Question

Song earns $130,000 taxable income as an interior designer and is taxed at an average rate of 25 percent (i.e., $32,500 of tax). Required:

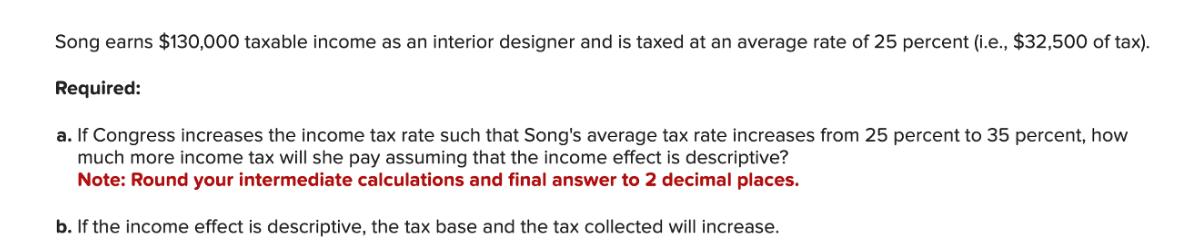

Song earns $130,000 taxable income as an interior designer and is taxed at an average rate of 25 percent (i.e., $32,500 of tax). Required: a. If Congress increases the income tax rate such that Song's average tax rate increases from 25 percent to 35 percent, how much more income tax will she pay assuming that the income effect is descriptive? Note: Round your intermediate calculations and final answer to 2 decimal places. b. If the income effect is descriptive, the tax base and the tax collected will increase.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To find out how much more income tax Song will pay when her average tax rate increases from 25 to ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Taxation Of Individuals And Business Entities 2015

Authors: Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

6th Edition

978-1259206955, 1259206955, 77862368, 978-0077862367

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App