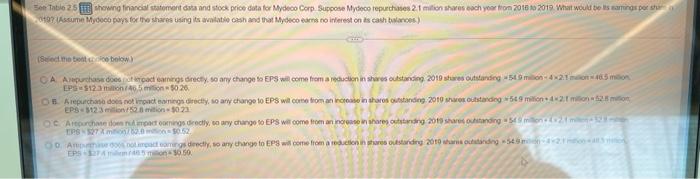

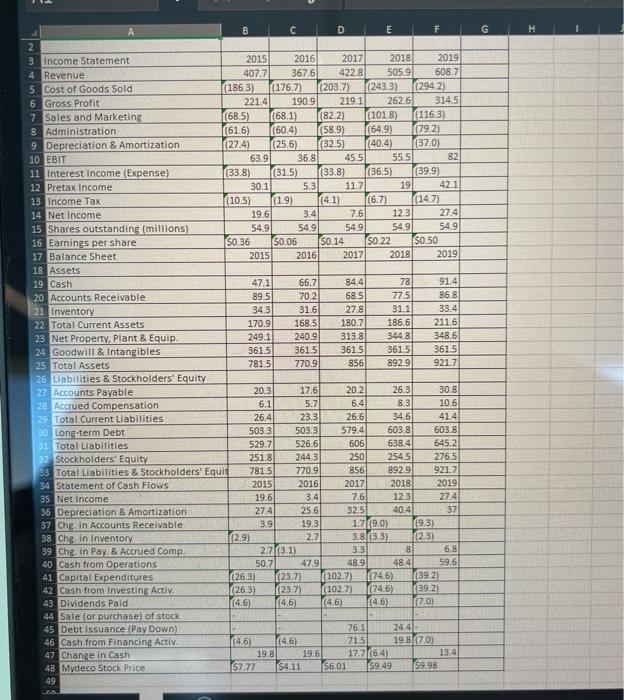

Son Table 25 showing financial statement data and stock price data for Mydeco Corp. Suppose Mydeco repurchases 2.1 milion shares each year from 2016 to 2019. What would be its earnings por sh 0197 (Assume Mydeco pays for the shares using its available cash and that Mydeco earns no inferest on as cash balances) (Select the best se below) CA Arepurchase does not impact earnings directly, so any change to EPS will come from a reduction in shares outstanding 2019 shares outstanding 54.9 million-4x21 mon46.5 milion EPS $12.3 million/40,5 mion-5026 OB Arepurchaso does not impact earnings directly, so any change to EPS will come from an increase in shares outstanding 2010 shares outstanding 549 million 4-2.1 milion 52.8 mon EPS $123 million/52.8 mition-5023 OC Arepurchase does not impact oorings directly, so any change to EPS will come from an increase in shares outstanding 2019 shares outstanding 54 million 21 mill EPS 527 A mion/62.0 $0.52. Oo. Anase do not impact comings directly, so any change to EPS will come from a reduction in shares outstanding 2010 shares outstanding 549--215 EPS $274 mm 405 milion 10.50 C D E 2016 2017 367.6 422.8 (186.3) (176.7) (203.7) (243.3) 221.4 190.9 219.1 262.6 (68.5) (68.1) (82.2) (101.8) (61.6) (60.4) (58.9) (64.9) (27.4) (25.6) (32.5) (40.4) 36.8 45.5 63.9 (33.8) (31.5) 30.1 5,3 (10.5) (1.9) 19.6 3.4 54.9 54.9 $0.36 $0.06 $0.14 2015 2016 47.1 66,7 89.5 70.2 34.3 31.6 170.9 168.5 249.1 240.9 313.8 361.5 361.5 361.5 781.5 770.9 856 20.3 17.6 20.2 6.1 5.7 6.4 26.4 23.3 26.6 503.3 503.3 579.4 529.7 526.6 251.8 244.3 781.5 770.9 2015 2016 19.6 27.4 3.9 2.7 (3.1) 2 3 Income Statement 4 Revenue 5 Cost of Goods Sold 6 Gross Profit 7 Sales and Marketing 8 Administration. 9 Depreciation & Amortization 10 EBIT 11 Interest Income (Expense) 12 Pretax Income 13 Income Tax 14 Net Income 15 Shares outstanding (millions) 16 Earnings per share 17 Balance Sheet 18 Assets 19 Cash 20 Accounts Receivable 21 Inventory 22 Total Current Assets 23 Net Property, Plant & Equip. 24 Goodwill & Intangibles 25 Total Assets 26 Liabilities & Stockholders' Equity 27 Accounts Payable 28 Accrued Compensation 29 Total Current Liabilities 30 Long-term Debt 31 Total Liabilities 32 Stockholders' Equity 33 Total Liabilities & Stockholders' Equit 34 Statement of Cash Flows 35 Net Income 36 Depreciation & Amortization 37 Chg. in Accounts Receivable 38 Chg. in Inventory 39 Chg, in Pay. & Accrued Comp. 40 Cash from Operations 41 Capital Expenditures 42 Cash from Investing Activ. 43 Dividends Paid 44 Sale (or purchase) of stock 45 Debt Issuance (Pay Down) 46 Cash from Financing Activ 47 Change in Cash 48 Mydeco Stock Price 49 ca B 2015 407.7 F 2019 2018 505.9 608.7 (294.2) 314.5 (116.3) (79.2) (37.0) 55.5 (33.8) (36.5) (39.9) 11.7 19 (4.1) (6.7) (14.7) 7.6 12.3 54.9 54.9 $0.22 $0.50 2017 2018 84.4 78 68.5 77.5 27.8 31.1 180.7 186.6 344.8 361.5 892.9 26.3 8.3 34.6 603.8 606 638.4 250 254.5 856 892.9 2017 2018 7.6 12.3 32.5 40.4 50.7 3.4 25.6 19.3 (2.9) 2.7 47.9 (26.3) (23.7) (102.7) (26.3) (23.7) (4.6) (4.6) (4.6) (4.6) 19.8 $7.77 $4.11 19.6 1.7(9.0) 3.8 (3.3) 3.3 48.9 $6.01 82 42.1 27.4 54.9 2019 91.4 86.8 33.4 211.6 348.6 361.5 921.7 30.8 10.6 41.4 603.8 645.2 276.5 921.7 2019 27.4 76.1 71.5 17.7 (64) (9.3) (2.3) 8 48.4 (74.6) (39.2) (102.7) (74.6) (39.2) (4.6) (4.6) (7.0) 511 24.4- 19.8 (7.0) $9.49 $9.98 16 37 6.8 59.6 13.4 G H