rent Revenue ko 100 Prepaid Insurance Accumulated Deprq Utilities Expense 2408 Common Stock Salaries and Wage Exp 530 4000 Retained Earnings Maintenance and Repair Expense 30 De Eguin ept ex 023 00o 3,330 35 20 Crestwood Adjusted Trial Balance December 31, 20X1 Credit Cash $17,170 A/R 16,900 ADA 2,028 38 30 3S8,s6o 170,00 4, Pre-paid insurance Land Building Accumulated Dep'n-Building 34,240 Equip 2 1340 Accumulated Dep'n-Equipment Salary payable Common stock Retained earnings Dues revenue Greens fees Rent revenue Utilities expense Salary expense Maintenance expense Bad debt expense 353 I 11,04 oo,1o 1400 lGoo 5 ,130 20,3sv .ODo Yuu 3,5 30 Unearned revenue Rent receivable Depreciation expense- building nl3y 1,131 Depreciation expense-equipment Insurance expense

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started