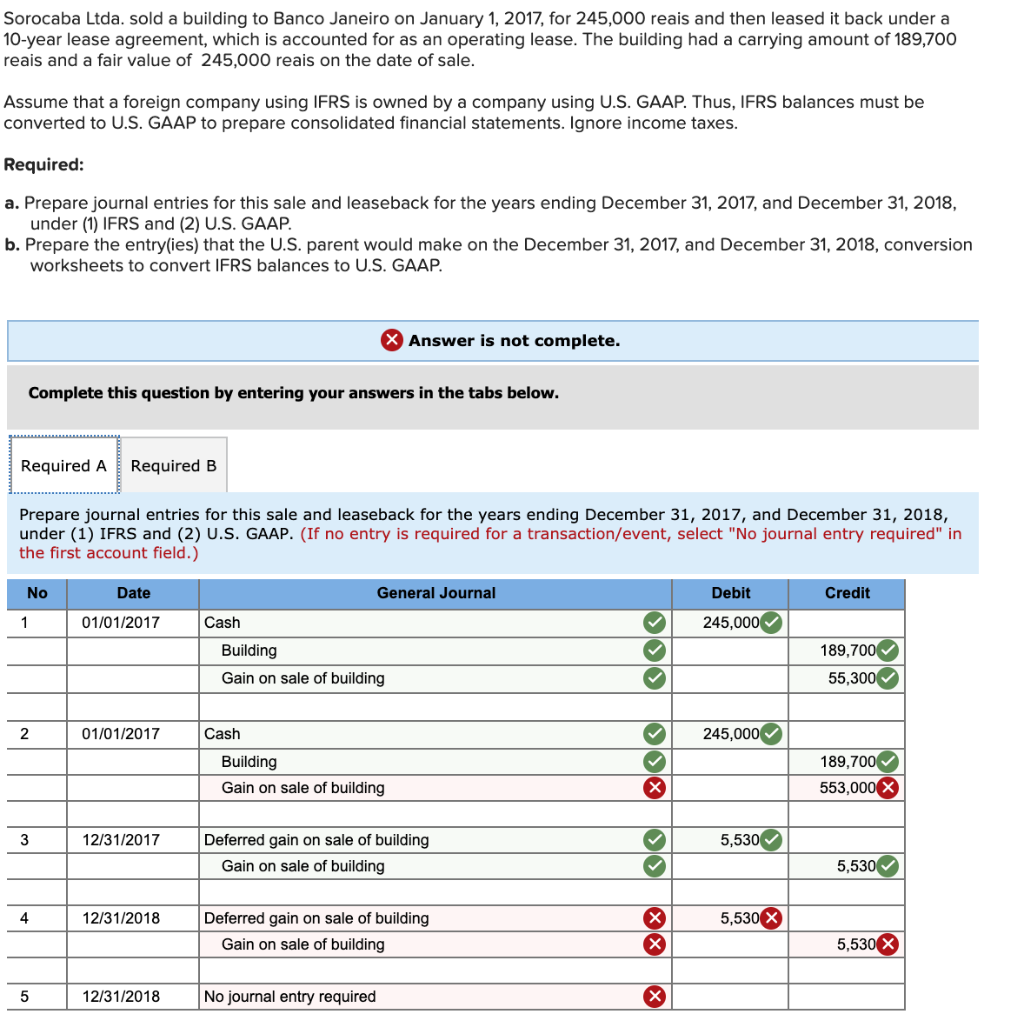

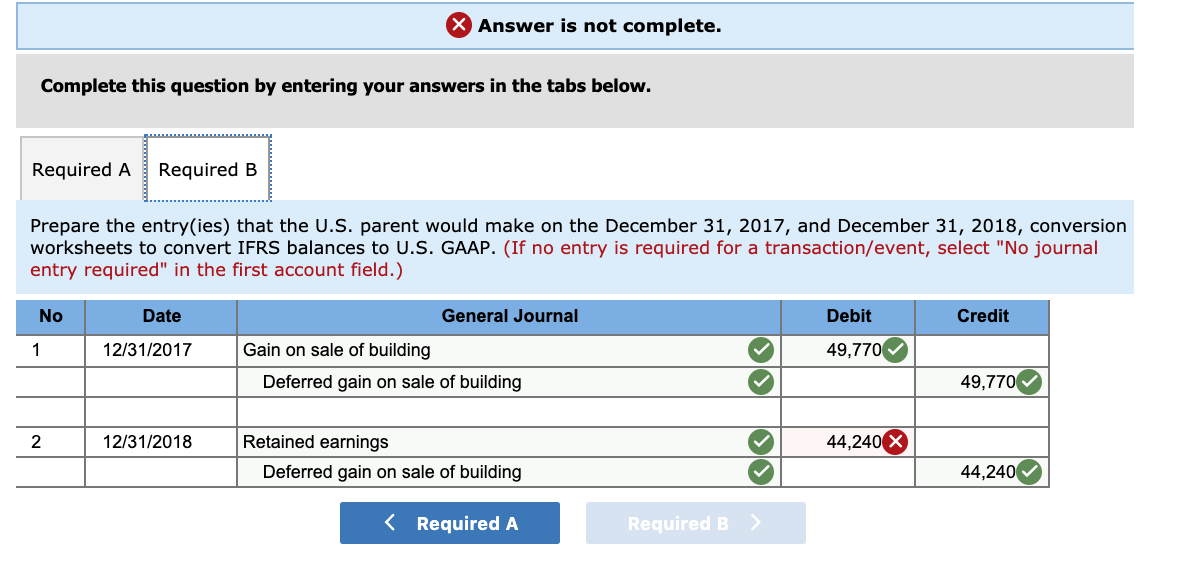

Sorocaba Ltda. sold a building to Banco Janeiro on January 1, 2017, for 245,000 reais and then leased it back under a 10-year lease agreement, which is accounted for as an operating lease. The building had a carrying amount of 189,700 reais and a fair value of 245,000 reais on the date of sale. Assume that a foreign company using IFRS is owned by a company using U.S. GAAP. Thus, IFRS balances must be converted to U.S. GAAP to prepare consolidated financial statements. Ignore income taxes. Required: a. Prepare journal entries for this sale and leaseback for the years ending December 31, 2017, and December 31, 2018, under (1) IFRS and (2) U.S. GAAP. b. Prepare the entry(ies) that the U.S. parent would make on the December 31, 2017, and December 31, 2018, conversion worksheets to convert IFRS balances to U.S. GAAP. X Answer is not complete. Complete this question by entering your answers in the tabs below. Required A Required B Prepare journal entries for this sale and leaseback for the years ending December 31, 2017, and December 31, 2018, under (1) IFRS and (2) U.S. GAAP. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) No Credit Date 01/01/2017 Debit 245,000 General Journal Cash Building Gain on sale of building 189,700 55,300 01/01/2017 Cash 245,000 Building Gain on sale of building 189,700 553,000 12/31/2017 5,530 Deferred gain on sale of building Gain on sale of building 5,530 12/31/2018 5,530 X Deferred gain on sale of building Gain on sale of building 5,530 X 5 12/31/2018 No journal entry required X Answer is not complete. Complete this question by entering your answers in the tabs below. Required A Required B Prepare the entry(ies) that the U.S. parent would make on the December 31, 2017, and December 31, 2018, conversion worksheets to convert IFRS balances to U.S. GAAP. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) No Credit Date 12/31/2017 General Journal Gain on sale of building Deferred gain on sale of building Debit 49,770 49,770 12/31/2018 44,240 x Retained earnings Deferred gain on sale of building 44,2400 44,240 Required A Required B )