someone please helpp,,how to answer this question? plsase use the second tabulation to analyze ,thanks

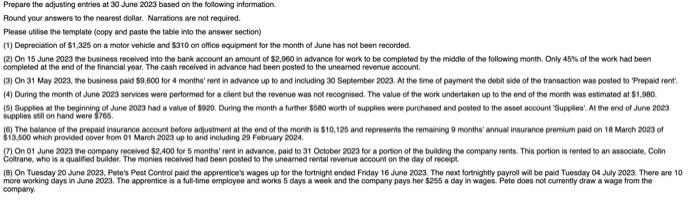

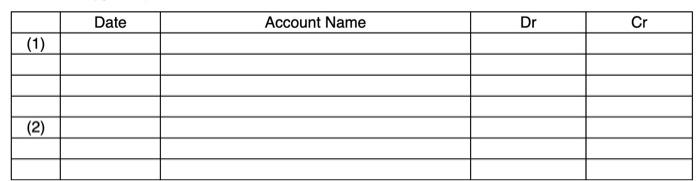

Prepare the adjusting entries at 30 June 2023 based on the following information. Fiound your answers to the nearest dollar. Narrations are not required. Please utilise the template (copy and paste the table into the answer section) (1) Depreciasion of $1,325 on a motor vehicle and $310 on office equipment for the month of June has not been recorded. (2) On 15 June 2023 the business received into the bark account an amount of $2,960 in advance lor work to be completed by the middle of the following month. Only 45% of the work had been completed at the end of the financial year. The cash received in advance had been posted to the uneamed revenue account. (3) On 31 May 2023, the business paid 50,600 for 4 months' rent in advance up to and including 30 September 20e3. At the tme of payment the dobit side of the transaction was posted to 'Prepaid rent: (4) During the month of June 2023 services were perlormed lor a client but the revenue was not recognised. The value of the work underiaken up to the end of the month was estimated at $1,980. (5) Supplet at the beginning of June 2023 had a value of $920. During the month a further $560 worth of tupplies were purchased and posted to the asset acoount 'Bupples'. Ar the end of June 20e3 suppties stil on hand were 5765. (6. The balanoe of the prepaid insurance account bedore adfustment at the end of the moneh is 510,125 and represents the remaining 9 months' annual insurance premium paid on 18 March 2023 of \$13.500 which provided cover from of March 2023 up to and including 29 February 2024. (7) On 01 June 2023 the company recelved $2,400 for 5 months' remt in advance, paid to 31 October 2023 for a portion of the building the compary rents. This portion is rented to an associate. Cclin Coltrane, who is a qualitied bulider. The monies received had been posted to the unearned rental revenue account on the day of rece-pt. (8) On Tuesday 20 June 2023. Pele's Pest Control pald the apprentice's wages up for the fortnight ended Fidday 16 June 2023. The neot forthightly payroll will be paid Tuesday o4 July 2023. There are 10 more working days in June 2023. The apprentice is a fulltime employee and works 5 dins a woek and the company pays her $2555 a day in wages. Pete does nok curentiy draw a wage from the campainy