Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sometimes ago, the industrial company CUCO conducted a preliminary appraisal related to the investment-expansion project PE1 which was suggested to be annexed to the first

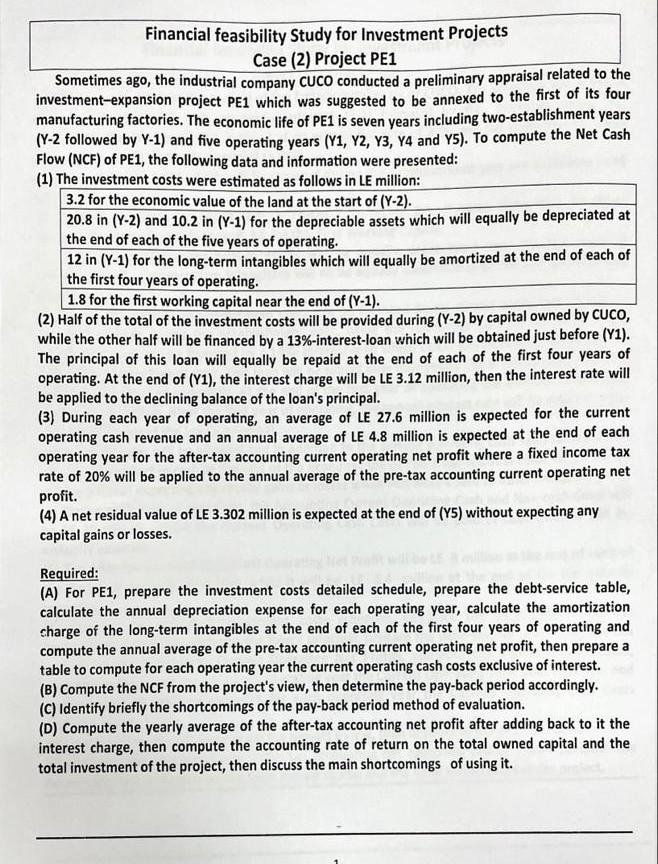

Sometimes ago, the industrial company CUCO conducted a preliminary appraisal related to the investment-expansion project PE1 which was suggested to be annexed to the first of its four manufacturing factories. The economic life of PE1 is seven years including two-establishment years ( Y2 followed by Y1) and five operating years (Y1, Y2, Y3, Y4 and Y5). To compute the Net Cash Flow (NCF) of PE1, the following data and information were presented: (2) Half of the total of the investment costs will be provided during ( Y2) by capital ownea by cucu, while the other half will be financed by a 13%-interest-loan which will be obtained just before (Y1). The principal of this loan will equally be repaid at the end of each of the first four years of operating. At the end of (Y1), the interest charge will be LE 3.12 million, then the interest rate will be applied to the declining balance of the loan's principal. (3) During each year of operating, an average of LE 27.6 million is expected for the current operating cash revenue and an annual average of LE 4.8 million is expected at the end of operating year for the after-tax accounting current operating net profit where a fixed income tax rate of 20% will be applied to the annual average of the pre-tax accounting current operating net profit. (4) A net residual value of LE 3.302 million is expected at the end of (Y5) without expecting any capital gains or losses. Required: (A) For PE1, prepare the investment costs detailed schedule, prepare the debt-service table, calculate the annual depreciation expense for each operating year, calculate the amortization charge of the long-term intangibles at the end of each of the first four years of operating and compute the annual average of the pre-tax accounting current operating net profit, then prepare a table to compute for each operating year the current operating cash costs exclusive of interest. (B) Compute the NCF from the project's view, then determine the pay-back period accordingly. (C) Identify briefly the shortcomings of the pay-back period method of evaluation. (D) Compute the yearly average of the after-tax accounting net profit after adding back to it the interest charge, then compute the accounting rate of return on the total owned capital and the total investment of the project, then discuss the main shortcomings of using it. Sometimes ago, the industrial company CUCO conducted a preliminary appraisal related to the investment-expansion project PE1 which was suggested to be annexed to the first of its four manufacturing factories. The economic life of PE1 is seven years including two-establishment years ( Y2 followed by Y1) and five operating years (Y1, Y2, Y3, Y4 and Y5). To compute the Net Cash Flow (NCF) of PE1, the following data and information were presented: (2) Half of the total of the investment costs will be provided during ( Y2) by capital ownea by cucu, while the other half will be financed by a 13%-interest-loan which will be obtained just before (Y1). The principal of this loan will equally be repaid at the end of each of the first four years of operating. At the end of (Y1), the interest charge will be LE 3.12 million, then the interest rate will be applied to the declining balance of the loan's principal. (3) During each year of operating, an average of LE 27.6 million is expected for the current operating cash revenue and an annual average of LE 4.8 million is expected at the end of operating year for the after-tax accounting current operating net profit where a fixed income tax rate of 20% will be applied to the annual average of the pre-tax accounting current operating net profit. (4) A net residual value of LE 3.302 million is expected at the end of (Y5) without expecting any capital gains or losses. Required: (A) For PE1, prepare the investment costs detailed schedule, prepare the debt-service table, calculate the annual depreciation expense for each operating year, calculate the amortization charge of the long-term intangibles at the end of each of the first four years of operating and compute the annual average of the pre-tax accounting current operating net profit, then prepare a table to compute for each operating year the current operating cash costs exclusive of interest. (B) Compute the NCF from the project's view, then determine the pay-back period accordingly. (C) Identify briefly the shortcomings of the pay-back period method of evaluation. (D) Compute the yearly average of the after-tax accounting net profit after adding back to it the interest charge, then compute the accounting rate of return on the total owned capital and the total investment of the project, then discuss the main shortcomings of using it

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started