Answered step by step

Verified Expert Solution

Question

1 Approved Answer

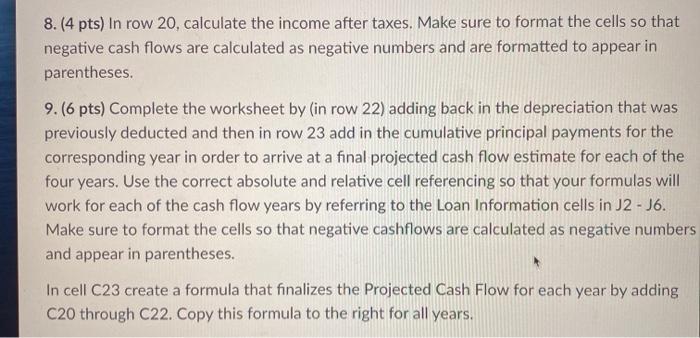

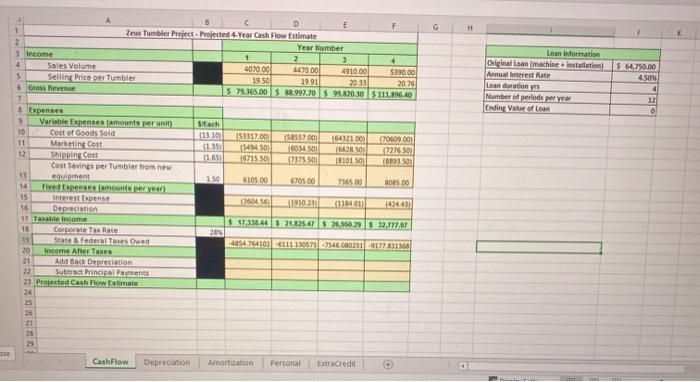

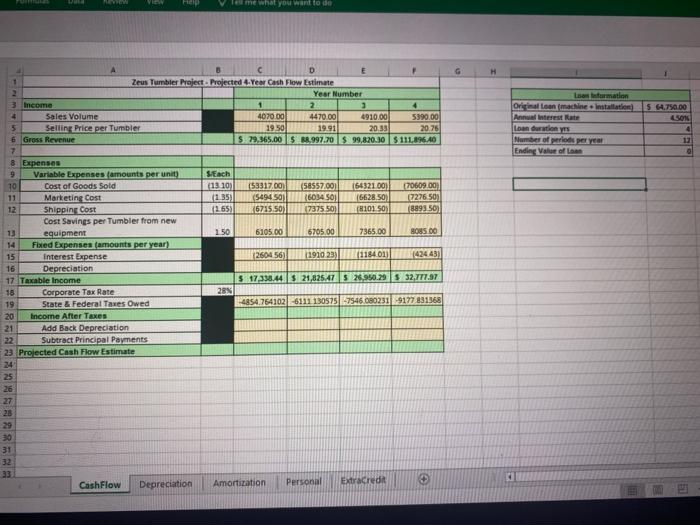

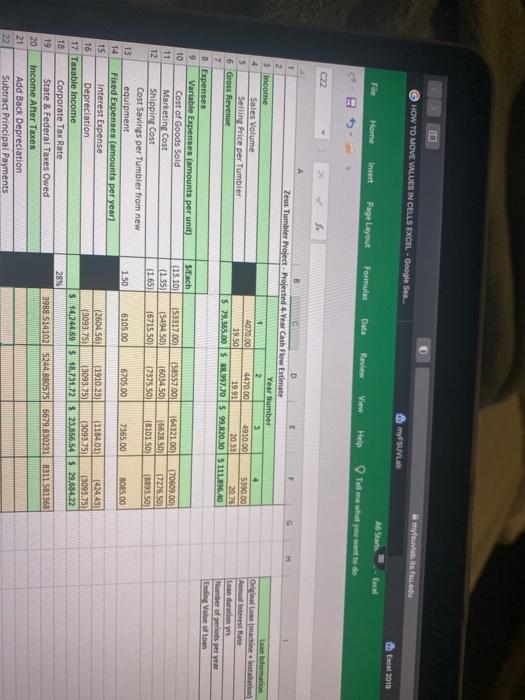

sorry i just got the rest of the information, im confused on the formulas i should use 8. (4 pts) in row 20, calculate the

sorry i just got the rest of the information, im confused on the formulas i should use

8. (4 pts) in row 20, calculate the income after taxes. Make sure to format the cells so that negative cash flows are calculated as negative numbers and are formatted to appear in parentheses. 9. (6 pts) Complete the worksheet by (in row 22) adding back in the depreciation that was previously deducted and then in row 23 add in the cumulative principal payments for the corresponding year in order to arrive at a final projected cash flow estimate for each of the four years. Use the correct absolute and relative cell referencing so that your formulas will work for each of the cash flow years by referring to the Loan Information cells in J2 - 16. Make sure to format the cells so that negative cashflows are calculated as negative numbers and appear in parentheses. In cell C23 create a formula that finalizes the Projected Cash Flow for each year by adding C20 through C22. Copy this formula to the right for all years. G H Loan Information Original Loan (machine installation Annual interest Rate Loan duration y Number of period per year Endine Value of loan $64750.00 4.50% F 1 Zeus Tumbler Project Projected 4-Year Cash Flow Estimate 2 Year Number Income 1 2 4 3 4 Sales Volume 407000 4470.00 491000 $190,00 5 Selling Price per Tumbler 1950 1991 20:33 2020 Gross Revenue 5.79.365.00 $ 18.997.20 99.820.30 $ 111.896.40 7 8 Expenses 9 Variable Expenses amounts per unit) Bach 100 Cost of Goods Sold (1319 15331700 15855700 6452100 700000 Marketing Cost 11.35 15. SO 10140 1662 SON 2276 12 Shipping Cost 11.05 15715 50 173750 181010 1821.01 Cost Savings per Tumbler from new 13 equipment 150 6105.00 670500 795.00 08500 14 Tidenses amounts per year) 15 Interest topense 20454 1930,23 16 Depreciation 17 Taxable income $17.338.4432182541 S 2650.95 13.777.97 10 Corporate Tax Rate 19 State Federal Tes Ded 4854204103-6111175754680231 9177831568 20 Income Alar Taxes 21 Add Back Depreciation Subtract Principal Payments 23. Projected Cash Flow Estimate 24 25 2 20 29 Die Cashflow Depreciation Amortization Personal Extracredit FIP ve me what you want to do G 5 4.750.00 SON 2075 som formation Ora Loon machine Installation Interest Rate Londrionys Number of period per year Ending Value of Los 17 D 1 Zeus Tumbler Project - Projected 4-Year Cash Flow Estimate 2 Year Number 3 Income 1 2 3 4 4 Sales Volume 4070.00 4470.00 491000 5390.00 5 Selline Price per Tumbler 1950 19.91 20:33 6 Gross Revenue $ 29,365.005 R8.997.70S 99.820.30 S 111896.40 7 8. Expenses 9 Variable Expenses (amounts per unit Seach 10 Cost of Goods Sold (1310) 153317.00) (58557.00) (54321.00) [70609.00) 11 Marketing Cost (135) (5494 501 16034 SOM 6628.50 U276.50 12 Shipping Cost (265) 16715.50 (7375.50) 18101.50 1889350) Cost Savings per Tumbler from new 13 equipment 1.50 6105.00 6705.00 7365.00 BOSS DO 14 Fixed Expenses (amounts per year) 15 Interest Expense 1260456) 11910 23) (1184.01) 1424 43) 16 Depreciation 17 Taxable income $ 17,333.44 $21,825.47 5 26.950.295 32./17.97 18 Corporate Tax Rate 28 19 State & Federal Taxes Owed 4854.764102-6111130575-7546 080231 9177 831368 20 Income After Taxes 21 Add Back Depreciation 22 Subtract Principal Payments 23 Projected Cash Flow Estimate 25 27 26 29 30 31 32 4 CashFlow Depreciation Amortization Personal Extracredit HOW TO MOVE VALUES IN CELLS EXCEL - Google Sea myvi...edu FSUVLAD Excel 2010 File Home Insert Ece Page Layout Formulas Data Review View Help Tell me what you want to de > C22 NO Loanimation Oral machine Installation Antest Rate 2039 Number of proper year Ending Valeotto 8 1 Zeus Tumbler Project Projected 4-Year Cash Flow Estimate Year Humber 3 Income 1 2 3 Sales Volume 4070.00 4470.00 4910.00 5990.00 Selling Price per Tumbler 19.50 19.91 20,75 6 Gross Revenue S29,365.00 88.997.705 99.620.305111896.40 7 5 Expenses 9 Variable Expenses (amounts per unit) Seach 10 Cost of Goods Sold (1310) (53317.00) (58557.00 (64321.00 (70609.00) 11 Marketing Cost (1.35 (5494 50) 6034 50) 16628 50 17276.50) 12 Shipping Cost (1.65) 16715.50) 17375.50) (8101 50 (8893.50 Cost Savings per Tumbler from new 13 equipment 150 6105.00 6705.00 7355 00 BO85.00 14 Fixed Expenses (amounts per year) 15 Interest Expense (260456 (1910-23) (118401) (424 431 16 Depreciation (3093.75) (3093.75 13093.75) 13093,75) 17 Taxable income $ 14,244.69 $ 18,731.725 23,855,545 29,684.22 18 Corporate Tax Rate 28% 19 State & Federal Taxes Owed 3988.5141025244.880575 6679.830231 8311 581368 20 Income After Taxes 21 Add Back Depreciation 22 Subtract Principal Payments 8. (4 pts) in row 20, calculate the income after taxes. Make sure to format the cells so that negative cash flows are calculated as negative numbers and are formatted to appear in parentheses. 9. (6 pts) Complete the worksheet by (in row 22) adding back in the depreciation that was previously deducted and then in row 23 add in the cumulative principal payments for the corresponding year in order to arrive at a final projected cash flow estimate for each of the four years. Use the correct absolute and relative cell referencing so that your formulas will work for each of the cash flow years by referring to the Loan Information cells in J2 - 16. Make sure to format the cells so that negative cashflows are calculated as negative numbers and appear in parentheses. In cell C23 create a formula that finalizes the Projected Cash Flow for each year by adding C20 through C22. Copy this formula to the right for all years. G H Loan Information Original Loan (machine installation Annual interest Rate Loan duration y Number of period per year Endine Value of loan $64750.00 4.50% F 1 Zeus Tumbler Project Projected 4-Year Cash Flow Estimate 2 Year Number Income 1 2 4 3 4 Sales Volume 407000 4470.00 491000 $190,00 5 Selling Price per Tumbler 1950 1991 20:33 2020 Gross Revenue 5.79.365.00 $ 18.997.20 99.820.30 $ 111.896.40 7 8 Expenses 9 Variable Expenses amounts per unit) Bach 100 Cost of Goods Sold (1319 15331700 15855700 6452100 700000 Marketing Cost 11.35 15. SO 10140 1662 SON 2276 12 Shipping Cost 11.05 15715 50 173750 181010 1821.01 Cost Savings per Tumbler from new 13 equipment 150 6105.00 670500 795.00 08500 14 Tidenses amounts per year) 15 Interest topense 20454 1930,23 16 Depreciation 17 Taxable income $17.338.4432182541 S 2650.95 13.777.97 10 Corporate Tax Rate 19 State Federal Tes Ded 4854204103-6111175754680231 9177831568 20 Income Alar Taxes 21 Add Back Depreciation Subtract Principal Payments 23. Projected Cash Flow Estimate 24 25 2 20 29 Die Cashflow Depreciation Amortization Personal Extracredit FIP ve me what you want to do G 5 4.750.00 SON 2075 som formation Ora Loon machine Installation Interest Rate Londrionys Number of period per year Ending Value of Los 17 D 1 Zeus Tumbler Project - Projected 4-Year Cash Flow Estimate 2 Year Number 3 Income 1 2 3 4 4 Sales Volume 4070.00 4470.00 491000 5390.00 5 Selline Price per Tumbler 1950 19.91 20:33 6 Gross Revenue $ 29,365.005 R8.997.70S 99.820.30 S 111896.40 7 8. Expenses 9 Variable Expenses (amounts per unit Seach 10 Cost of Goods Sold (1310) 153317.00) (58557.00) (54321.00) [70609.00) 11 Marketing Cost (135) (5494 501 16034 SOM 6628.50 U276.50 12 Shipping Cost (265) 16715.50 (7375.50) 18101.50 1889350) Cost Savings per Tumbler from new 13 equipment 1.50 6105.00 6705.00 7365.00 BOSS DO 14 Fixed Expenses (amounts per year) 15 Interest Expense 1260456) 11910 23) (1184.01) 1424 43) 16 Depreciation 17 Taxable income $ 17,333.44 $21,825.47 5 26.950.295 32./17.97 18 Corporate Tax Rate 28 19 State & Federal Taxes Owed 4854.764102-6111130575-7546 080231 9177 831368 20 Income After Taxes 21 Add Back Depreciation 22 Subtract Principal Payments 23 Projected Cash Flow Estimate 25 27 26 29 30 31 32 4 CashFlow Depreciation Amortization Personal Extracredit HOW TO MOVE VALUES IN CELLS EXCEL - Google Sea myvi...edu FSUVLAD Excel 2010 File Home Insert Ece Page Layout Formulas Data Review View Help Tell me what you want to de > C22 NO Loanimation Oral machine Installation Antest Rate 2039 Number of proper year Ending Valeotto 8 1 Zeus Tumbler Project Projected 4-Year Cash Flow Estimate Year Humber 3 Income 1 2 3 Sales Volume 4070.00 4470.00 4910.00 5990.00 Selling Price per Tumbler 19.50 19.91 20,75 6 Gross Revenue S29,365.00 88.997.705 99.620.305111896.40 7 5 Expenses 9 Variable Expenses (amounts per unit) Seach 10 Cost of Goods Sold (1310) (53317.00) (58557.00 (64321.00 (70609.00) 11 Marketing Cost (1.35 (5494 50) 6034 50) 16628 50 17276.50) 12 Shipping Cost (1.65) 16715.50) 17375.50) (8101 50 (8893.50 Cost Savings per Tumbler from new 13 equipment 150 6105.00 6705.00 7355 00 BO85.00 14 Fixed Expenses (amounts per year) 15 Interest Expense (260456 (1910-23) (118401) (424 431 16 Depreciation (3093.75) (3093.75 13093.75) 13093,75) 17 Taxable income $ 14,244.69 $ 18,731.725 23,855,545 29,684.22 18 Corporate Tax Rate 28% 19 State & Federal Taxes Owed 3988.5141025244.880575 6679.830231 8311 581368 20 Income After Taxes 21 Add Back Depreciation 22 Subtract Principal Payments Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started