Answered step by step

Verified Expert Solution

Question

1 Approved Answer

someone plssss help asap thank u Required information [The following information applies to the questions displayed below] Ramirez Company installs a computerized manufacturing machine in

someone plssss help asap thank u

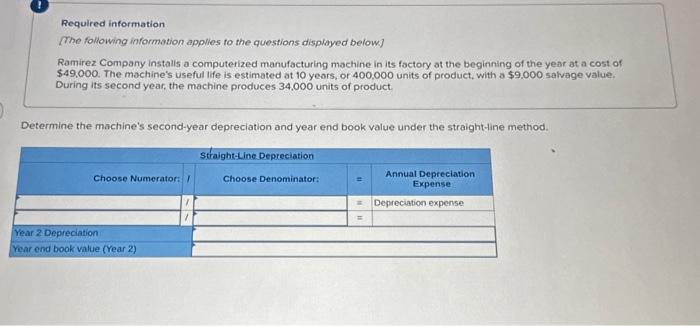

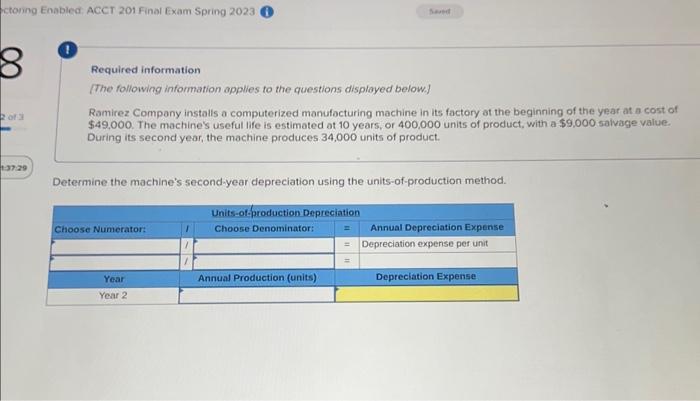

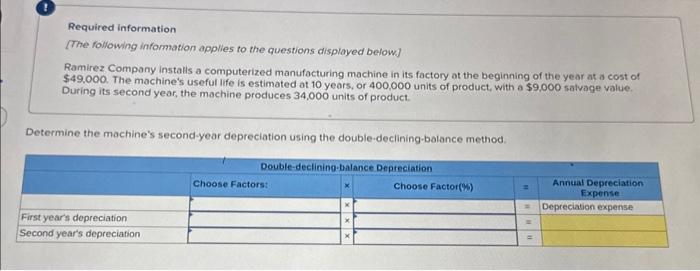

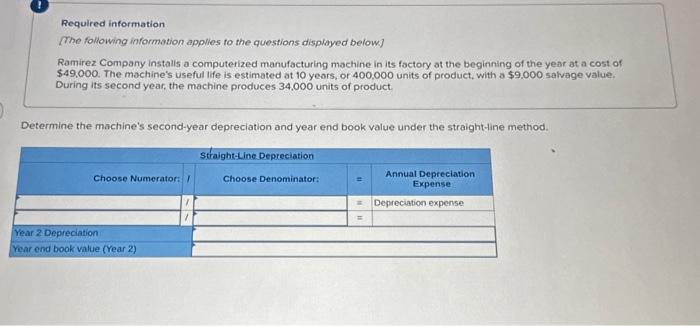

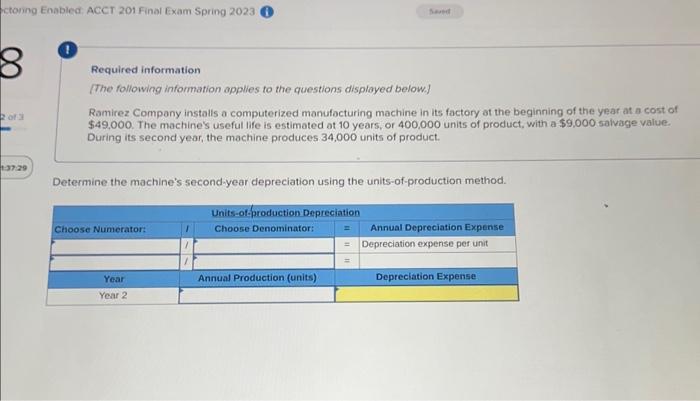

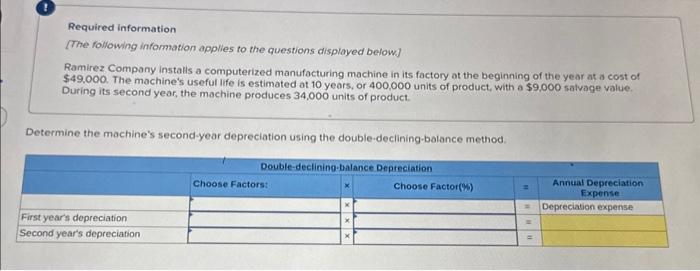

Required information [The following information applies to the questions displayed below] Ramirez Company installs a computerized manufacturing machine in its foctory at the beginning of the year at a cost of $49,000. The machine's useful life is estimated at 10 years, or 400,000 units of product, with a $9,000 salvage value. During its second year, the machine produces 34,000 units of product. Determine the machine's second-year depreciation and year end book value under the straight-ine method. ctonng Enabled: ACCT 201 Final Exam Spring 2023 (1 1 Required information [The following information applies to the questions disployed below.] Ramirez Company installs a computerized manufocturing machine in its factory at the beginning of the year at a cost of $49,000. The machine's useful life is estimated ot 10 years, or 400,000 units of product, with a $9,000 salvage value. During its second year, the machine produces 34,000 units of product. Determine the machine's second-year depreciation using the units-of-production method. Required information [The following information applies to the questions displayed betow] Ramirez Compony installs a computerized manufacturing machine in its factory at the beginning of the year at a cost of $49,000. The machine's useful life is estimated at 10 years, or 400,000 units of product, with a $9,000 salvage value. During its second year, the machine produces 34,000 units of product. Determine the machine's second-year depreciation using the double-declining-balance method

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started