Answered step by step

Verified Expert Solution

Question

1 Approved Answer

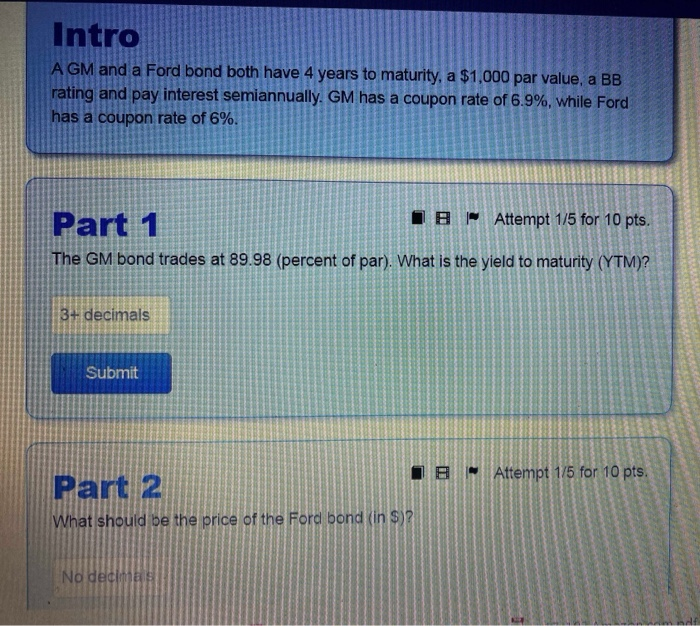

sorry for the bundle of different questions Intro A GM and a Ford bond both have 4 years to maturity, a $1,000 par value, a

sorry for the bundle of different questions

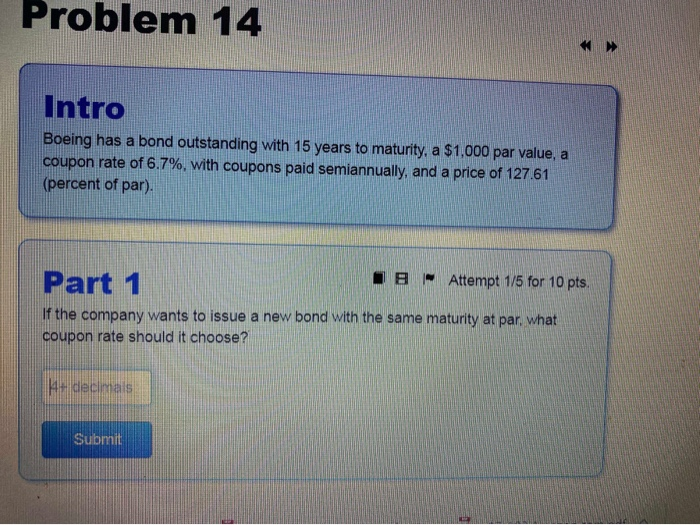

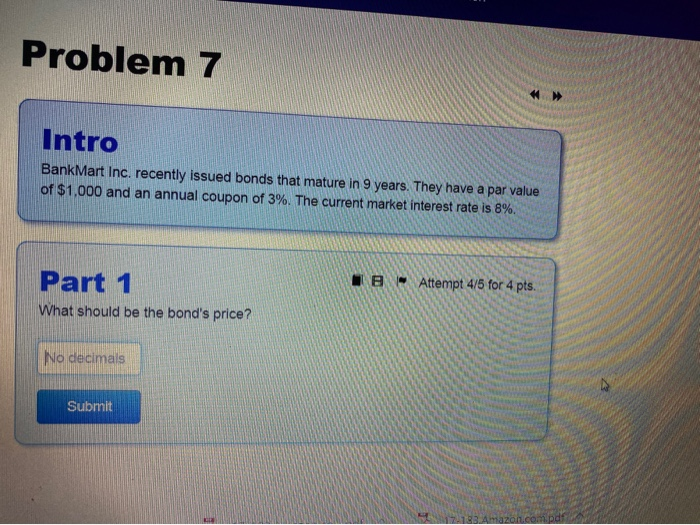

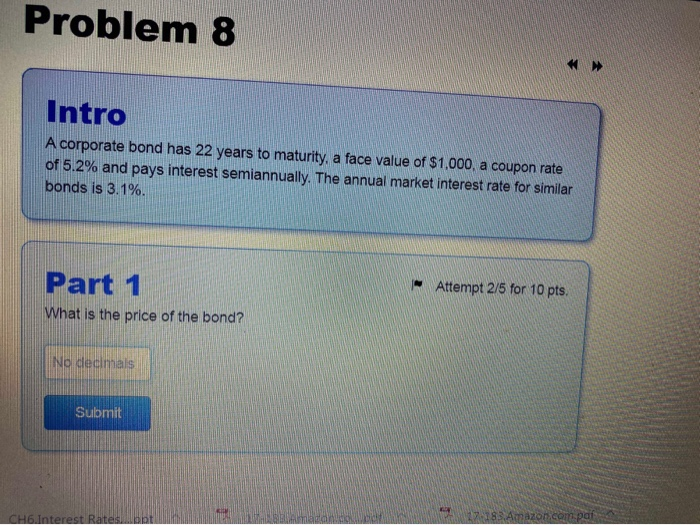

Intro A GM and a Ford bond both have 4 years to maturity, a $1,000 par value, a BB rating and pay interest semiannually. GM has a coupon rate of 6.9%, while Ford has a coupon rate of 6% Part 1 Attempt 175 for 10 pts. The GM bond trades at 89.98 (percent of par). What is the yield to maturity (YTM)? 3+ decimals Submit Attempt 175 for 10 pts. Part What should be the price of the Ford bond in $)? Problem 14 Intro Boeing has a bond outstanding with 15 years to maturity, a $1,000 par value, a coupon rate of 6.7%, with coupons paid semiannually, and a price of 127.61 (percent of par). Part 1 - Attempt 175 for 10 pts. If the company wants to issue a new bond with the same maturity at par what coupon rate should it choose? Submit Problem 7 Intro BankMart Inc. recently issued bonds that mature in 9 years. They have a par value of $1,000 and an annual coupon of 3%. The current market interest rate is 8%. - Attempt 4/5 for 4 pts. Part 1 What should be the bond's price? No decimals Submit Problem 8 Intro A corporate bond has 22 years to maturity, a face value of $1,000, a coupon rate of 5.2% and pays interest semiannually. The annual market interest rate for similar bonds is 3.1%. - Attempt 2/5 for 10 pts. Part 1 What is the price of the bond? No decimals Submit 383. Amazon.com Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started