Answered step by step

Verified Expert Solution

Question

1 Approved Answer

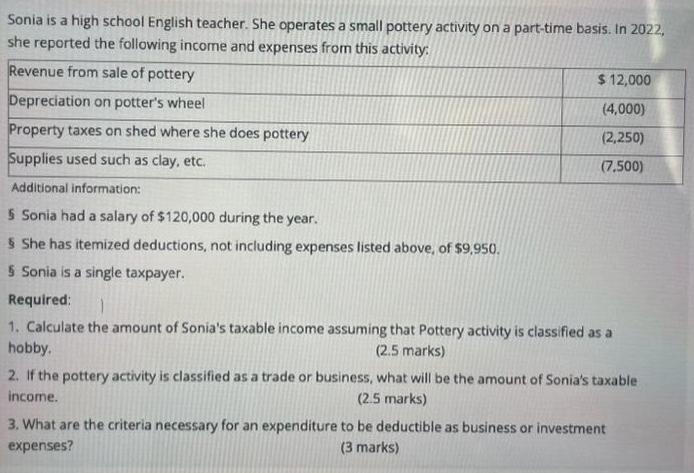

Sonia is a high school English teacher. She operates a small pottery activity on a part-time basis. In 2022, she reported the following income

Sonia is a high school English teacher. She operates a small pottery activity on a part-time basis. In 2022, she reported the following income and expenses from this activity: Revenue from sale of pottery Depreciation on potter's wheel Property taxes on shed where she does pottery Supplies used such as clay, etc. $12,000 (4,000) (2,250) (7.500) Additional information: 5 Sonia had a salary of $120,000 during the year. She has itemized deductions, not including expenses listed above, of $9,950. 5 Sonia is a single taxpayer. Required: 1. Calculate the amount of Sonia's taxable income assuming that Pottery activity is classified as a hobby. (2.5 marks) 2. If the pottery activity is classified as a trade or business, what will be the amount of Sonia's taxable income. (2.5 marks) 3. What are the criteria necessary for an expenditure to be deductible as business or investment expenses? (3 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets calculate Sonias taxable income under two scenarios first assuming the pottery activity is classified as a hobby and second assuming its classifi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started