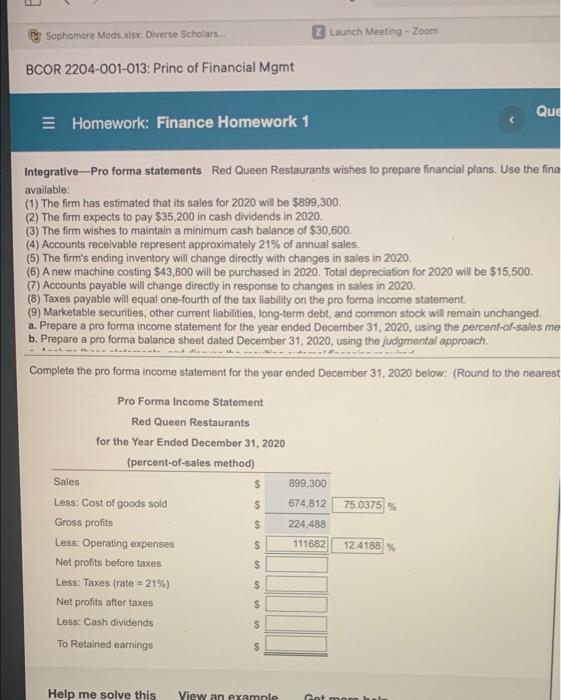

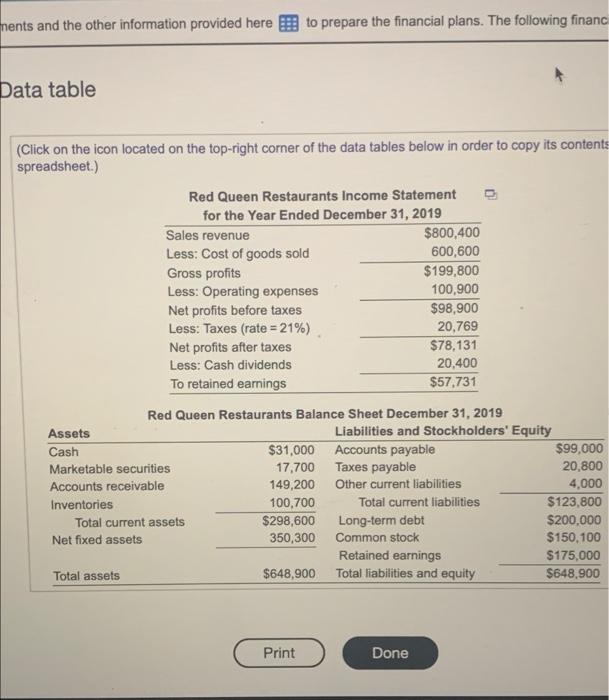

Sophomore Mods.se Diverse Scholars... Lunch Meeting - Zoom BCOR 2204-001-013: Princ of Financial Mgmt Qud = Homework: Finance Homework 1 Integrative-Pro forma statements Red Queen Restaurants wishes to prepare financial plans. Use the fina available: (1) The firm has estimated that its sales for 2020 will be $899,300. (2) The firm expects to pay $35,200 in cash dividends in 2020. (3) The firm wishes to maintain a minimum cash balance of $30,600. (4) Accounts receivable represent approximately 21% of annual sales. (5) The firm's ending inventory will change directly with changes in sales in 2020 (6) A new machine costing 543,800 will be purchased in 2020. Total depreciation for 2020 will be $15,500. 7) Accounts payable will change directly in response to changes in sales in 2020. (8) Taxes payable will equal one-fourth of the tax liability on the pro forma income statement (9) Marketable securities, other current liabilities, long-term debt, and common stock will remain unchanged. a. Prepare a pro forma income statement for the year ended December 31, 2020, using the percent-of-sales me b. Prepare a pro forma balance sheet dated December 31, 2020, using the judgmental approach. Complete the pro forma income statement for the year ended December 31, 2020 below: (Round to the nearest Pro Forma Income Statement Red Queen Restaurants for the Year Ended December 31, 2020 (percent-of-sales method) Sales S 899,300 Less: Cost of goods sold 674,812 75.0375 Gross profits $ 224,488 Less: Operating expenses 111682 12.4188 Net profits before taxes $ Less: Taxes (rate=21%) Net profits after taxes Less: Cash dividends To Retained earnings $ $ $ $ $ Help me solve this View an examnle Got mom al ments and the other information provided here to prepare the financial plans. The following financ Data table (Click on the icon located on the top-right corner of the data tables below in order to copy its contents spreadsheet.) Red Queen Restaurants Income Statement for the Year Ended December 31, 2019 Sales revenue $800,400 Less: Cost of goods sold 600,600 Gross profits $199,800 Less: Operating expenses 100,900 Net profits before taxes $98,900 Less: Taxes (rate=21%) 20,769 Net profits after taxes $78,131 Less: Cash dividends 20,400 To retained earnings $57.731 Red Queen Restaurants Balance Sheet December 31, 2019 Assets Liabilities and Stockholders' Equity Cash $31,000 Accounts payable $99,000 Marketable securities 17,700 Taxes payable 20,800 Accounts receivable 149,200 Other current liabilities 4,000 Inventories 100,700 Total current liabilities $123,800 Total current assets $298,600 Long-term debt $200,000 Net fixed assets 350,300 Common stock $150,100 Retained earnings $175,000 Total assets $648,900 Total liabilities and equity $648.900 Print Done