Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sorry about the long question, disregard it as i figured it out and handed in my test. No need to do the question :) Problem

Sorry about the long question, disregard it as i figured it out and handed in my test. No need to do the question :)

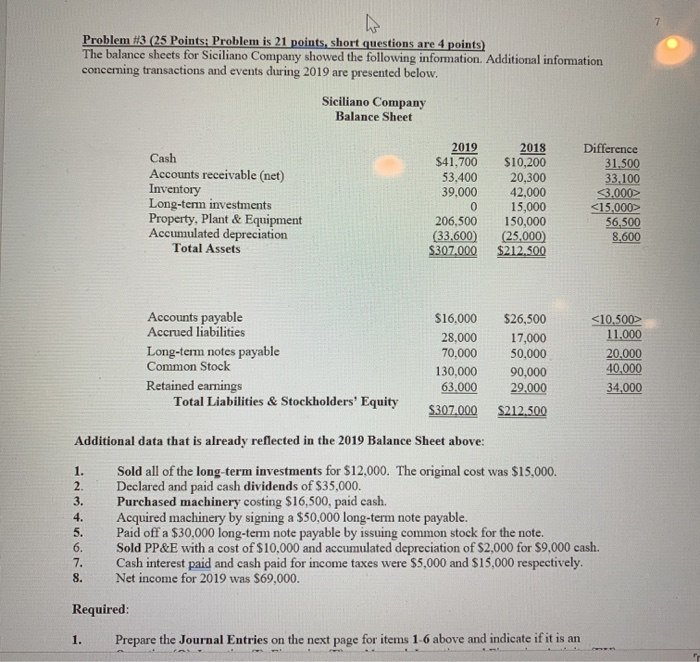

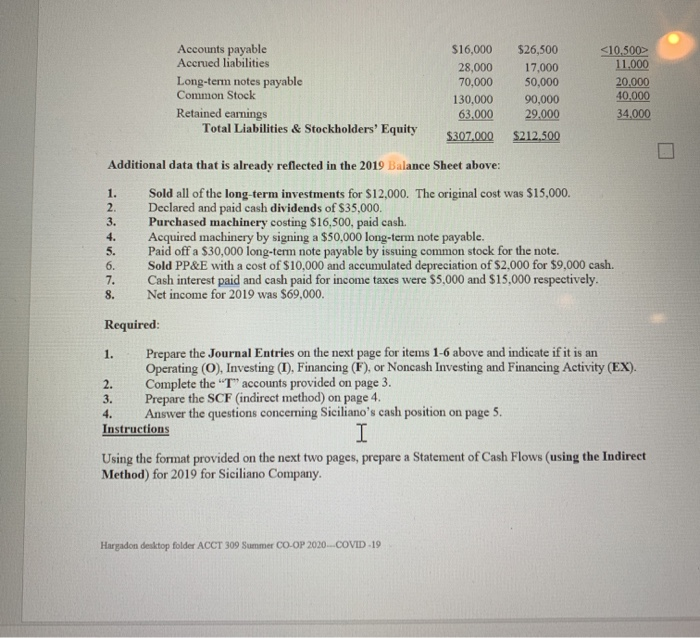

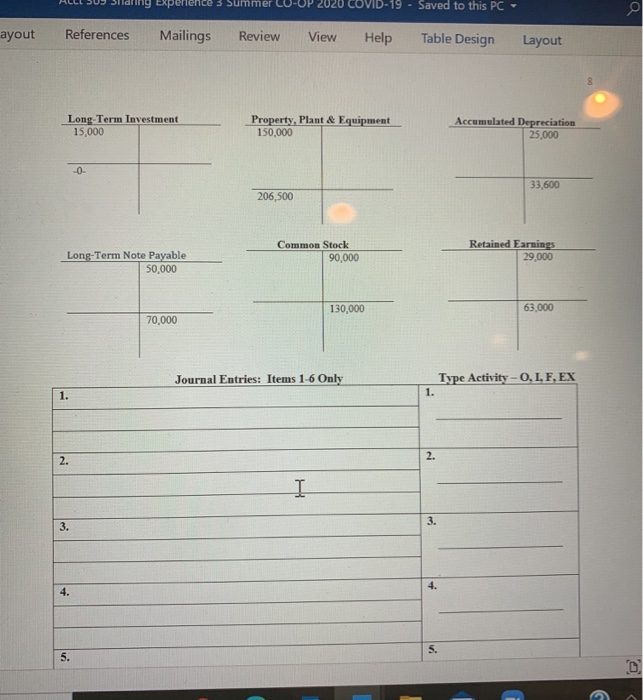

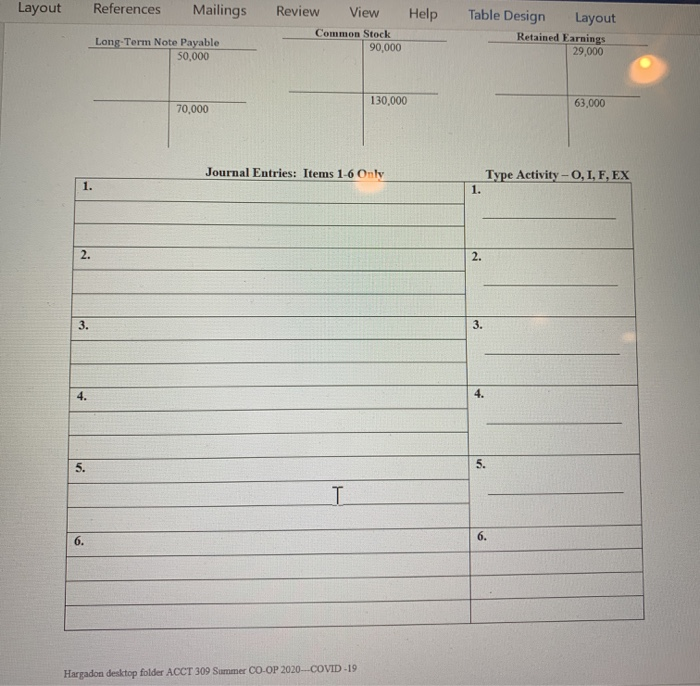

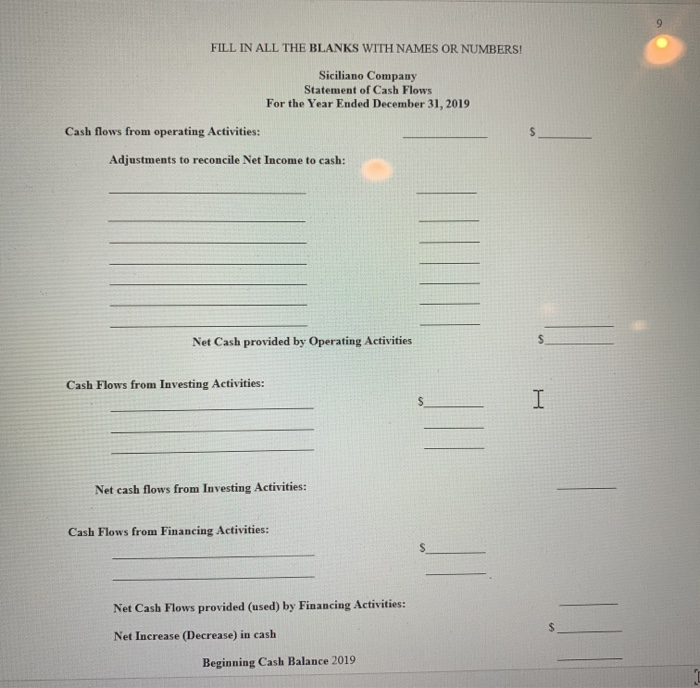

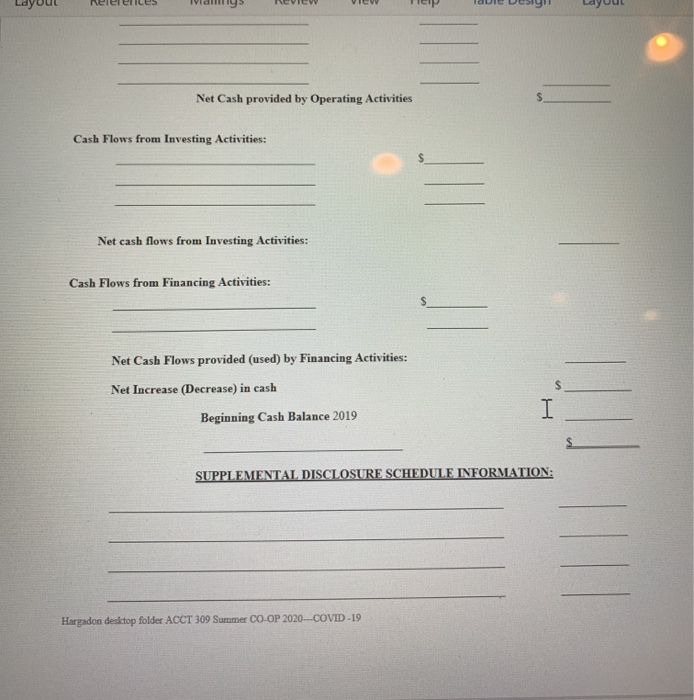

Problem #3 (25 Points; Problem is 21 points, short questions are 4 points) The balance sheets for Siciliano Company showed the following information. Additional information concerning transactions and events during 2019 are presented below. Siciliano Company Balance Sheet Cash Accounts receivable (net) Inventory Long-term investments Property, Plant & Equipment Accumulated depreciation Total Assets 2019 $41,700 53.400 39.000 0 206,500 (33.600) $307.000 2018 $10,200 20,300 42,000 15,000 150,000 (25,000 $212.500 Difference 31.500 33.100 3.000> 56.500 8.600 Accounts payable $16,000 $26,500 Accrued liabilities 28,000 17,000 11,000 Long-term notes payable 70,000 50,000 20.000 Common Stock 130,000 90,000 40,000 Retained earnings 63.000 29.000 34,000 Total Liabilities & Stockholders' Equity $307,000 S212.500 Additional data that is already reflected in the 2019 Balance Sheet above: 1. Sold all of the long-term investments for $12,000. The original cost was $15,000. 2 Declared and paid cash dividends of $35,000. 3. Purchased machinery costing $16,500, paid cash. 4. Acquired machinery by signing a $50,000 long-term note payable. 5. Paid off a $30,000 long-term note payable by issuing common stock for the note. 6. Sold PP&E with a cost of $10,000 and accumulated depreciation of $2,000 for $9,000 cash. 7. Cash interest paid and cash paid for income taxes were $5,000 and $15,000 respectively. 8. Net income for 2019 was $69,000. Required: 1. Prepare the Journal Entries on the next page for items 1-6 above and indicate if it is an Accounts payable Accrued liabilities Long-term notes payable Common Stock Retained earnings Total Liabilities & Stockholders' Equity $16,000 28,000 70,000 130,000 63,000 $26,500 17,000 50,000 90,000 29.000 11,000 20.000 40,000 34.000 $307.000 $212.500 4. 5. 7. Additional data that is already reflected in the 2019 Balance Sheet above: 1. Sold all of the long-term investments for $12,000. The original cost was $15,000. 2. Declared and paid cash dividends of $35,000. 3. Purchased machinery costing $16,500, paid cash. Acquired machinery by signing a $50,000 long-term note payable. Paid off a $30,000 long-term note payable by issuing common stock for the note. 6. Sold PP&E with a cost of $10,000 and accumulated depreciation of $2,000 for $9,000 cash. Cash interest paid and cash paid for income taxes were $5,000 and $15,000 respectively. 8. Net income for 2019 was $69.000. Required: 1. Prepare the Journal Entries on the next page for items 1-6 above and indicate if it is an Operating (O), Investing (1), Financing (F), or Noncash Investing and Financing Activity (EX). 2. Complete the "T" accounts provided on page 3. 3. Prepare the SCF (indirect method) on page 4 Answer the questions concerning Siciliano's cash position on page 5. Instructions I Using the format provided on the next two pages, prepare a Statement of Cash Flows (using the Indirect Method) for 2019 for Siciliano Company. Hargadon desktop folder ACCT 309 Summer CO-OP 2020...COVID-19 3 Summer 2020 COVID-19 - Saved to this PC- Q ayout References Mailings Review View Help Table Design Layout 8 Long Term Investment 15,000 Property, Plant & Equipment 150,000 Accumulated Depreciation 25,000 -0. 33,600 206,500 Common Stock 90,000 Retained Earnings 29,000 Long-Term Note Payable 50,000 130,000 63.000 70,000 Journal Entries: Items 1-6 Only Type Activity-O.L.FEX 1. 1. 2. 2. I 3. 3. 4. 4. 5. Layout References Mailings Review View Help Table Design Layout Retained Earnings 29,000 Common Stock 90,000 Long-Term Note Payable 50,000 130,000 63,000 70,000 Journal Entries: Items 1-6 Only Type Activity - 0, 1, F, EX 1. 1. 2. 2. 3. 3. 4. 4. 5. 5. T 6. 6. Hargadon desktop folder ACCT 309 Summer CO-OP 2020---COVID -19 9 FILL IN ALL THE BLANKS WITH NAMES OR NUMBERS! Siciliano Company Statement of Cash Flows For the Year Ended December 31, 2019 Cash flows from operating Activities: $ Adjustments to reconcile Net Income to cash: Net Cash provided by Operating Activities $ Cash Flows from Investing Activities: I JU Net cash flows from Investing Activities: Cash Flows from Financing Activities: Net Cash Flows provided (used) by Financing Activities: $ Net Increase (Decrease) in cash Beginning Cash Balance 2019 Net Cash provided by Operating Activities Cash Flows from Investing Activities: $ Net cash flows from Investing Activities: Cash Flows from Financing Activities: Net Cash Flows provided (used) by Financing Activities: Net Increase (Decrease) in cash I Beginning Cash Balance 2019 SUPPLEMENTAL DISCLOSURE SCHEDULE INFORMATION: Hargadon desktop folder ACCT 309 Summer CO-OP 2020---COVID -19 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started