Question

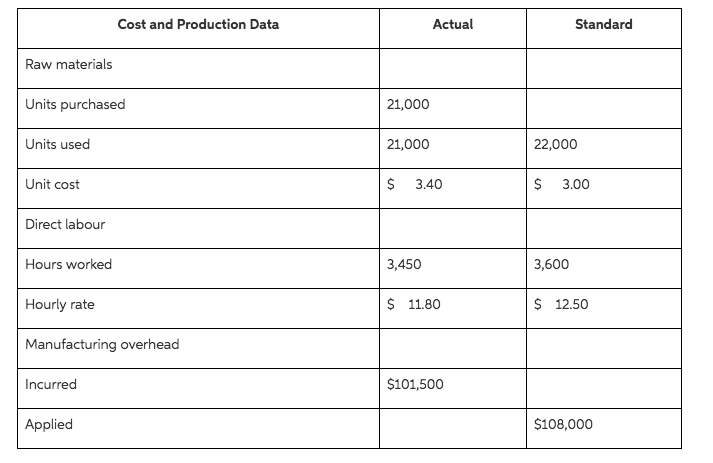

Soriano Manufacturing Company uses a standard cost accounting system to account for the manufacturing of exhaust fans. In July 2017, it accumulates the following data

Soriano Manufacturing Company uses a standard cost accounting system to account for the manufacturing of exhaust fans. In July 2017, it accumulates the following data for 1,500 units started and finished:

manufacturing overhead was applied based on direct labour hours. Normal capacity for the month was 3,400 direct labour hours. At normal capacity, budgeted overhead costs were $20 per labour hour variable and $10 per labour hour fixed. total budgeted costs were $34,000

job finished during the month were sold for $280,000, selling and admin expenses were $25,000

(a) calculate all of the variances for direct materials and direct labour

(b) calculate the total manufacturing overhead variance

(c) calculate the overhead budget variance and the overhead volume variance

(d) prepare an income state for management showing the variances. Ignore income tax

*Note (a) LQV = $1,875 F (b) OHV = $6,500 F

*I am struggling with part C

* PLEASE DO NOT SOLVE WITH EXCEL

Cost and Production Data Actual Standard Raw materials Units purchased 21,000 Units used 21,000 22,000 S S Unit cost 3.40 3.00 Direct labour Hours worked 3,450 3,600 $ 11.80 S 12,50 Hourly rate Manufacturing overhead Incurred $101,500 $108,000 Applied

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started