Answered step by step

Verified Expert Solution

Question

1 Approved Answer

someone plz help!! it is due soon XYZ is a calendar-year corporation that began business on January 1,2021 . For the year, it reported the

someone plz help!! it is due soon

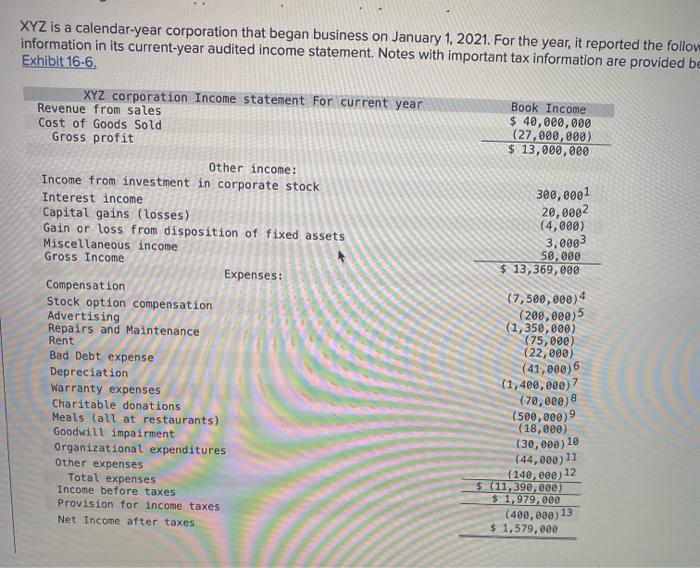

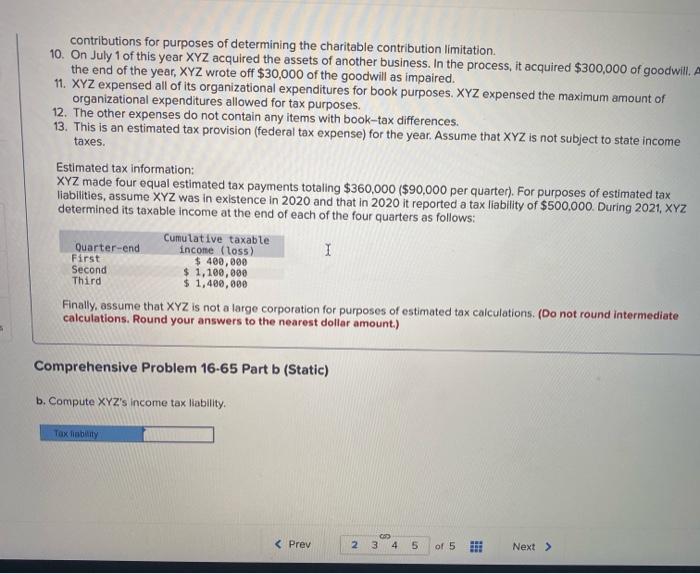

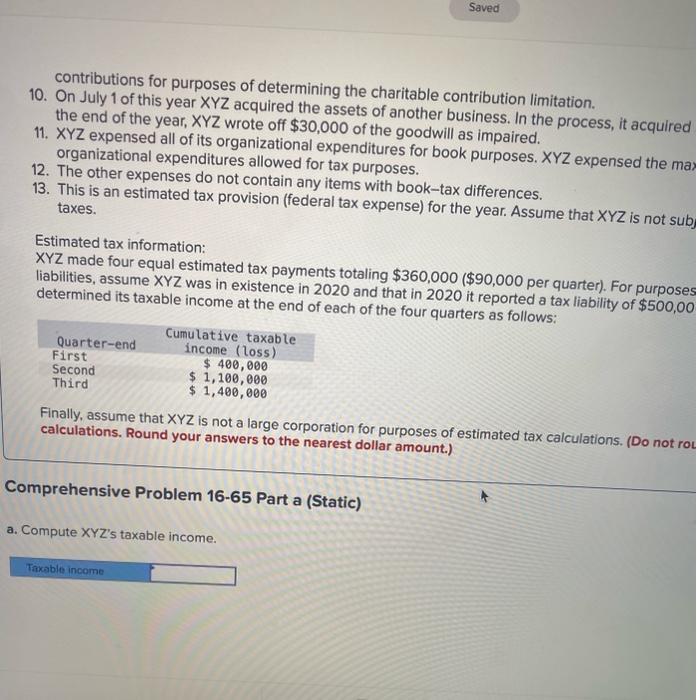

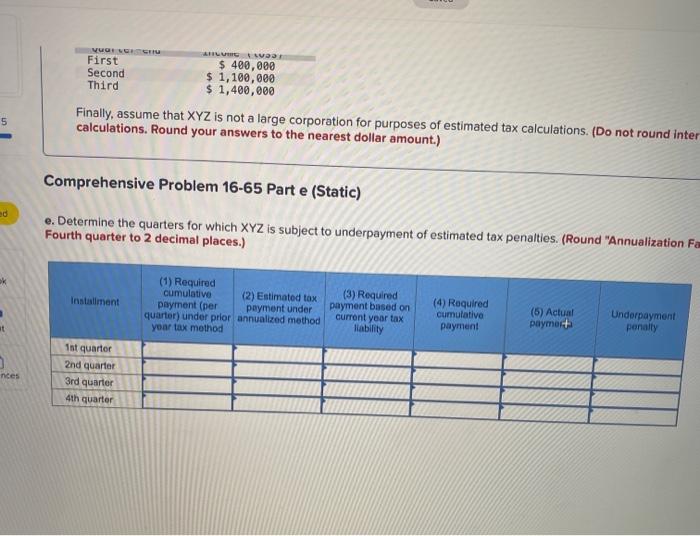

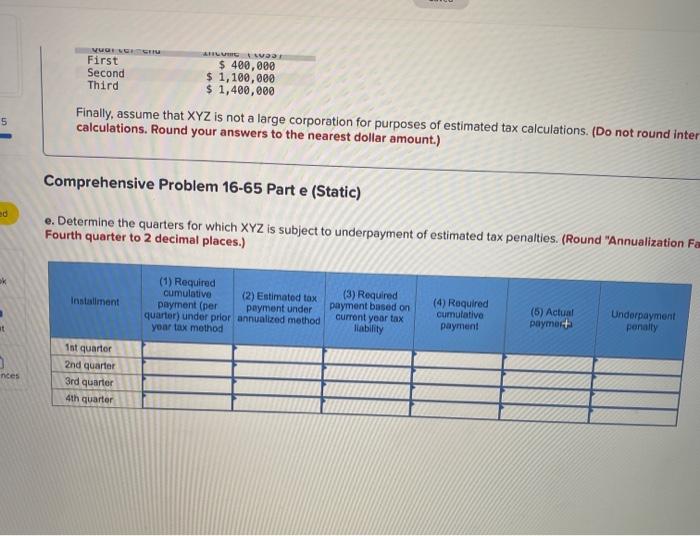

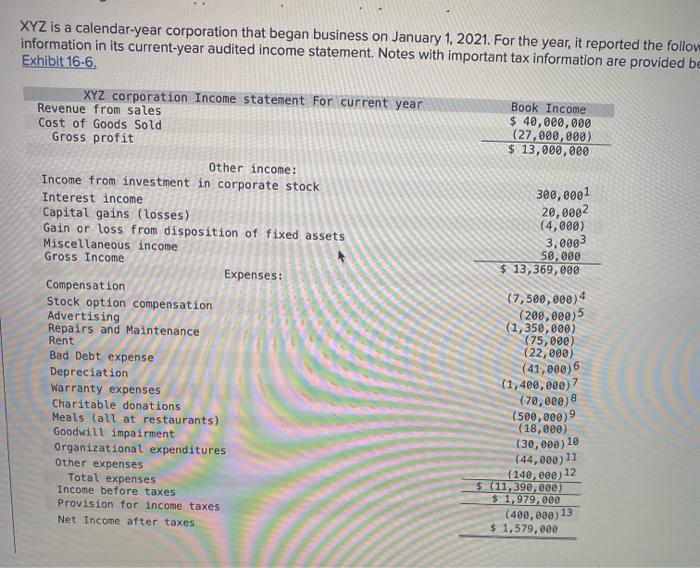

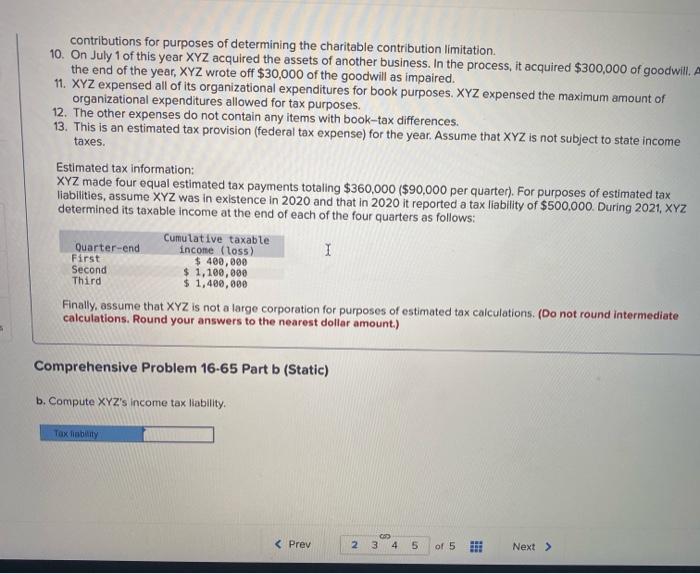

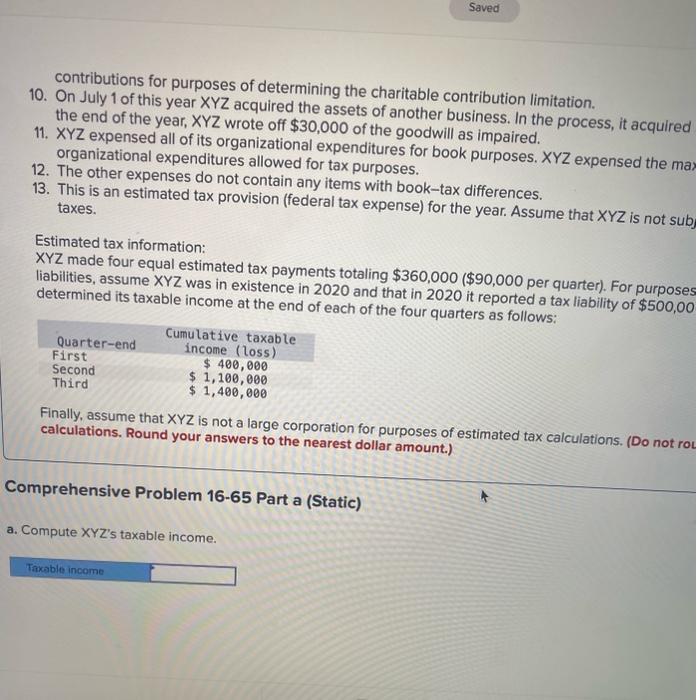

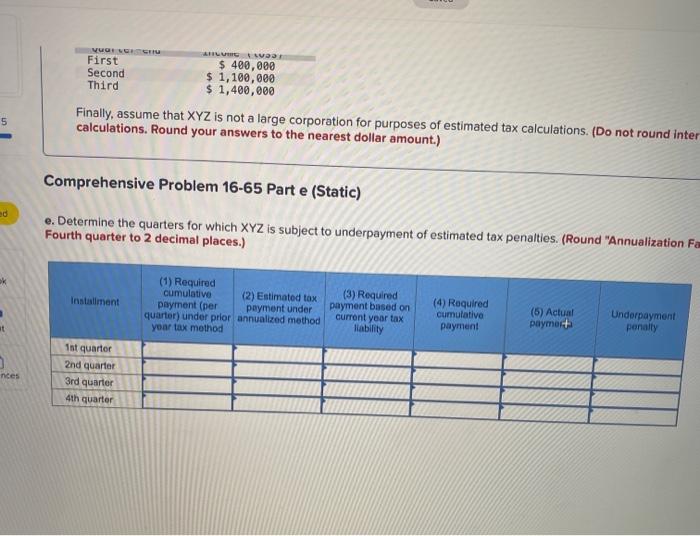

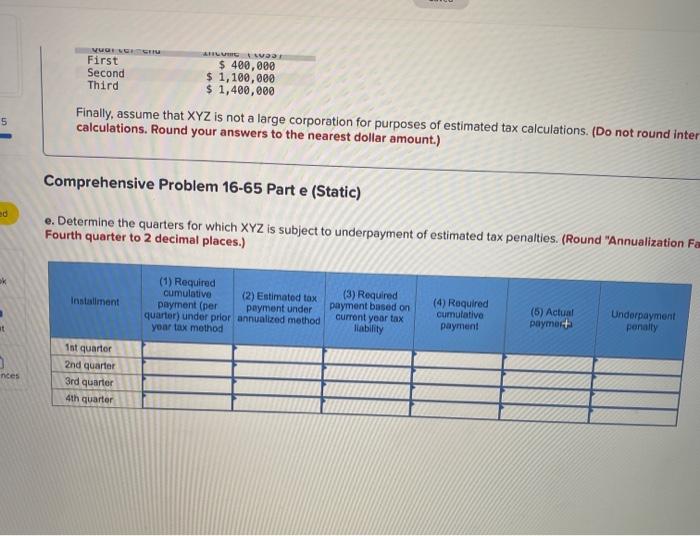

XYZ is a calendar-year corporation that began business on January 1,2021 . For the year, it reported the follow information in its current-year audited income statement. Notes with important tax information are provided b Exhibit 16-6. contributions for purposes of determining the charitable contribution limitation. 10. On July 1 of this year XYZ acquired the assets of another business. In the process, it acquired $300,000 of goodwill. the end of the year, XYZ wrote off $30,000 of the goodwill as impaired. 11. XYZ expensed all of its organizational expenditures for book purposes. XYZ expensed the maximum amount of organizational expenditures allowed for tax purposes. 12. The other expenses do not contain any items with book-tax differences. 13. This is an estimated tax provision (federal tax expense) for the year. Assume that XYZ is not subject to state income taxes. Estimated tax information: XYZ made four equal estimated tax payments totaling $360,000($90,000 per quarter). For purposes of estimated tax liabilities, assume XYZ was in existence in 2020 and that in 2020 it reported a tax liability of $500,000. During 2021, XYZ determined its taxable income at the end of each of the four quarters as follows: Finally, assume that XYZ is not a large corporation for purposes of estimated tax calculations. (Do not round intermediate calculations. Round your answers to the nearest dollar amount.) Comprehensive Problem 16.65 Part b (Static) b. Compute XYZ's income tax liability. contributions for purposes of determining the charitable contribution limitation. 10. On July 1 of this year XYZ acquired the assets of another business. In the process, it acquired the end of the year, XYZ wrote off $30,000 of the goodwill as impaired. 11. XYZ expensed all of its organizational expenditures for book purposes. XYZ expensed the ma organizational expenditures allowed for tax purposes. 12. The other expenses do not contain any items with book-tax differences. 13. This is an estimated tax provision (federal tax expense) for the year. Assume that XYZ is not sub taxes. Estimated tax information: XYZ made four equal estimated tax payments totaling $360,000 ( $90,000 per quarter). For purpose liabilities, assume XYZ was in existence in 2020 and that in 2020 it reported a tax liability of $500,00 determined its taxable income at the end of each of the four quarters as follows: Finally, assume that XYZ is not a large corporation for purposes of estimated tax calculations. (Do not roi calculations. Round your answers to the nearest dollar amount.) Comprehensive Problem 16-65 Part a (Static) a. Compute XYZ's taxable income. Finally, assume that XYZ is not a large corporation for purposes of estimated tax calculations. (Do not round intel calculations. Round your answers to the nearest dollar amount.) Comprehensive Problem 16-65 Part e (Static) e. Determine the quarters for which XYZ is subject to underpayment of estimated tax penalties. (Round "Annualization Fe Fourth quarter to 2 decimal places.) Finally, assume that XYZ is not a large corporation for purposes of estimated tax calculations. (Do not round intel calculations. Round your answers to the nearest dollar amount.) Comprehensive Problem 16-65 Part e (Static) e. Determine the quarters for which XYZ is subject to underpayment of estimated tax penalties. (Round "Annualization Fe Fourth quarter to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started