Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Soroka Corporation (Soroka) distributes consumer electronics and computers throughout the United States. Its most recent unadjusted balance sheet appears in Table C2.1. Soroka values

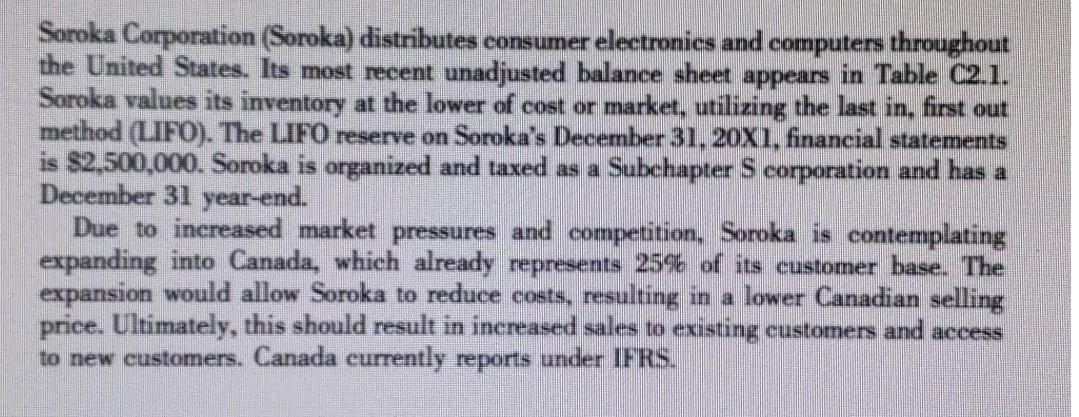

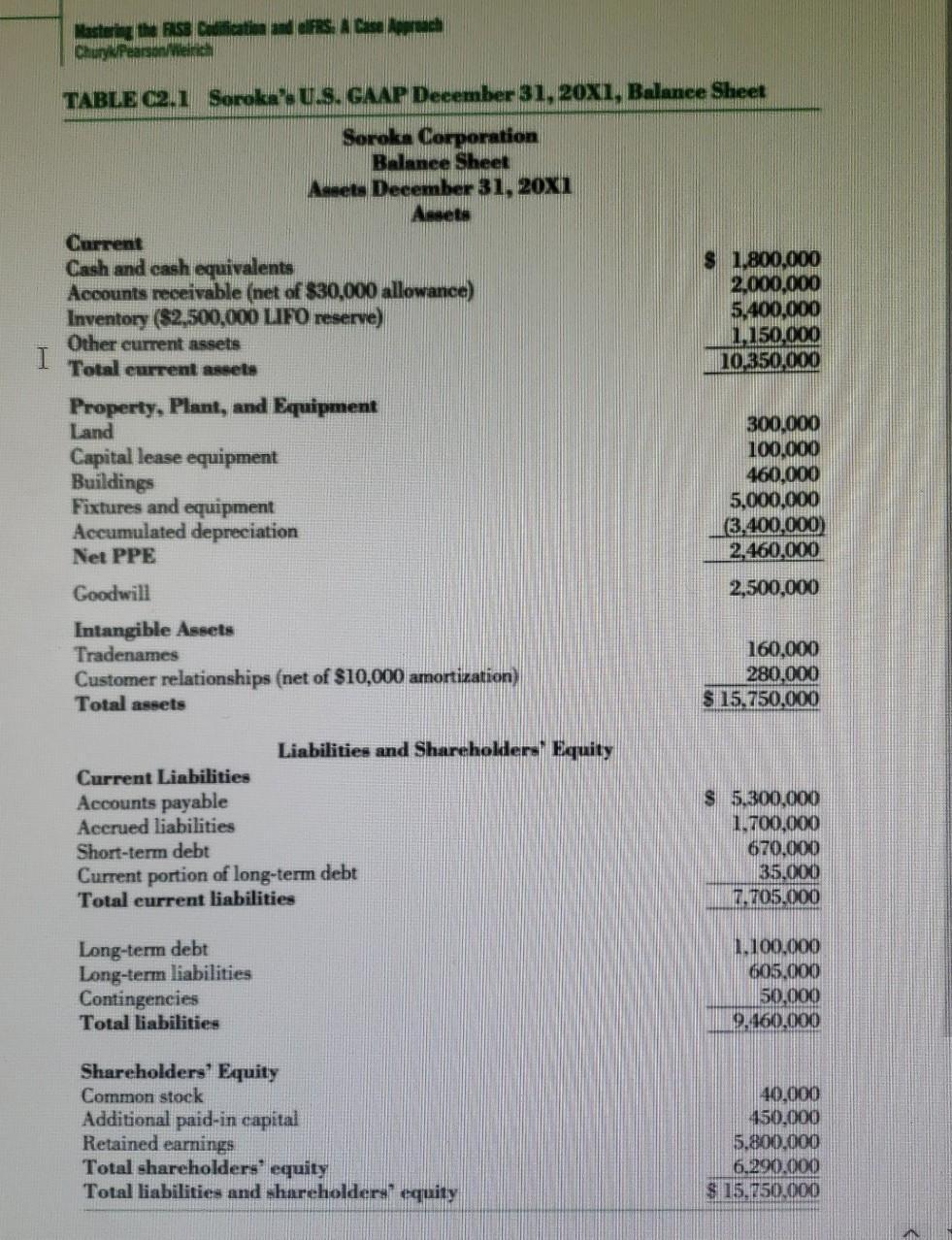

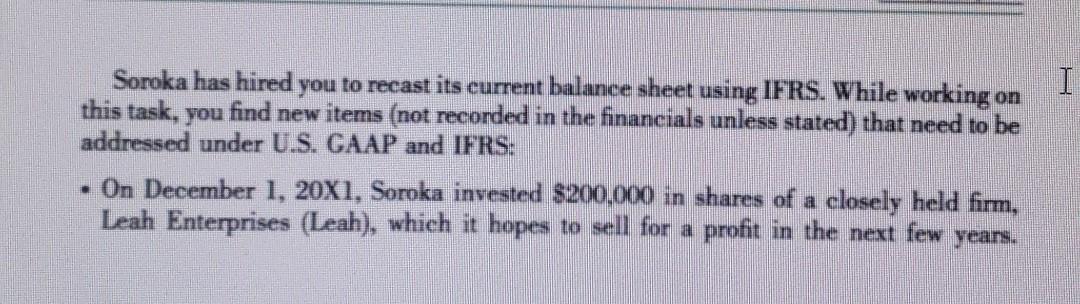

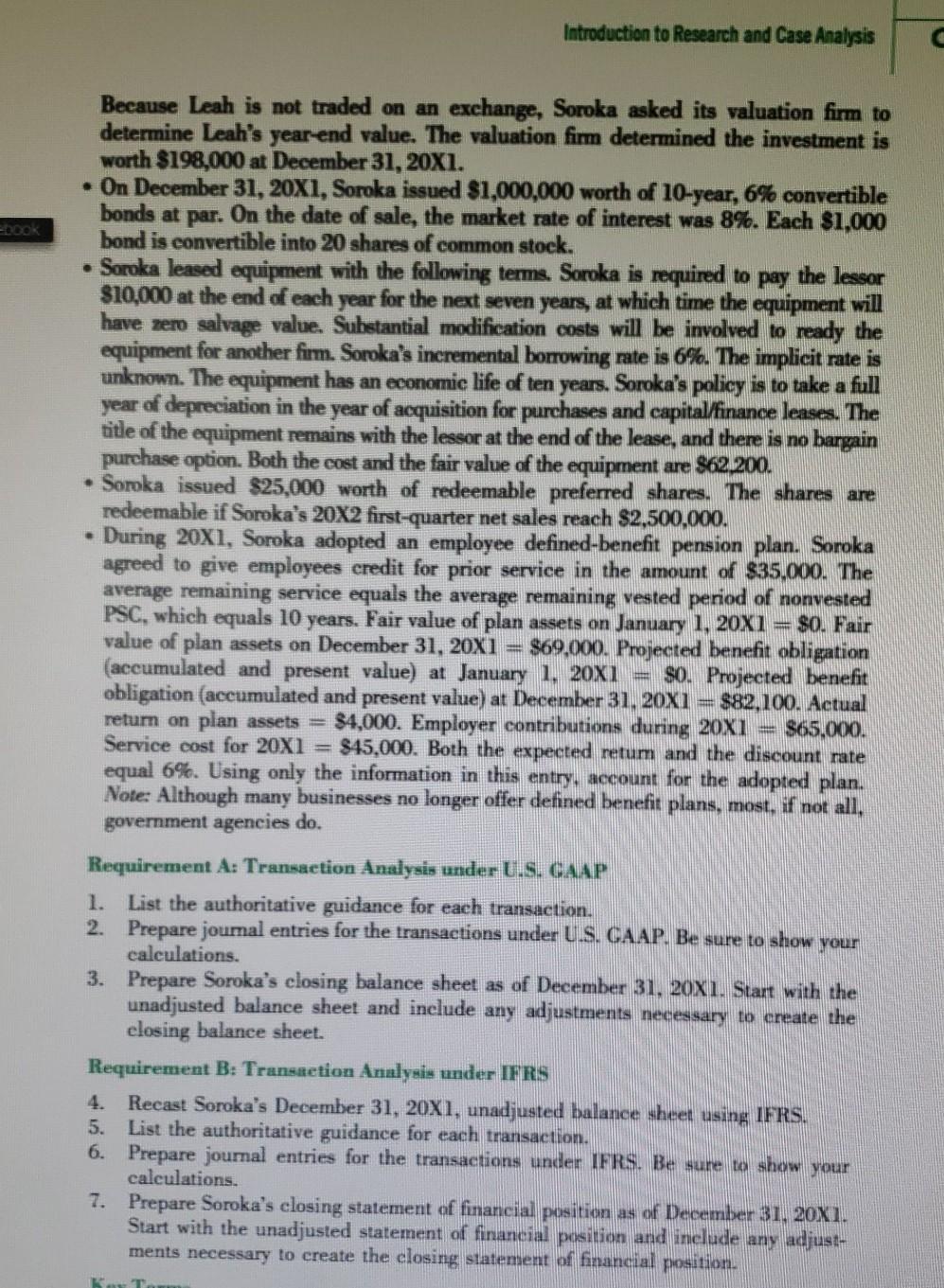

Soroka Corporation (Soroka) distributes consumer electronics and computers throughout the United States. Its most recent unadjusted balance sheet appears in Table C2.1. Soroka values its inventory at the lower of cost or market, utilizing the last in, first out method (LIFO). The LIFO reserve on Soroka's December 31, 20X1, financial statements is $2,500,000. Soroka is organized and taxed as a Subchapter S corporation and has a December 31 year-end. Due to increased market pressures and competition, Soroka is contemplating expanding into Canada, which already represents 25% of its customer base. The expansion would allow Soroka to reduce costs, resulting in a lower Canadian selling price. Ultimately, this should result in increased sales to existing customers and access to new customers. Canada currently reports under IFRS. I Mastering the FASB Codification and elFRS. A Case Approach Churyk/Pearson/Weirich TABLE C2.1 Soroka's U.S. GAAP December 31, 20X1, Balance Sheet Soroka Corporation Balance Sheet Assets December 31, 20X1 Assets Current Cash and cash equivalents Accounts receivable (net of $30,000 allowance) Inventory ($2,500,000 LIFO reserve) Other current assets Total current assets Property, Plant, and Equipment Land Capital lease equipment Buildings Fixtures and equipment Accumulated depreciation Net PPE Goodwill Intangible Assets Tradenames Customer relationships (net of $10,000 amortization) Total assets Current Liabilities Accounts payable Accrued liabilities Short-term debt Liabilities and Shareholders Equity Current portion of long-term debt Total current liabilities Long-term debt Long-term liabilities Contingencies Total liabilities Shareholders' Equity Common stock Additional paid-in capital Retained earnings Total shareholders' equity Total liabilities and shareholders' equity 1,800,000 2,000,000 5,400,000 1,150,000 10,350,000 300,000 100,000 460,000 5,000,000 (3,400,000) 2,460,000 2,500,000 160,000 280,000 $15.750,000 $ 5,300,000 1,700,000 ,000 35,000 7.705.000 1.100.000 605,000 50,000 9.460,000 40,000 450.000 5,800,000 6.290.000 $15.750.000 Soroka has hired you to recast its current balance sheet using IFRS. While working on this task, you find new items (not recorded in the financials unless stated) that need to be addressed under U.S. GAAP and IFRS: . On December 1, 20X1, Soroka invested $200,000 in shares of a closely held firm, Leah Enterprises (Leah), which it hopes to sell for a profit in the next few years. H Because Leah is not traded on an exchange, Soroka asked its valuation firm to determine Leah's year-end value. The valuation firm determined the investment is worth $198,000 at December 31, 20X1. On December 31, 20X1, Soroka issued $1,000,000 worth of 10-year, 6% convertible bonds at par. On the date of sale, the market rate of interest was 8%. Each $1,000 bond is convertible into 20 shares of common stock. Introduction to Research and Case Analysis Soroka leased equipment with the following terms. Soroka is required to pay the lessor $10,000 at the end of each year for the next seven years, at which time the equipment will have zero salvage value. Substantial modification costs will be involved to ready the equipment for another firm. Soroka's incremental borrowing rate is 6%. The implicit rate is unknown. The equipment has an economic life of ten years. Soroka's policy is to take a full year of depreciation in the year of acquisition for purchases and capital/finance leases. The title of the equipment remains with the lessor at the end of the lease, and there is no bargain purchase option. Both the cost and the fair value of the equipment are $62,200. . Soroka issued $25,000 worth of redeemable preferred shares. The shares are redeemable if Soroka's 20X2 first-quarter net sales reach $2,500,000. During 20X1, Soroka adopted an employee defined-benefit pension plan. Soroka agreed to give employees credit for prior service in the amount of $35,000. The average remaining service equals the average remaining vested period of nonvested PSC, which equals 10 years. Fair value of plan assets on January 1, 20X1 = 80. Fair value of plan assets on December 31, 20X1= $69,000. Projected benefit obligation (accumulated and present value) at January 1, 20X1 $0. Projected benefit obligation (accumulated and present value) at December 31, 20X1= $82,100. Actual return on plan assets = $4,000. Employer contributions during 20X1 $65,000. Service cost for 20X1= $45,000. Both the expected retum and the discount rate equal 6%. Using only the information in this entry, account for the adopted plan. Note: Although many businesses no longer offer defined benefit plans, most, if not all, government agencies do. Requirement A: Transaction Analysis under U.S. CAAP 1. List the authoritative guidance for each transaction. 2. Prepare journal entries for the transactions under U.S. GAAP. Be sure to show your calculations. 3. Prepare Soroka's closing balance sheet as of December 31, 20X1. Start with the unadjusted balance sheet and include any adjustments necessary to create the closing balance sheet. Requirement B: Transaction Analysis under IFRS 4. Recast Soroka's December 31, 20X1, unadjusted balance sheet using IFRS. 5. List the authoritative guidance for each transaction. 6. Prepare journal entries for the transactions under IFRS. Be sure to show your calculations. Prepare Soroka's closing statement of financial position as of December 31, 20X1. Start with the unadjusted statement of financial position and include any adjust- ments necessary to create the closing statement of financial position. T 7. K.

Step by Step Solution

★★★★★

3.39 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Requirement A Transaction Analysis under US GAAP 1 Authoritative Guidance Transaction Authoritative Guidance Investment in Leah Enterprises ASC 323 Investments Issuance of convertible bonds ASC 815 De...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started