Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sophia operates Crimson Tide Training Equipment as a sole proprietorship. The company is an accrual basis taxpayer and has an outstanding $1,000,000 unsecured receivable from

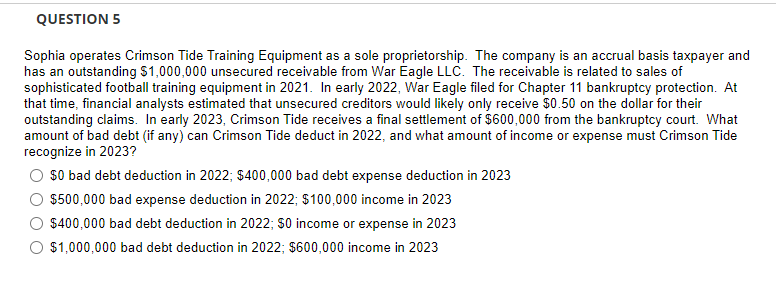

Sophia operates Crimson Tide Training Equipment as a sole proprietorship. The company is an accrual basis taxpayer and has an outstanding $1,000,000 unsecured receivable from War Eagle LLC. The receivable is related to sales of sophisticated football training equipment in 2021. In early 2022, War Eagle filed for Chapter 11 bankruptcy protection. At that time, financial analysts estimated that unsecured creditors would likely only receive $0.50 on the dollar for their outstanding claims. In early 2023, Crimson Tide receives a final settlement of $600,000 from the bankruptcy court. What amount of bad debt (if any) can Crimson Tide deduct in 2022, and what amount of income or expense must Crimson Tide recognize in 2023 ? $0 bad debt deduction in 2022; $400,000 bad debt expense deduction in 2023 $500,000 bad expense deduction in 2022; $100,000 income in 2023 $400,000 bad debt deduction in 2022; $0 income or expense in 2023 $1,000,000 bad debt deduction in 2022; $600,000 income in 2023

Sophia operates Crimson Tide Training Equipment as a sole proprietorship. The company is an accrual basis taxpayer and has an outstanding $1,000,000 unsecured receivable from War Eagle LLC. The receivable is related to sales of sophisticated football training equipment in 2021. In early 2022, War Eagle filed for Chapter 11 bankruptcy protection. At that time, financial analysts estimated that unsecured creditors would likely only receive $0.50 on the dollar for their outstanding claims. In early 2023, Crimson Tide receives a final settlement of $600,000 from the bankruptcy court. What amount of bad debt (if any) can Crimson Tide deduct in 2022, and what amount of income or expense must Crimson Tide recognize in 2023 ? $0 bad debt deduction in 2022; $400,000 bad debt expense deduction in 2023 $500,000 bad expense deduction in 2022; $100,000 income in 2023 $400,000 bad debt deduction in 2022; $0 income or expense in 2023 $1,000,000 bad debt deduction in 2022; $600,000 income in 2023 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started