Answered step by step

Verified Expert Solution

Question

1 Approved Answer

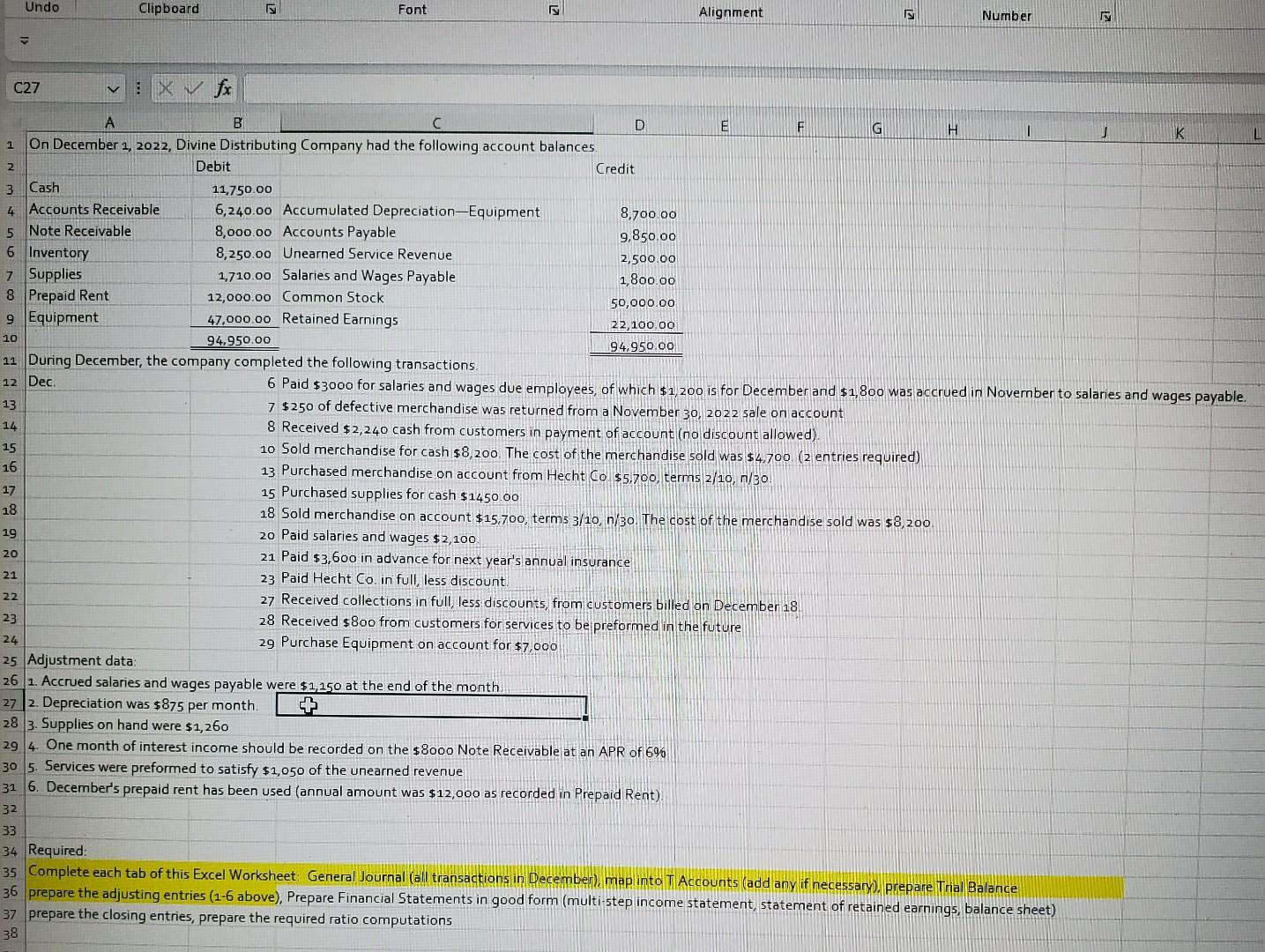

sorry for the long problem any help would be appreciated On December 1,2022 , Divine Distributing Company had the following account balances. vuing vecemper, tne

sorry for the long problem any help would be appreciated

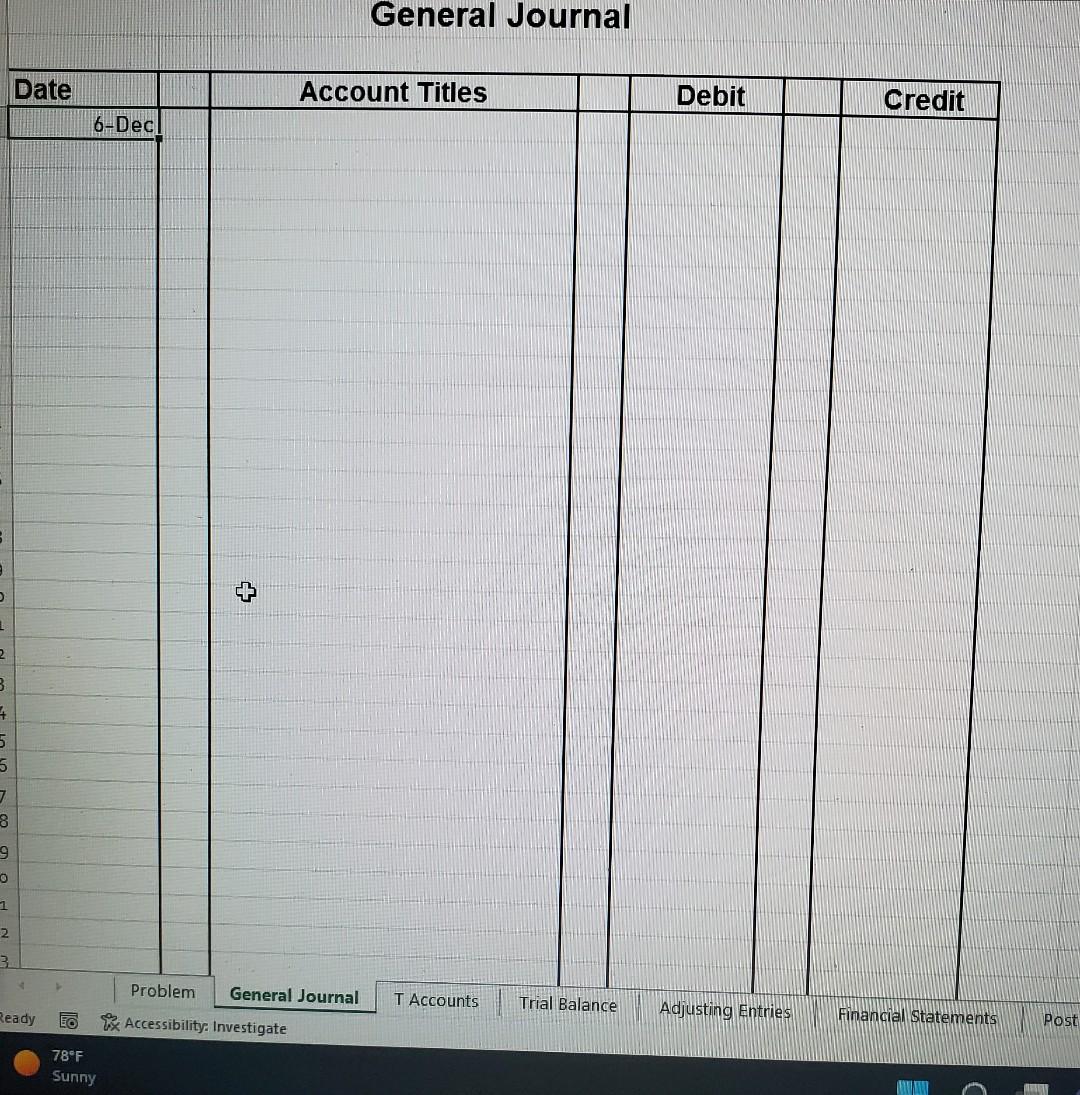

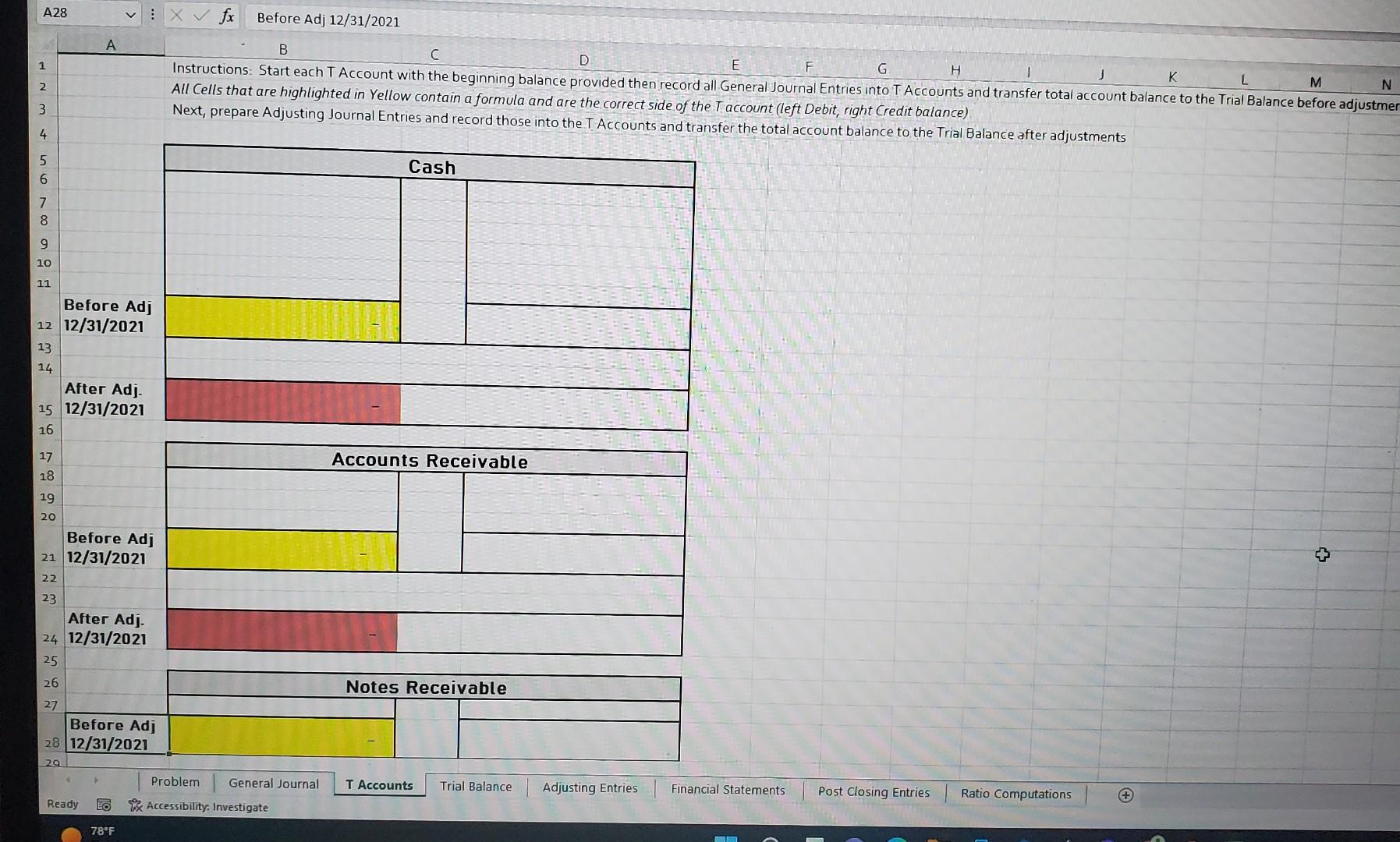

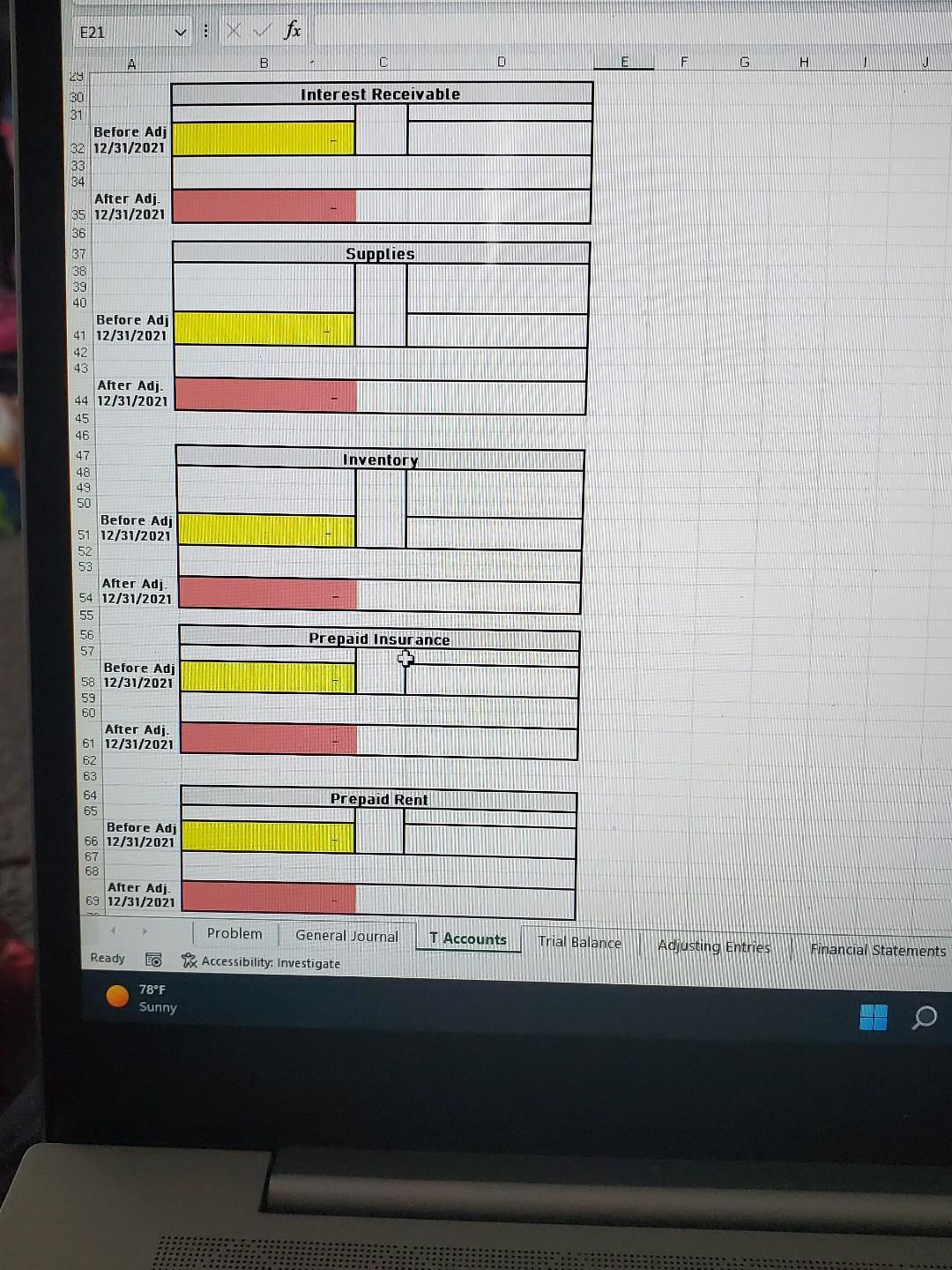

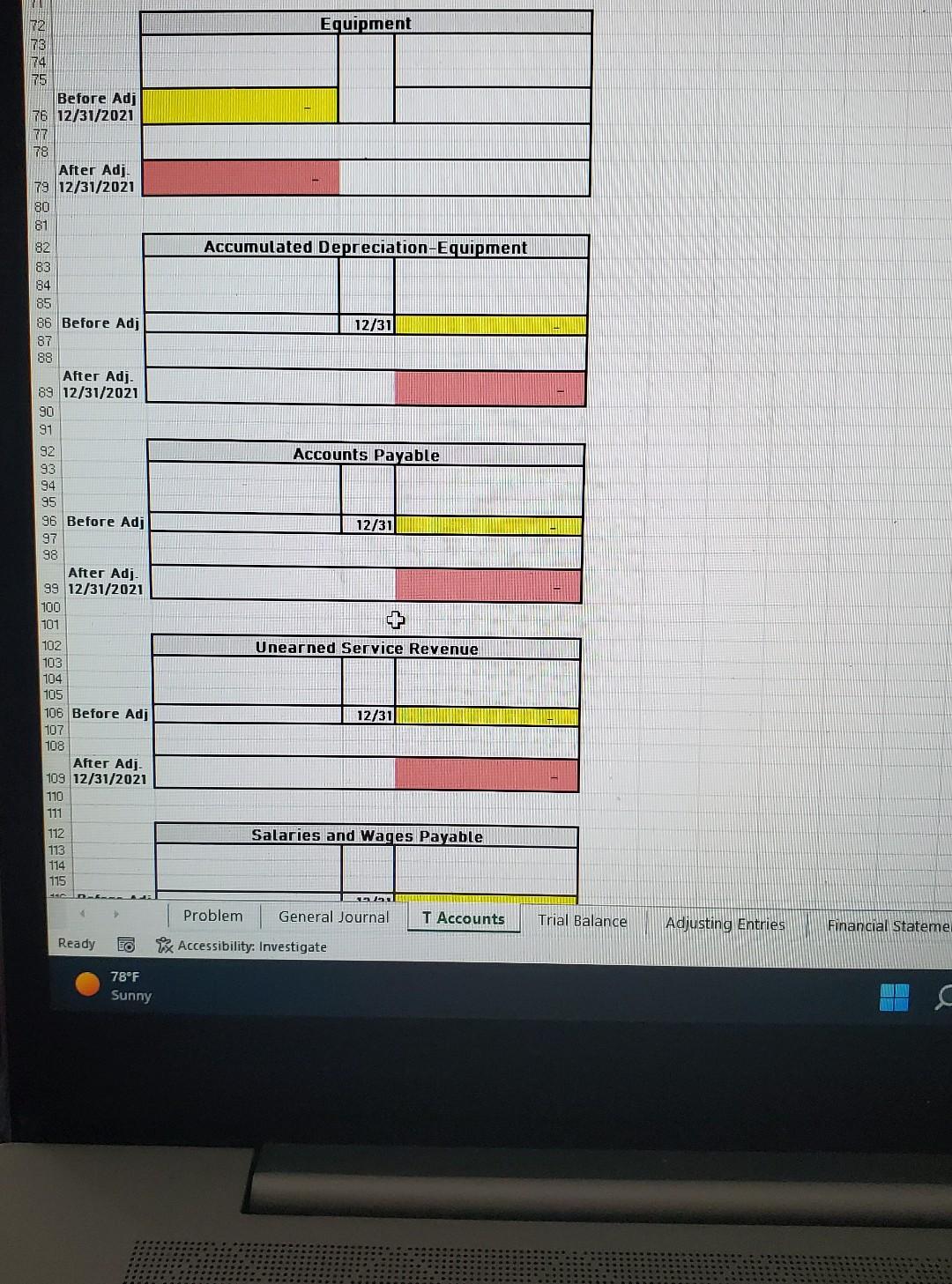

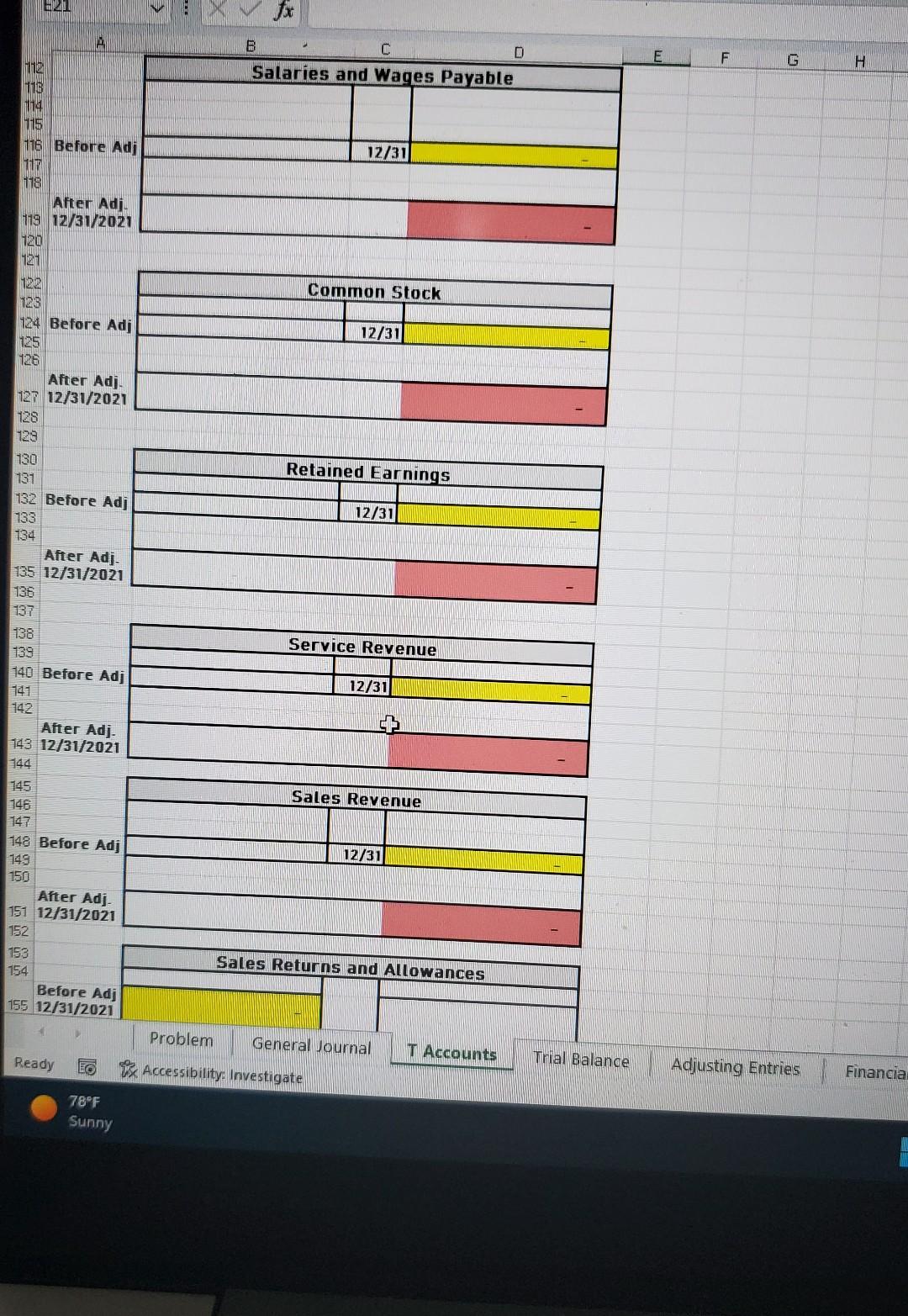

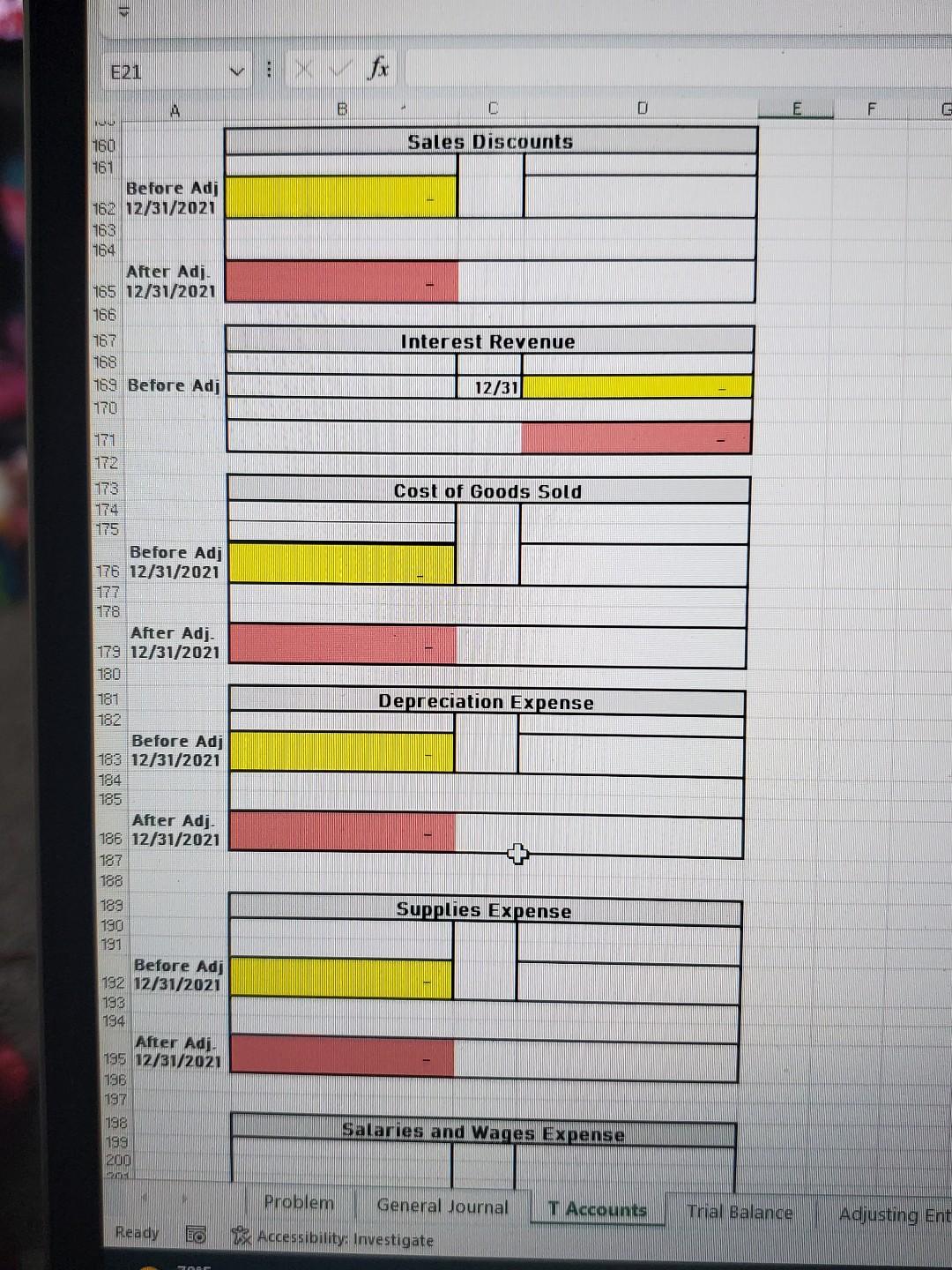

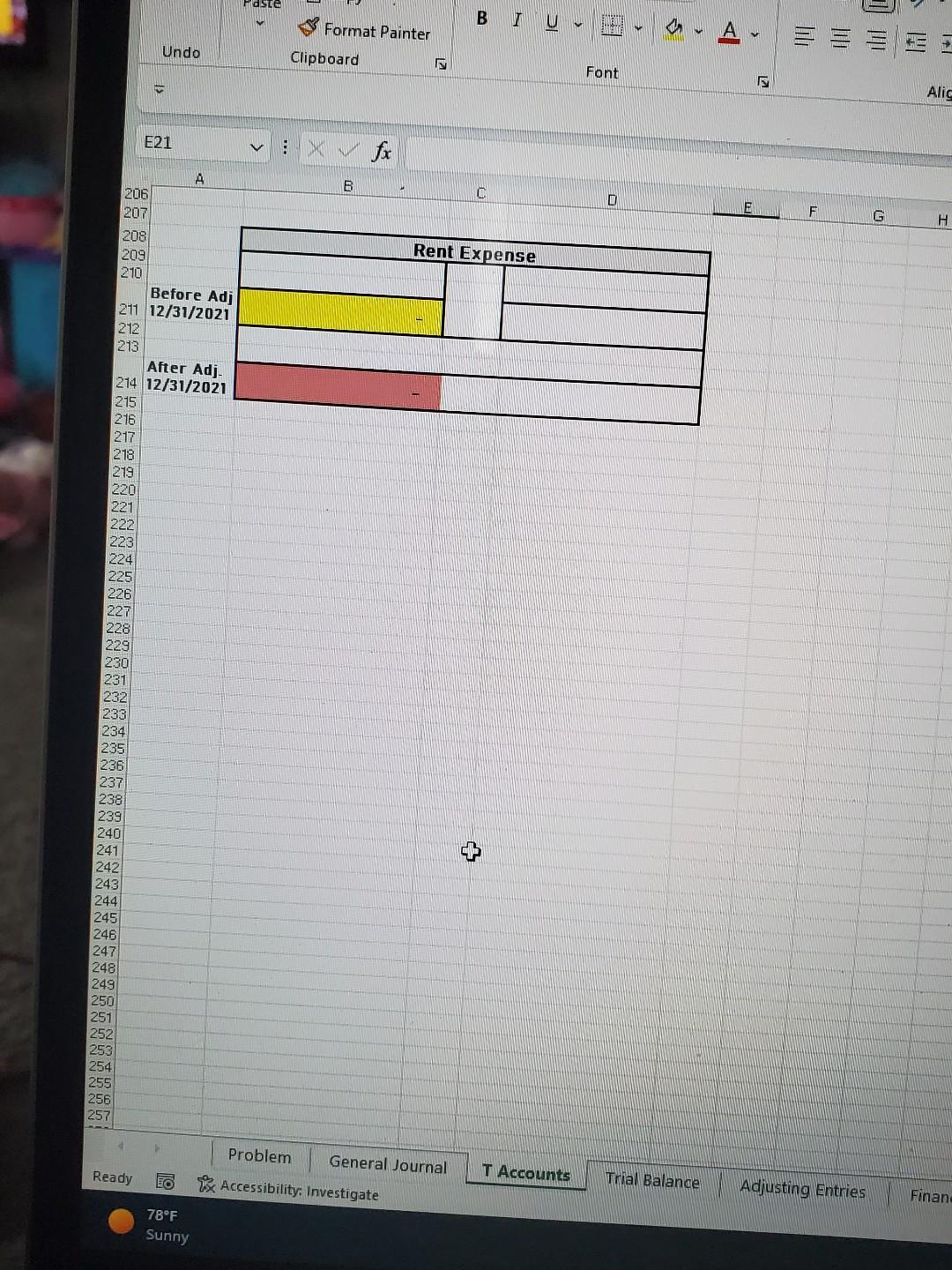

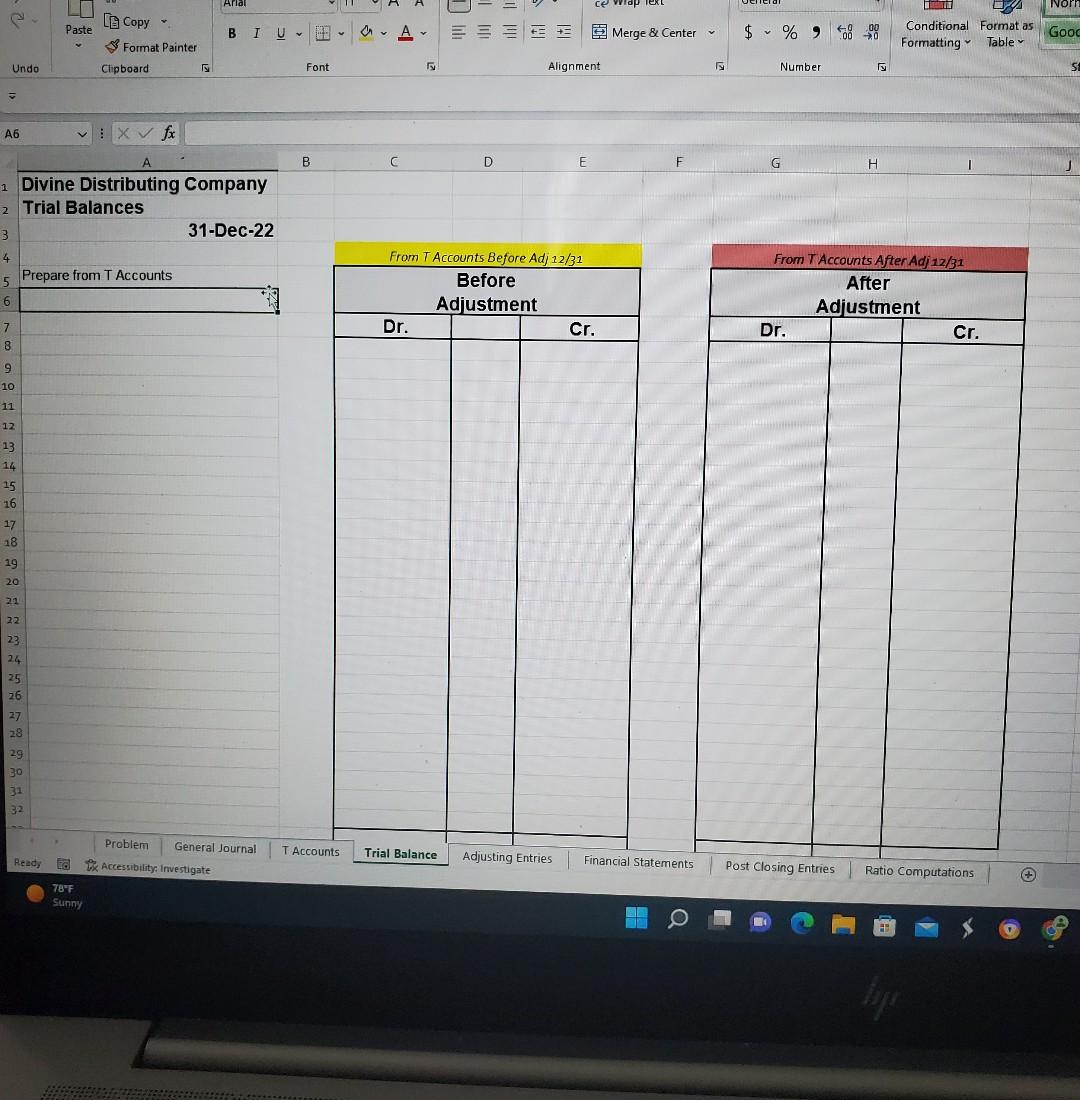

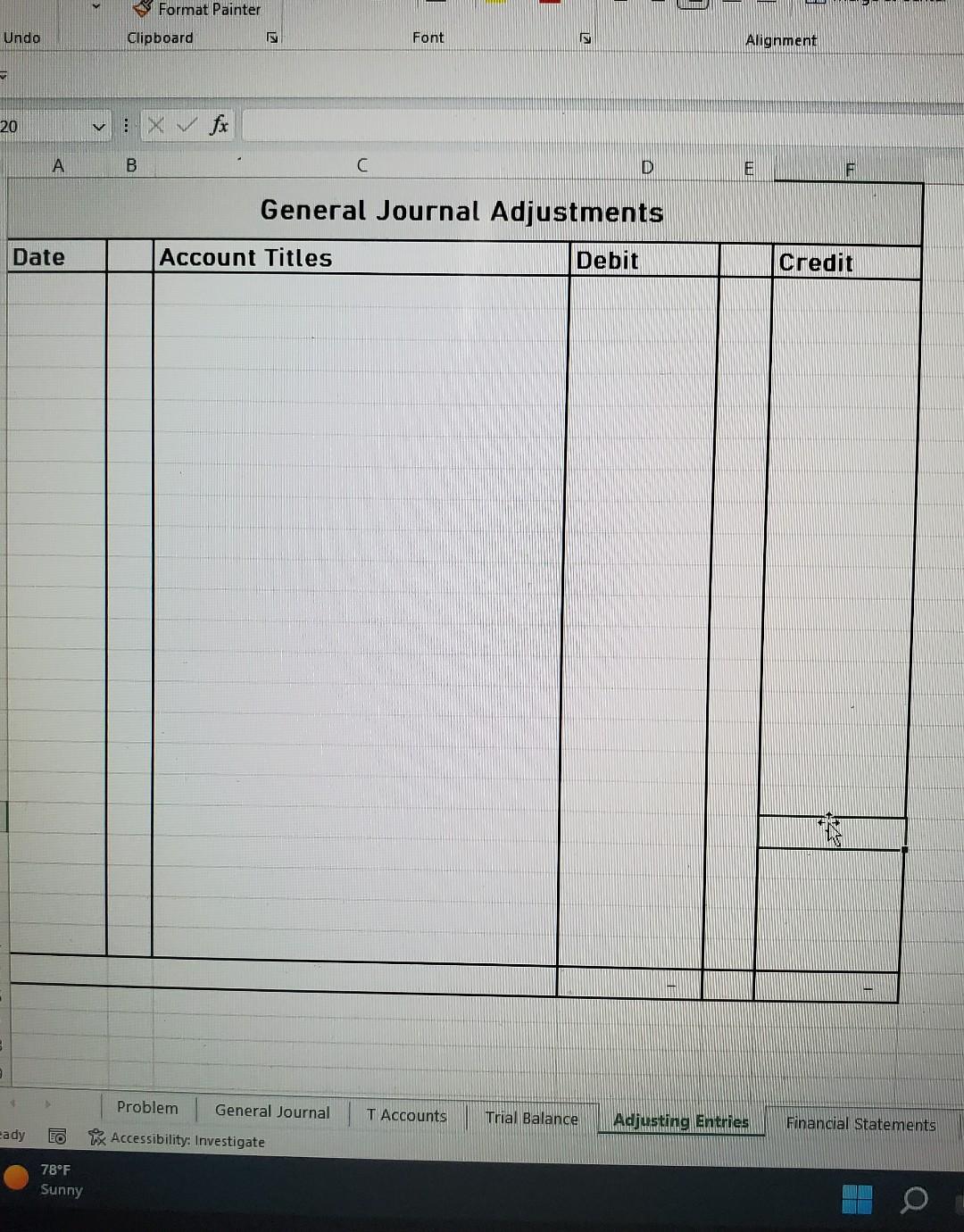

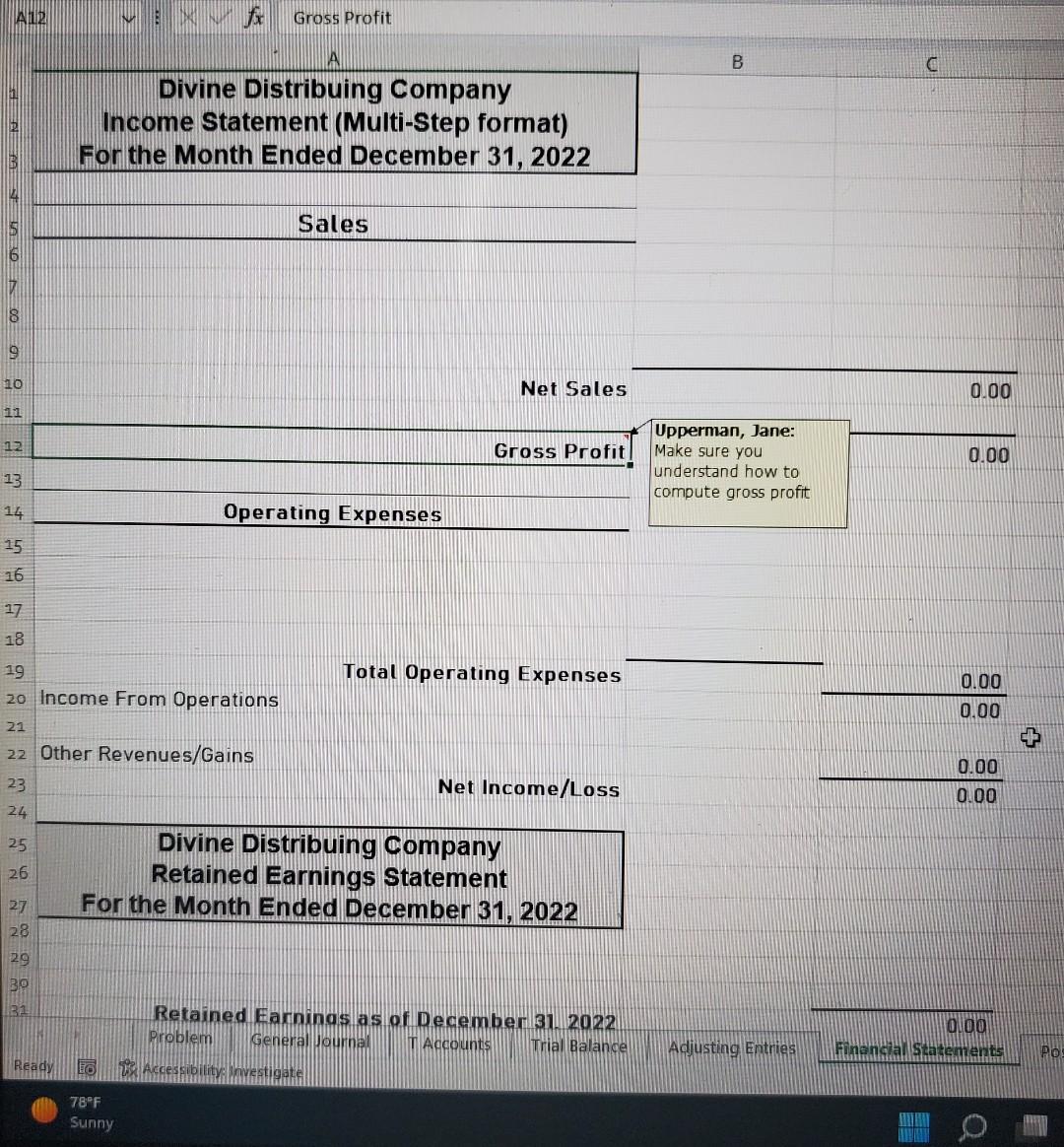

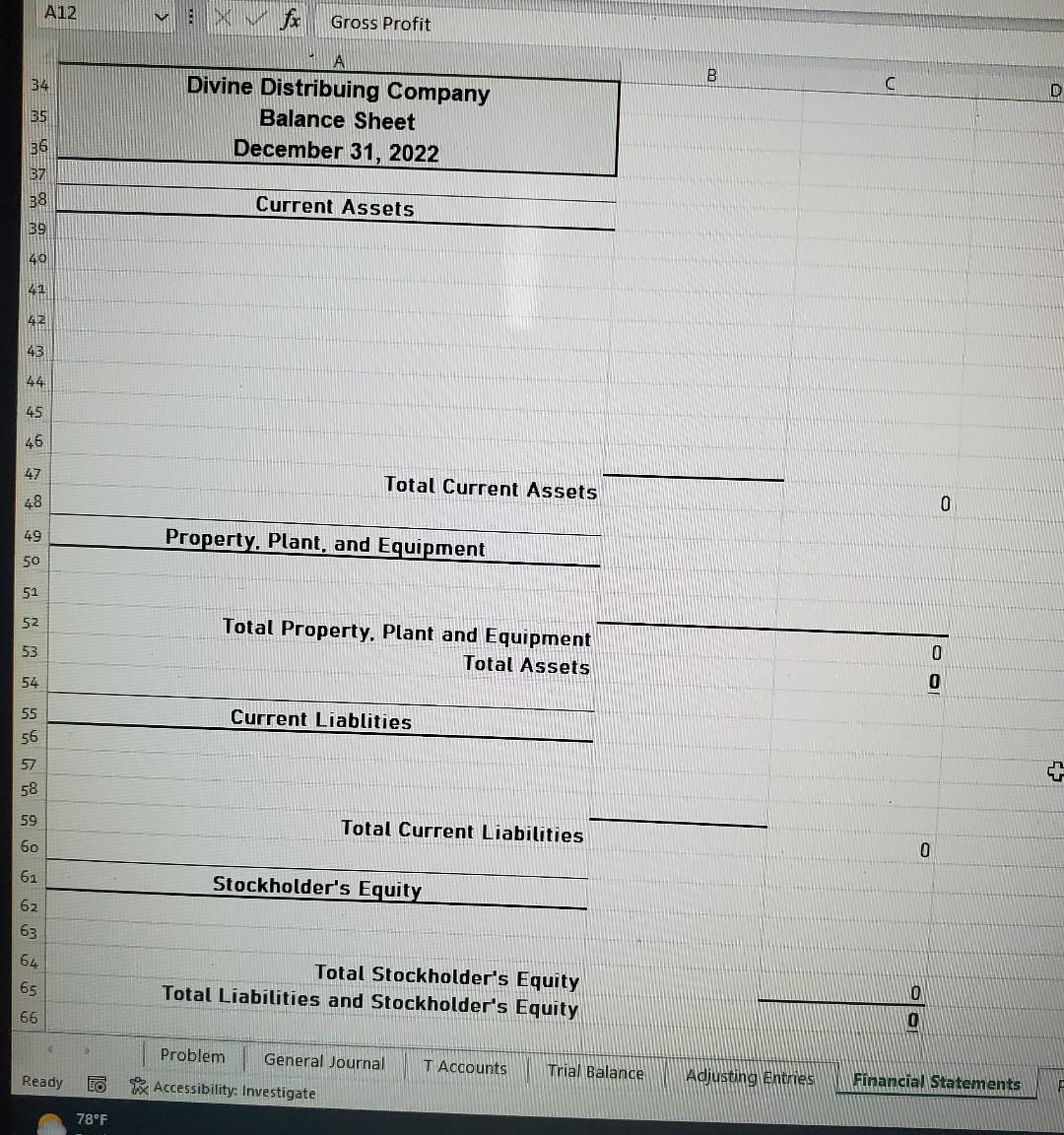

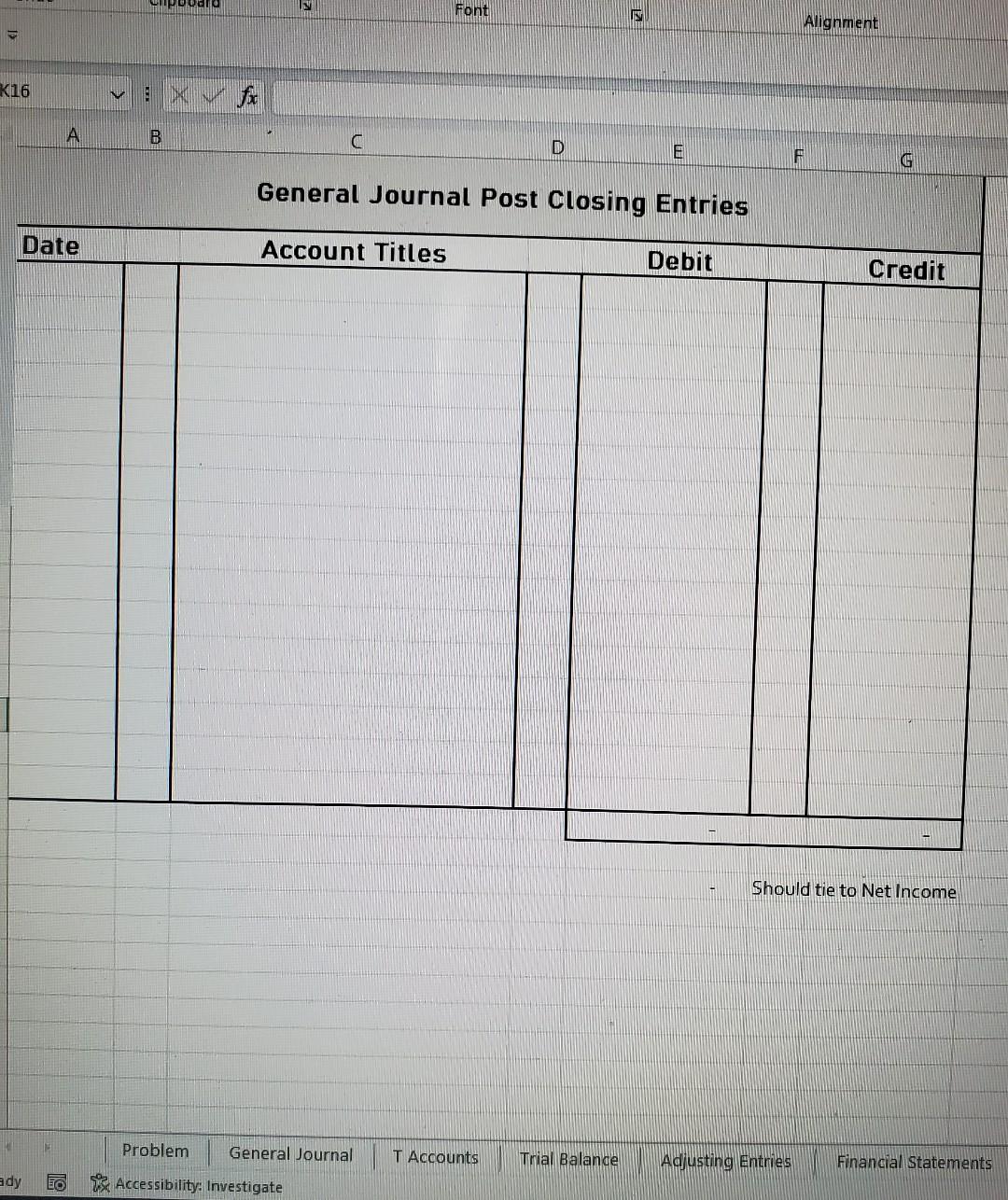

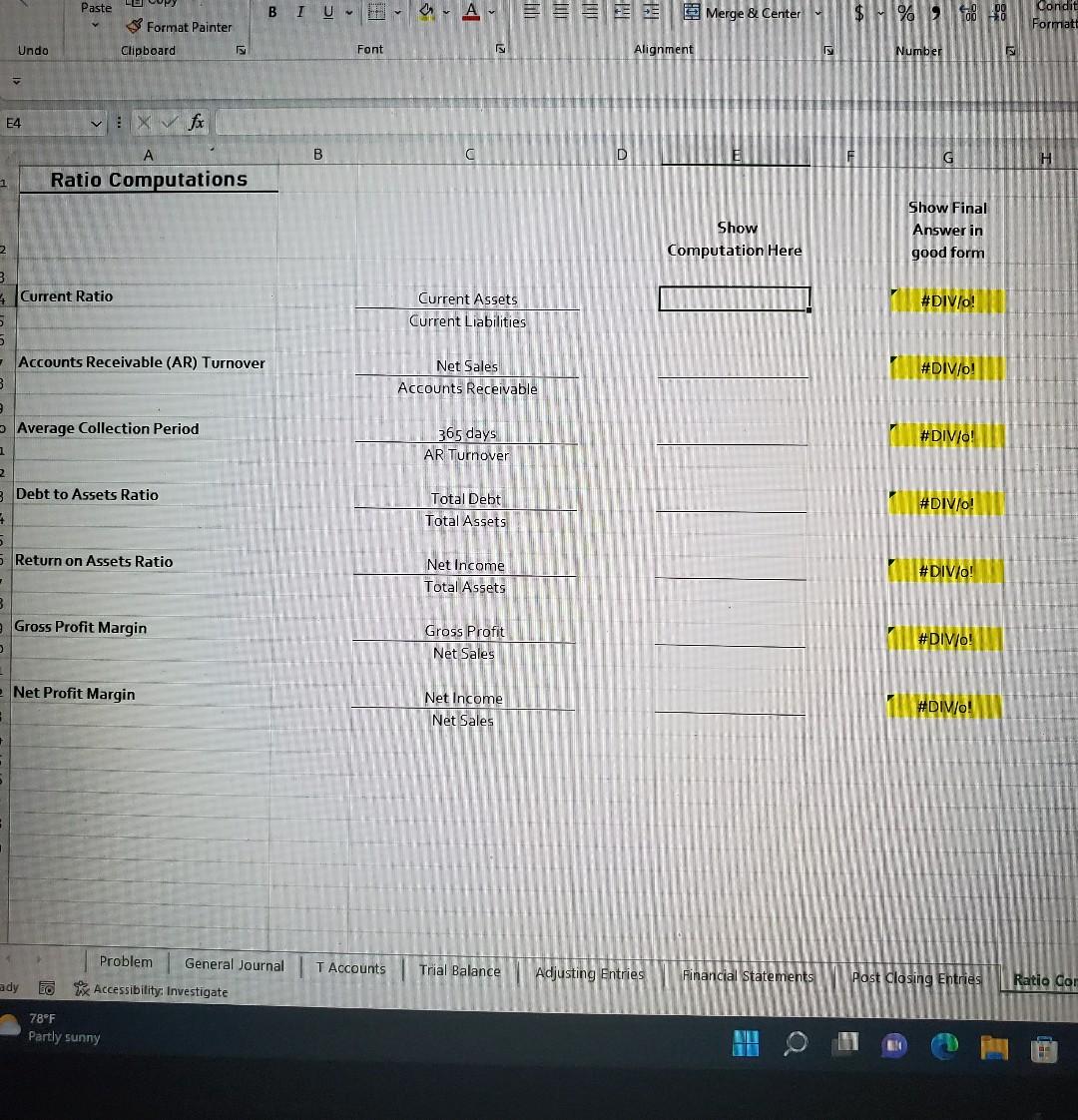

On December 1,2022 , Divine Distributing Company had the following account balances. vuing vecemper, tne company completed the following transactions. 7$250 of defective merchandise was returned from a November 30,2022 sale on account 8 Received $2,240 cash from customers in payment of account (no discount allowed). 10 Sold merchandise for cash $8,200. The cost of the merchandise sold was $4,700. (2 entries required) 13 Purchased merchandise on account from Hecht Co. $5,700, term 2/10,/30. 15 Purchased supplies for cash $1450.00 18 Sold merchandise on account $15,700, terms 3/10,n/30. The cost of the merchandise sold was $8,200. 20 Paid salaries and wages $2,100. 21 Paid $3,600 in advance for next year's annual insurance 23 Paid Hecht Co. in full, less discount. 27 Received collections in full, less discounts, from customers billed on December 18 . 28 Received $800 from customers for services to be preformed in the future 29 Purchase Equipment on account for $7,000 Adjustment data: 1. Accrued salaries and wages payable were $1,150 at the end of the month. 2. Depreciation was $875 per month. 3. Supplies on hand were $1,260 4. One month of interest income should be recorded on the $8000 Note Receivable at an APR of 6% 5. Services were preformed to satisfy $1,050 of the unearned revenue 6. December's prepaid rent has been used (annual amount was $12,000 as recorded in Prepaid Rent). Required: Complete each tab of this Excel Worksheet: General Journal (all transactions in December), map into T Accounts (add any if necessary). prepare Trial Balance prepare the adjusting entries ( 16 above), Prepare Financial Statements in good form (multi-step income statement, statement of retained earnings, balance sheet) prepare the closing entries, prepare the required ratio computations General Journal All Cells that are highlighted in Yellow contain a formula and are the correct side of the T account (left Debit, right Credit balance) Next, prepare Adjusting Journal Entries and record those into the T Accounts and transfer the total account balance to the Trial Balance after adjustments Fx Accessibility: Investigate Ready 78F Sunny \begin{tabular}{l} Undo \\ Date Clipboard Painter \\ \hline \end{tabular} Allis fx Gross Profit Income From Operations Total Operating Expenses 0.000.00 Other Revenues/Gains Net Income/Loss 0.000.00 Divine Distribuing Company Retained Earnings Statement For the Month Ended December 31,2022 78F Sunny I Problem I General Journal | T Accounts Trial Balance Adjusting Eneries 78F General Journal Post Closing Entries Should tie to Net Income \begin{tabular}{l} Undo \\ = \\ E4 \\ Rastipboard \\ Ratio Computations \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started