Somoza Ghana wants to prepare a 5 year profoma statement and you have been hired as a consultant for this job.

Prepare a 5 year profoma statement with the details below.

It should be answered using Microsoft excel

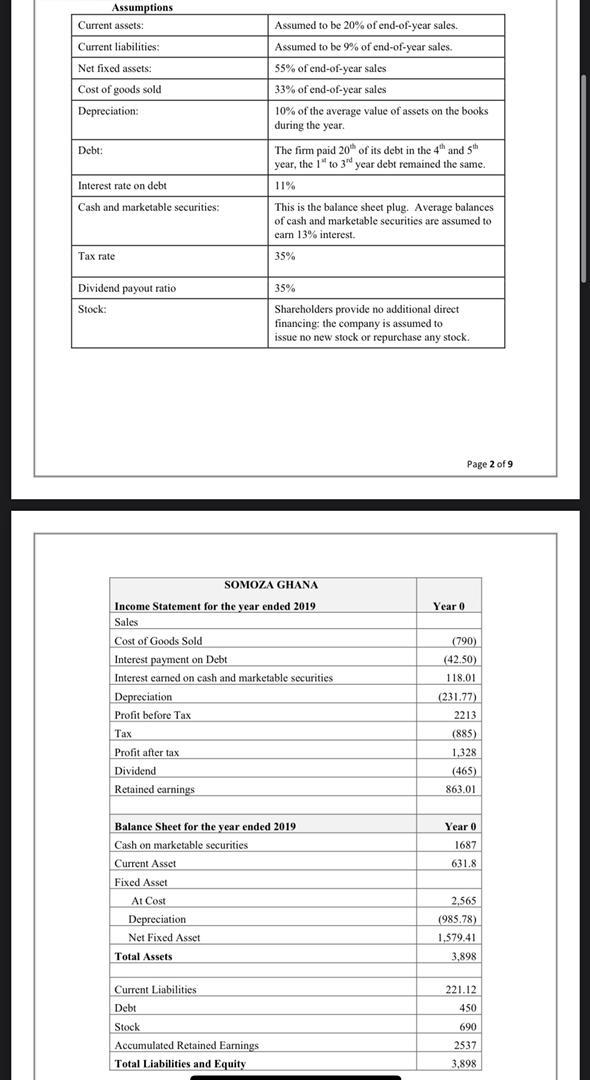

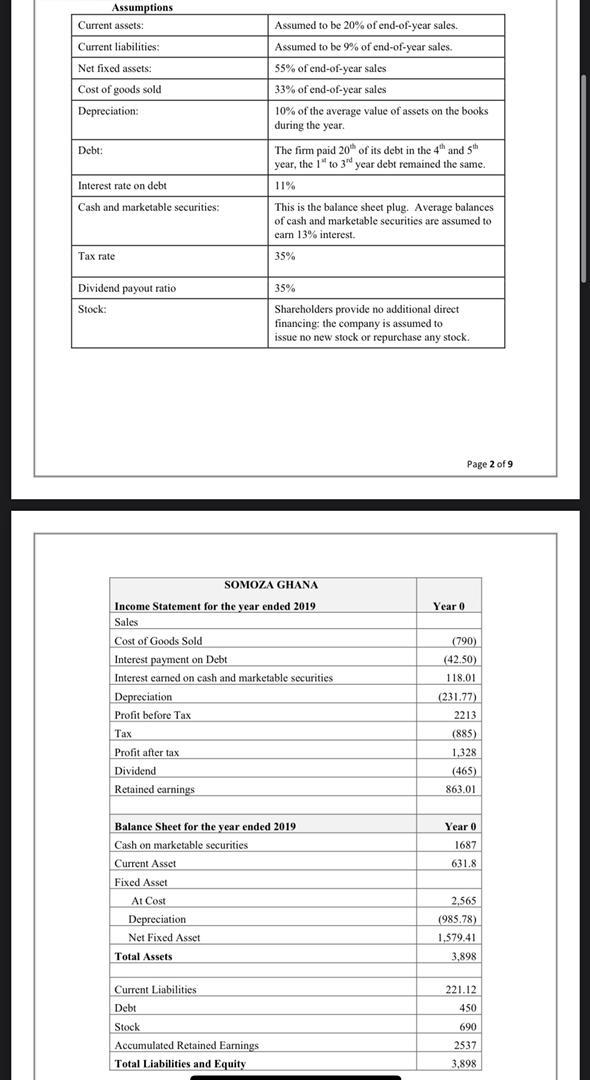

Assumptions Current assets: Current liabilities: Net fixed assets: Cost of goods sold Depreciation: Assumed to be 20% of end-of-year sales. Assumed to be 9% of end-of-year sales. -. 55% of end-of-year sales 33% of end-of-year sales 10% of the average value of assets on the books during the year The firm paid 20 of its debt in the 4th and 5th year, the 1" to 3 year debt remained the same. 11% This is the balance sheet plug. Average balances of cash and marketable securities are assumed to cam 13% interest Debt: Interest rate on debt Cash and marketable securities: : Tax rate 35% Dividend payout ratio Stock: 35% Shareholders provide no additional direct financing the company is assumed to issue no new stock or repurchase any stock. Page 2 of 9 Year 0 SOMOZA GHANA Income Statement for the year ended 2019 Sales Cost of Goods Sold Interest payment on Debt Interest earned on cash and marketable securities Depreciation Profit before Tax | Profit after tax Dividend Retained carnings (790) (42.50) 118.01 (231.77) 2213 (885) 1,328 (465) 863.01 Year 0 1687 631.8 Balance Sheet for the year ended 2019 Cash on marketable securities Current Asset Fixed Asset At Cost Depreciation Net Fixed Asset Total Assets 2,565 (985.78) 1.579.41 3,898 221.12 450 Current Liabilities Debt Stock Accumulated Retained Earnings Total Liabilities and Equity 690 2537 3,898 Assumptions Current assets: Current liabilities: Net fixed assets: Cost of goods sold Depreciation: Assumed to be 20% of end-of-year sales. Assumed to be 9% of end-of-year sales. -. 55% of end-of-year sales 33% of end-of-year sales 10% of the average value of assets on the books during the year The firm paid 20 of its debt in the 4th and 5th year, the 1" to 3 year debt remained the same. 11% This is the balance sheet plug. Average balances of cash and marketable securities are assumed to cam 13% interest Debt: Interest rate on debt Cash and marketable securities: : Tax rate 35% Dividend payout ratio Stock: 35% Shareholders provide no additional direct financing the company is assumed to issue no new stock or repurchase any stock. Page 2 of 9 Year 0 SOMOZA GHANA Income Statement for the year ended 2019 Sales Cost of Goods Sold Interest payment on Debt Interest earned on cash and marketable securities Depreciation Profit before Tax | Profit after tax Dividend Retained carnings (790) (42.50) 118.01 (231.77) 2213 (885) 1,328 (465) 863.01 Year 0 1687 631.8 Balance Sheet for the year ended 2019 Cash on marketable securities Current Asset Fixed Asset At Cost Depreciation Net Fixed Asset Total Assets 2,565 (985.78) 1.579.41 3,898 221.12 450 Current Liabilities Debt Stock Accumulated Retained Earnings Total Liabilities and Equity 690 2537 3,898