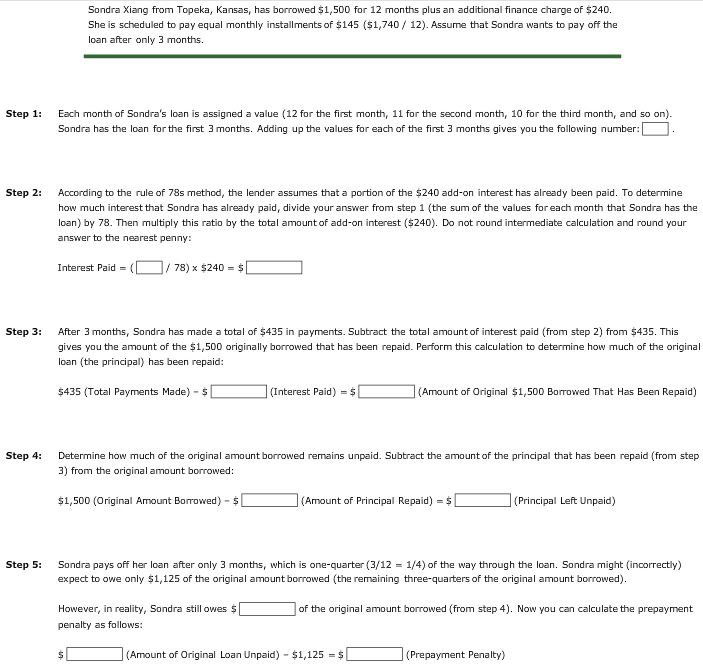

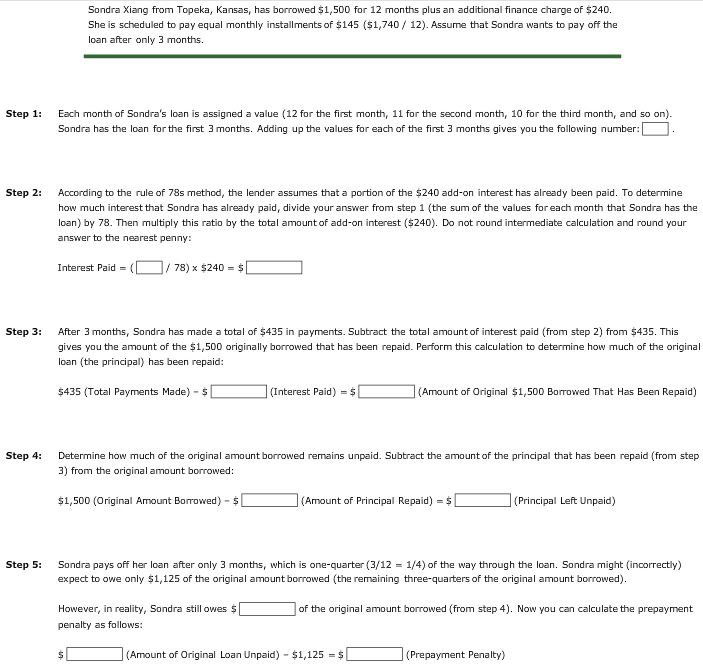

Sondra Xiang from Topeka, Kansas, has borrowed $1,500 for 12 months plus an additional finance charge of $240. She is scheduled to pay equal monthly installments of $145 ($1,740/ 12). Assume that Sondra wants to pay off the loan after only 3 months. Step 1: Each month of Sondra's loan is assigned a value (12 for the first month, 11 for the second month, 10 for the third month, and so on). Sondra has the loan for the first 3 months. Adding up the values for each of the first 3 months gives you the following number According to the rule of 78s method, the lender assumes that a portion of the $240 add-on interest has already been paid. To determine how much interest that Sondra has already paid, divide your answer from step 1 (the sum of the values for each month that Sondra has the loan) by 78. Then multiply this ratio by the total amount of add-on interest ($240). Do not round intermediate calculation and round your answer to the nearest penny: Step 2: Interest Paid( / 78) x $240$ Step 3: After 3 months, Sondra has made a total of $435 in payments. Subtract the total amount of interest paid (from step 2) from $435. This gives you the amount of the $1,500 originally borrowed that has been repaid. Perform this calculation to determine how much of the original loan (the principal) has been repaid: $435 (Total Payments Made)-(Interest Paid) (Amount of Original $1,500 Borrowed That Has Been Repaid) Step 4: Determine how much of the original amount borrowed remains unpaid. Subtract the amount of the principal that has been repaid (from step 3) from the original amount borrowed $1,500 (Original Amount Borowed) (Amount of Principal Repaid) (Principal Left Unpaid) Step 5: Sondra pays off her loan after only 3 months, which is one-quarter (3/12 1/4) of the way through the loan. Sondra might (incorrectly) expect to owe only $1,125 of the original amount borrowed (the remaining three-quarters of the original amount borrowed). However, in reality, Sondra still owes $ penalty as follows: of the original amount borrowed (from step 4). Now you can calculate the prepayment $(Amount of Original Loan Unpaid) $1,125(Prepayment Penalty) Sondra Xiang from Topeka, Kansas, has borrowed $1,500 for 12 months plus an additional finance charge of $240. She is scheduled to pay equal monthly installments of $145 ($1,740/ 12). Assume that Sondra wants to pay off the loan after only 3 months. Step 1: Each month of Sondra's loan is assigned a value (12 for the first month, 11 for the second month, 10 for the third month, and so on). Sondra has the loan for the first 3 months. Adding up the values for each of the first 3 months gives you the following number According to the rule of 78s method, the lender assumes that a portion of the $240 add-on interest has already been paid. To determine how much interest that Sondra has already paid, divide your answer from step 1 (the sum of the values for each month that Sondra has the loan) by 78. Then multiply this ratio by the total amount of add-on interest ($240). Do not round intermediate calculation and round your answer to the nearest penny: Step 2: Interest Paid( / 78) x $240$ Step 3: After 3 months, Sondra has made a total of $435 in payments. Subtract the total amount of interest paid (from step 2) from $435. This gives you the amount of the $1,500 originally borrowed that has been repaid. Perform this calculation to determine how much of the original loan (the principal) has been repaid: $435 (Total Payments Made)-(Interest Paid) (Amount of Original $1,500 Borrowed That Has Been Repaid) Step 4: Determine how much of the original amount borrowed remains unpaid. Subtract the amount of the principal that has been repaid (from step 3) from the original amount borrowed $1,500 (Original Amount Borowed) (Amount of Principal Repaid) (Principal Left Unpaid) Step 5: Sondra pays off her loan after only 3 months, which is one-quarter (3/12 1/4) of the way through the loan. Sondra might (incorrectly) expect to owe only $1,125 of the original amount borrowed (the remaining three-quarters of the original amount borrowed). However, in reality, Sondra still owes $ penalty as follows: of the original amount borrowed (from step 4). Now you can calculate the prepayment $(Amount of Original Loan Unpaid) $1,125(Prepayment Penalty)