Answered step by step

Verified Expert Solution

Question

1 Approved Answer

someone solve this plz, hw and 1hr till submisstion it has been up for 3 hours now... Question No: 04 (Case Analysis) Part A-Leasing (CL0

someone solve this plz, hw and 1hr till submisstion it has been up for 3 hours now...

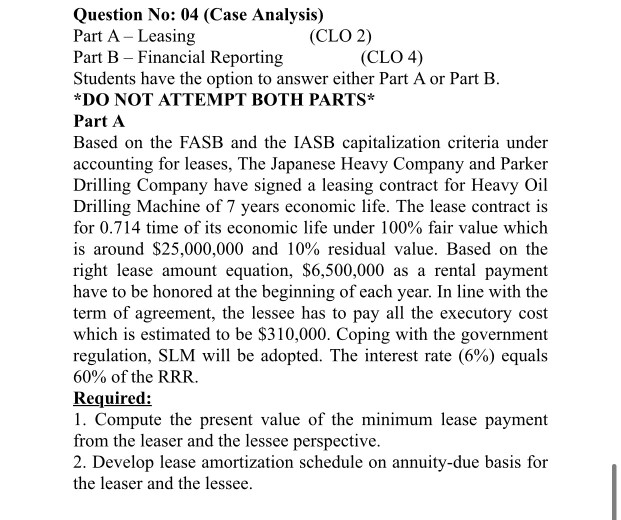

Question No: 04 (Case Analysis) Part A-Leasing (CL0 2). Part B - Financial Reporting (CLO 4) Students have the option to answer either Part A or Part B. *DO NOT ATTEMPT BOTH PARTS* Part A Based on the FASB and the IASB capitalization criteria under accounting for leases, The Japanese Heavy Company and Parker Drilling Company have signed a leasing contract for Heavy Oil Drilling Machine of 7 years economic life. The lease contract is for 0.714 time of its economic life under 100% fair value which is around $25,000,000 and 10% residual value. Based on the right lease amount equation, $6,500,000 as a rental payment have to be honored at the beginning of each year. In line with the term of agreement, the lessee has to pay all the executory cost which is estimated to be $310,000. Coping with the government regulation, SLM will be adopted. The interest rate (6%) equals 60% of the RRR. Required: 1. Compute the present value of the minimum lease payment from the leaser and the lessee perspective. 2. Develop lease amortization schedule on annuity-due basis for the leaser and the lessee. Question No: 04 (Case Analysis) Part A-Leasing (CL0 2). Part B - Financial Reporting (CLO 4) Students have the option to answer either Part A or Part B. *DO NOT ATTEMPT BOTH PARTS* Part A Based on the FASB and the IASB capitalization criteria under accounting for leases, The Japanese Heavy Company and Parker Drilling Company have signed a leasing contract for Heavy Oil Drilling Machine of 7 years economic life. The lease contract is for 0.714 time of its economic life under 100% fair value which is around $25,000,000 and 10% residual value. Based on the right lease amount equation, $6,500,000 as a rental payment have to be honored at the beginning of each year. In line with the term of agreement, the lessee has to pay all the executory cost which is estimated to be $310,000. Coping with the government regulation, SLM will be adopted. The interest rate (6%) equals 60% of the RRR. Required: 1. Compute the present value of the minimum lease payment from the leaser and the lessee perspective. 2. Develop lease amortization schedule on annuity-due basis for the leaser and the lesseeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started