Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sondheim Ltd. entered into a lease with New Age Leasing Corp. The lease is for new specialized factory equipment that has a fair value

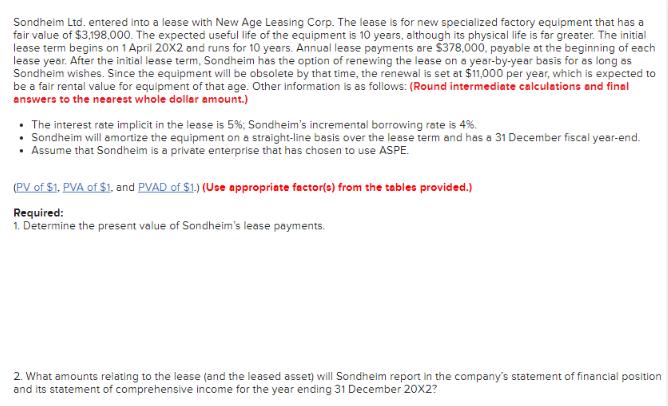

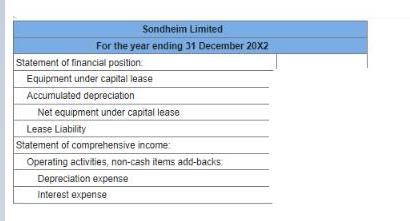

Sondheim Ltd. entered into a lease with New Age Leasing Corp. The lease is for new specialized factory equipment that has a fair value of $3,198,000. The expected useful life of the equipment is 10 years, although its physical life is far greater. The initial lease term begins on 1 April 20X2 and runs for 10 years. Annual lease payments are $378,000, payable at the beginning of each lease year. After the initial lease term, Sondheim has the option of renewing the lease on a year-by-year basis for as long as Sondheim wishes. Since the equipment will be obsolete by that time, the renewal is set at $11,000 per year, which is expected to be a fair rental value for equipment of that age. Other information is as follows: (Round intermediate calculations and final answers to the nearest whole dollar amount.) The interest rate implicit in the lease is 5%; Sondheim's incremental borrowing rate is 4%. Sondheim will amortize the equipment on a straight-line basis over the lease term and has a 31 December fiscal year-end. Assume that Sondheim is a private enterprise that has chosen to use ASPE (PV of $1. PVA of $1. and PVAD of $1.) (Use appropriate factor(s) from the tables provided.) Required: 1. Determine the present value of Sondheim's lease payments. 2. What amounts relating to the lease (and the leased asset) will Sondheim report in the company's statement of financial position and its statement of comprehensive income for the year ending 31 December 20X2? Sondheim Limited For the year ending 31 December 20X2 Statement of financial position: Equipment under capital lease Accumulated depreciation Net equipment under capital lease Lease Liability Statement of comprehensive income: Operating activities, non-cash items add-backs Depreciation expense Interest expense

Step by Step Solution

★★★★★

3.27 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

1 Present Value of Lease Payments To calculate the present value of the lease payments well use the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started