Someone to help here with these

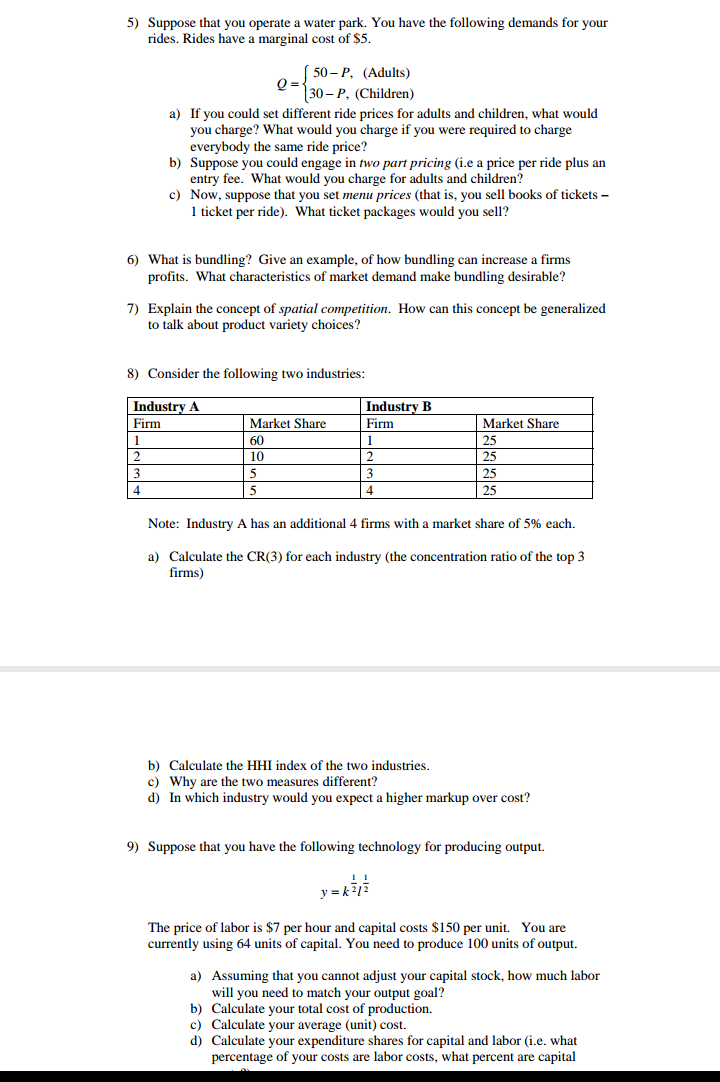

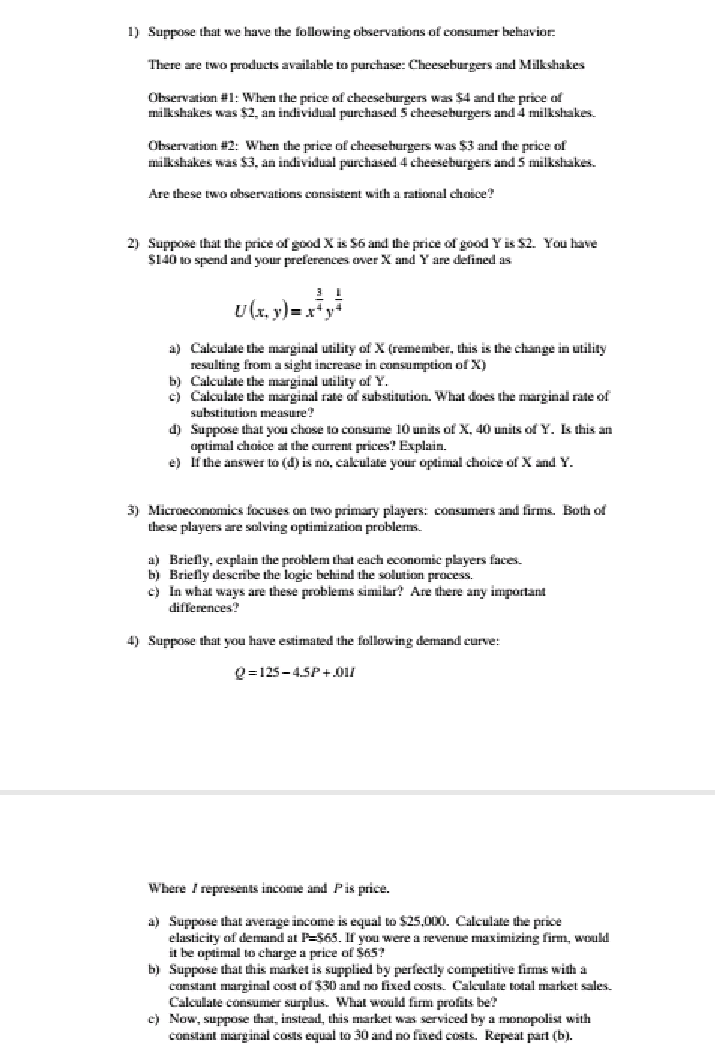

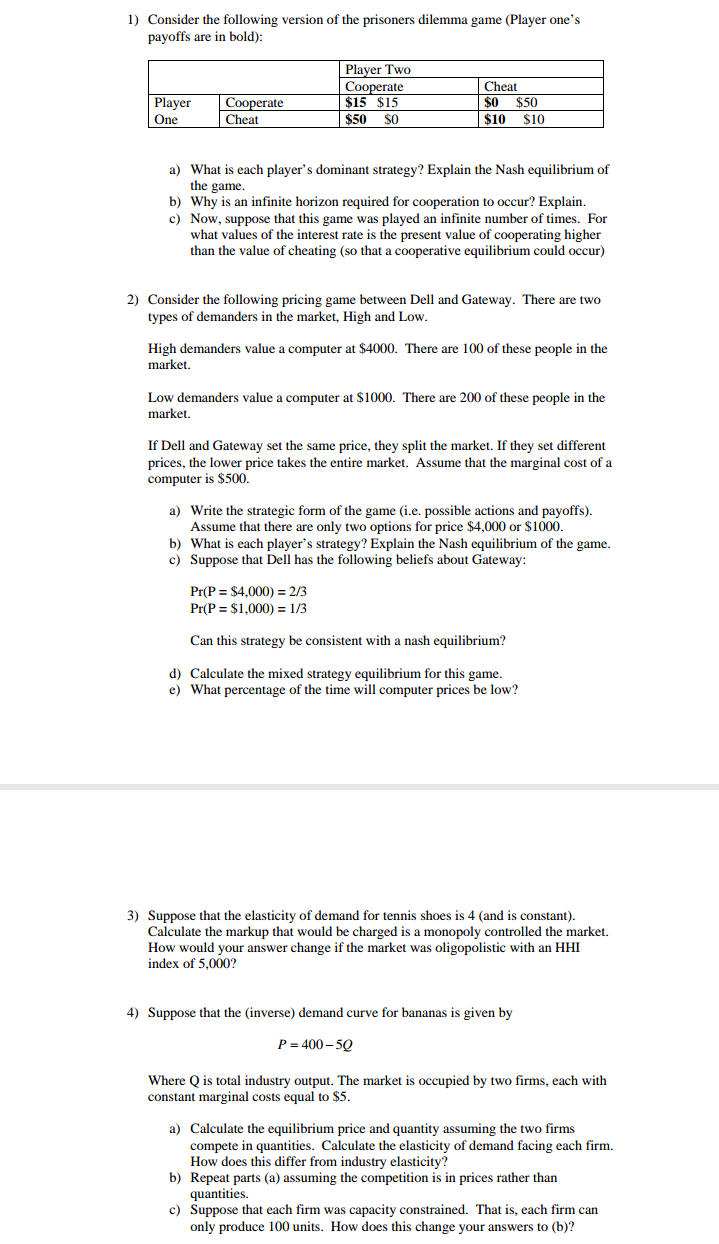

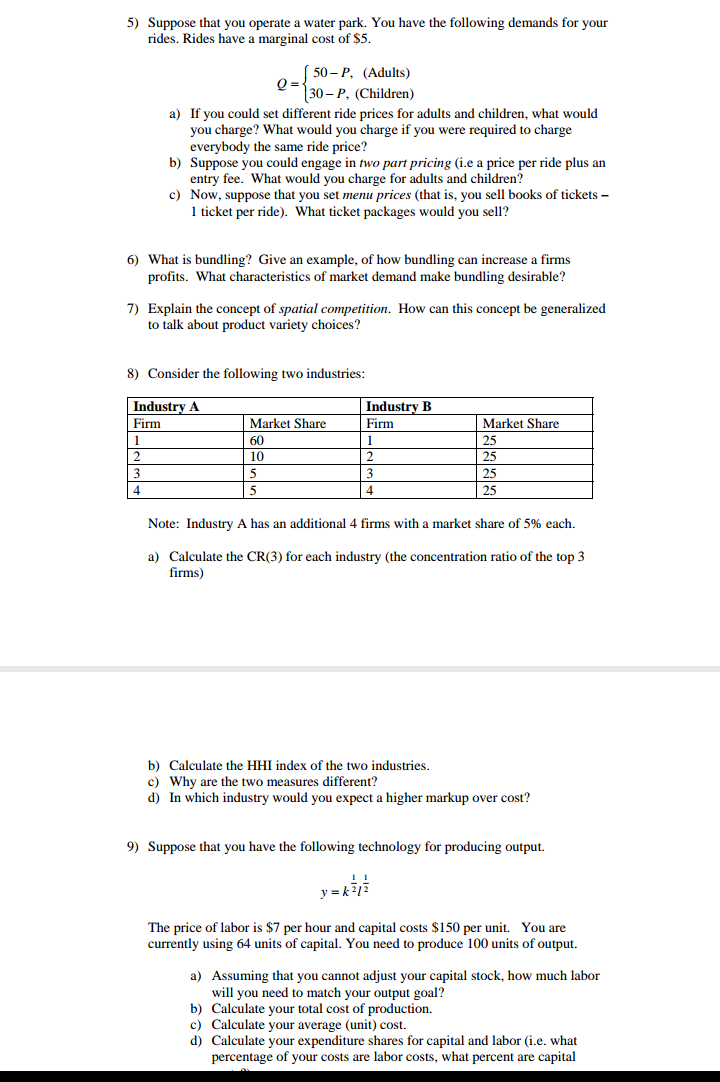

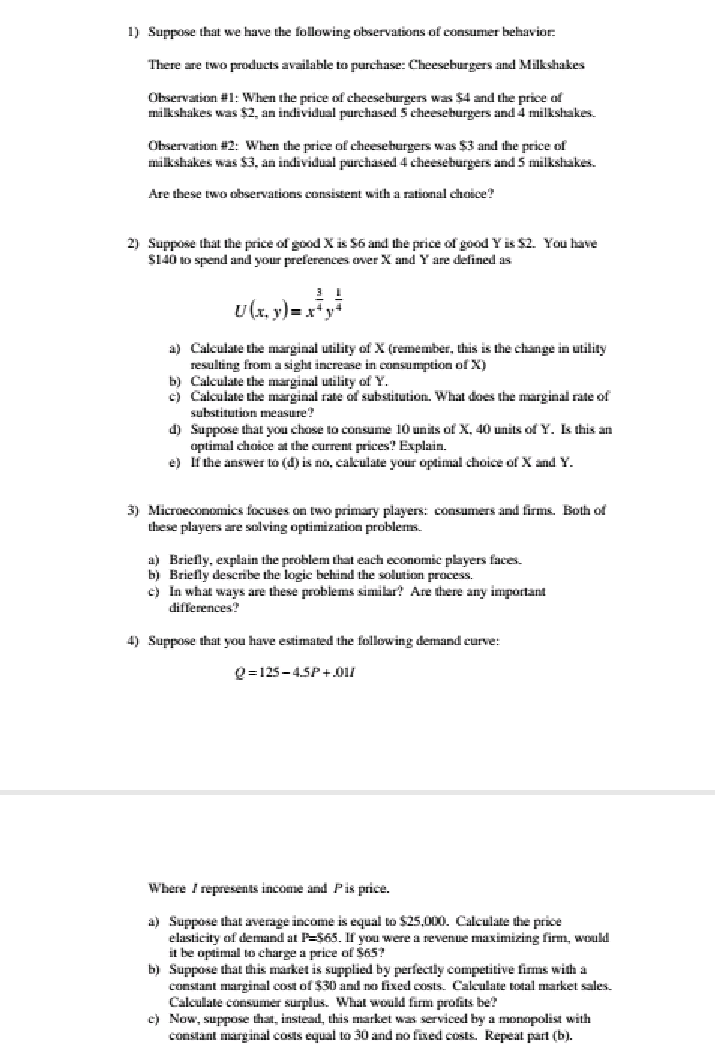

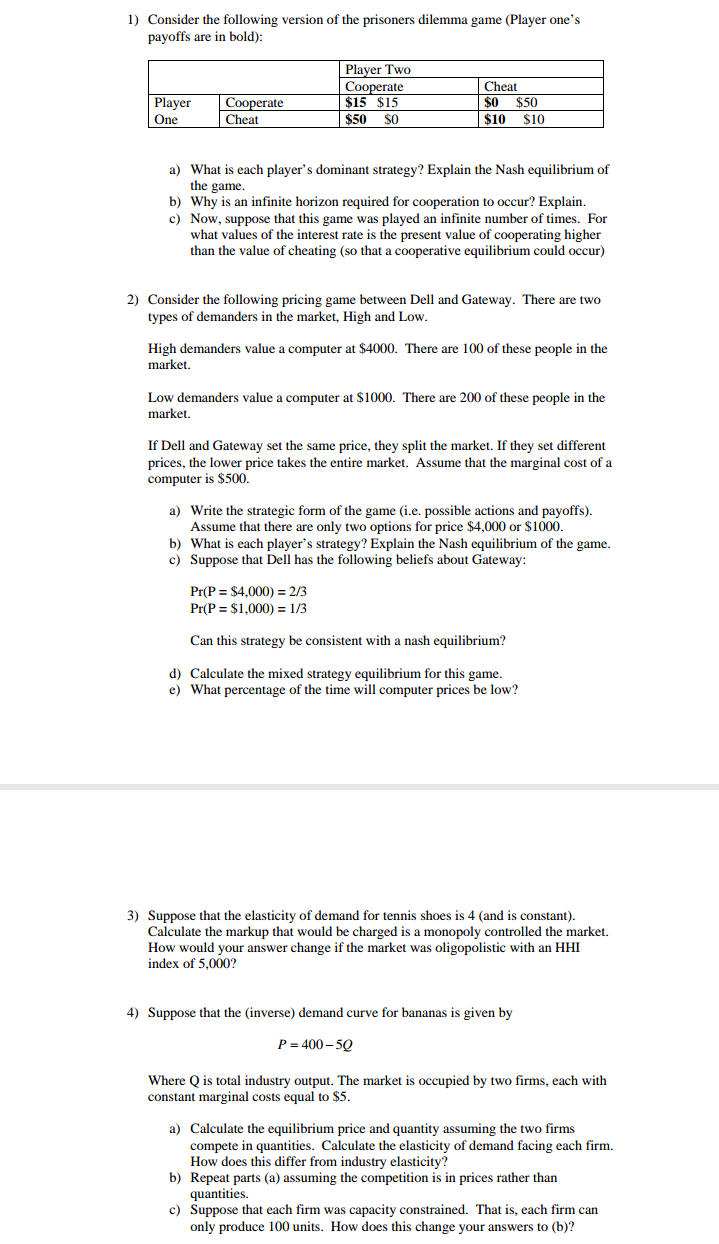

5) Suppose that you operate a water park. You have the following demands for your rides. Rides have a marginal cost of $5. 50-P, (Adults) 30- P. (Children) a) If you could set different ride prices for adults and children, what would you charge? What would you charge if you were required to charge everybody the same ride price? b) Suppose you could engage in two part pricing (i.e a price per ride plus an entry fee. What would you charge for adults and children? c) Now, suppose that you set menu prices (that is, you sell books of tickets - 1 ticket per ride). What ticket packages would you sell? 6) What is bundling? Give an example, of how bundling can increase a firms profits. What characteristics of market demand make bundling desirable? 7) Explain the concept of spatial competition. How can this concept be generalized to talk about product variety choices? 8) Consider the following two industries: Industry A Industry B Firm Market Share Firm Market Share 60 1 25 10 25 3 5 25 4 5 25 Note: Industry A has an additional 4 firms with a market share of 5% each. a) Calculate the CR(3) for each industry (the concentration ratio of the top 3 firms) b) Calculate the HHI index of the two industries. c) Why are the two measures different? d) In which industry would you expect a higher markup over cost? 9) Suppose that you have the following technology for producing output. y = k2/2 The price of labor is $7 per hour and capital costs $150 per unit. You are currently using 64 units of capital. You need to produce 100 units of output. a) Assuming that you cannot adjust your capital stock, how much labor will you need to match your output goal? b) Calculate your total cost of production. c) Calculate your average (unit) cost. d) Calculate your expenditure shares for capital and labor (i.e. what percentage of your costs are labor costs, what percent are capital1) Suppose that we have the following observations of consumer behavior There are two products available to purchase: Cheeseburgers and Milkshakes Observation #1: When the price of cheeseburgers was $4 and the price of milkshakes was $2, an individual purchased 5 cheeseburgers and 4 milkshakes. Observation #2: When the price of cheeseburgers was $3 and the price of milkshakes was $3. an individual purchased 4 cheeseburgers and 5 milkshakes. Are these two observations consistent with a rational choice? 2) Suppose that the price of good X is $6 and the price of good Y is $2. You have $140 to spend and your preferences over X and Y are defined as UCry)=xty a) Calculate the marginal utility of X (remember, this is the change in utility resulting from a sight increase in consumption of X) by Calculate the marginal utility of Y. c) Calculate the marginal rate of substitution. What does the marginal rate of substitution measure?! I Suppose that you chose to consume 10 units of X, 40 units of Y. Is this an optimal choice at the current prices? Explain. 2) If the answer to (d) is no, calculate your optimal choice of X and Y. 3) Microeconomics focuses on two primary players: consumers and firms. Both of these players are solving optimization problems. a) Briefly, explain the problem that each economic players faces. b) Briefly describe the logic behind the solution process. c) In what ways are these problemis similar?" Are there any important differences? 4) Suppose that you have estimated the following demand curve: 2=125-4.5P+01 Where / represents income and Pis price. a) Suppose that average income is equal to $25,000. Calculate the price elasticity of demand at P=$65. If you were a revenue maximizing firm, would it be optimal to charge a price of $65? by Suppose that this market is supplied by perfectly competitive firmis with a constant marginal cost of $30 and no fixed costs. Calculate total market sales. Calculate consumer surplus. What would form profits bet C) Now, suppose that, instead, this market was serviced by a monopolist with constant marginal costs equal to 30 and no fixed costs. Repeat part (b).1) Consider the following version of the prisoners dilemma game (Player one's payoffs are in bold): Player Two Cooperate Cheat Player Cooperate $15 $15 $0 $50 One Cheat $50 $0 $10 $10 a) What is each player's dominant strategy? Explain the Nash equilibrium of the game. b) Why is an infinite horizon required for cooperation to occur? Explain. c) Now, suppose that this game was played an infinite number of times. For what values of the interest rate is the present value of cooperating higher than the value of cheating (so that a cooperative equilibrium could occur) 2) Consider the following pricing game between Dell and Gateway. There are two types of demanders in the market, High and Low. High demanders value a computer at $4000. There are 100 of these people in the market. Low demanders value a computer at $1000. There are 200 of these people in the market. If Dell and Gateway set the same price, they split the market. If they set different prices, the lower price takes the entire market. Assume that the marginal cost of a computer is $500. a) Write the strategic form of the game (i.e. possible actions and payoffs). Assume that there are only two options for price $4,000 or $1000. b) What is each player's strategy? Explain the Nash equilibrium of the game. c) Suppose that Dell has the following beliefs about Gateway: Pr(P = $4,000) = 2/3 Pr(P = $1,000) = 1/3 Can this strategy be consistent with a nash equilibrium? d) Calculate the mixed strategy equilibrium for this game. e) What percentage of the time will computer prices be low? 3) Suppose that the elasticity of demand for tennis shoes is 4 (and is constant). Calculate the markup that would be charged is a monopoly controlled the market. How would your answer change if the market was oligopolistic with an HHI index of 5,000? 4) Suppose that the (inverse) demand curve for bananas is given by P =400-50 Where Q is total industry output. The market is occupied by two firms, each with constant marginal costs equal to $5. a) Calculate the equilibrium price and quantity assuming the two firms compete in quantities. Calculate the elasticity of demand facing each firm. How does this differ from industry elasticity? b) Repeat parts (a) assuming the competition is in prices rather than quantities. c) Suppose that each firm was capacity constrained. That is, each firm can only produce 100 units. How does this change your answers to (b)?5) Explain the similarities/difference between Cournot competition and Bertrand competition. What are the key assumptions/results of each? 6) Explain the following statement: "If firms are competing in quantities, then it pays to be the first to the market. However, if firms arte competing in price, its worthwhile to wait for your opponent to make his move" 7) What is the chain store paradox? What is the major lesson we get from this game? 8) Suppose that the probability of getting in an accident is 3%. The average cost of an accident is $100,000. Suppose that the average car driver has preferences given by U(1) = JI a) Assuming that this individual earns $100,000 per year in income, calculate his expected utility if he buys no insurance. b) Calculate the cost of this policy for the insurance company. c) Suppose that half the population was made up of unsafe drivers (i.e. with a higher accident rate). How high would the unsafe driver's accident rate have to be for this market to break down? d) Explain how moral hazard and adverse selection are dealt with in the insurance industry. 9) Suppose that the market demand is described by P =120-(0+q) Where O is the output of the incumbent firm, q is the output of the potential entrant and P is the market price. The incumbent's cost function is given by TC(Q) = 600 While the cost function of the entrant is given by TC(Q)=60q +80 (80 is a sunk cost paid upon entering the market) a) If the entrant observes the incumbent producing O units of output and expects this level to be maintained, what is the equation for the entrant's residual demand curve? b) If the entrant maximizes profits using the residual demand in (a), what output will the entrant produce? c) How much would the incumbent have to produce to keep the entrant out of the market? At what price will the incumbent sell this output