Sorry I posted the same question twice on here.

please I need some help!! i will appreciate it!

Thank you!!!

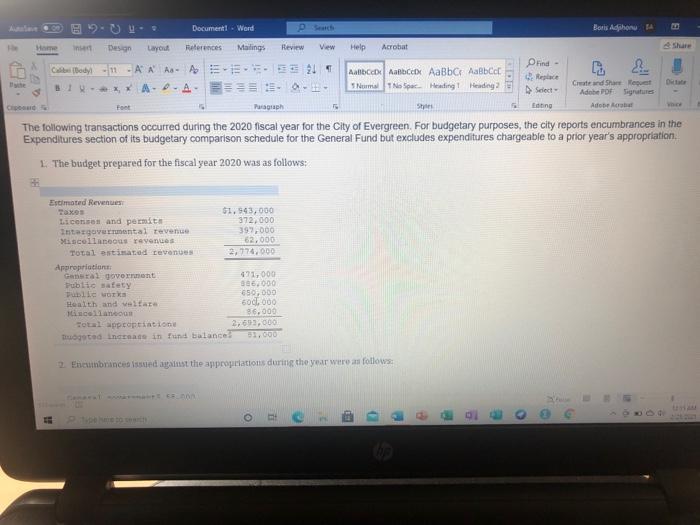

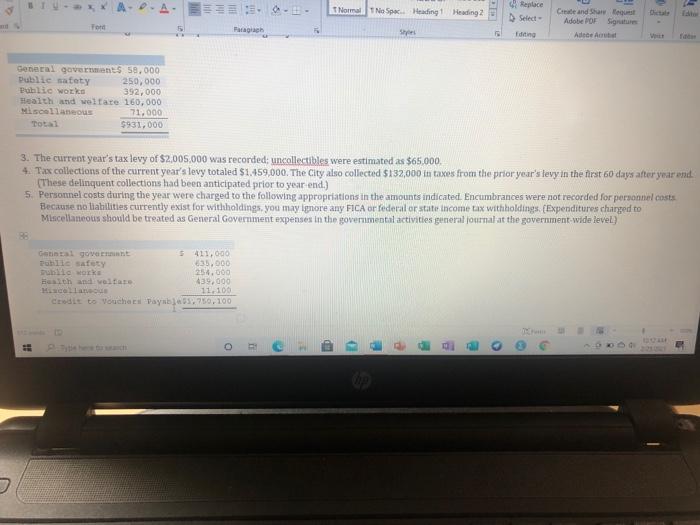

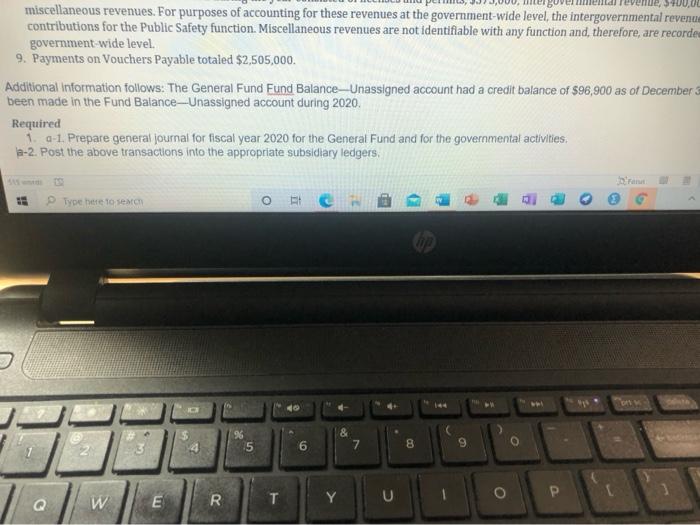

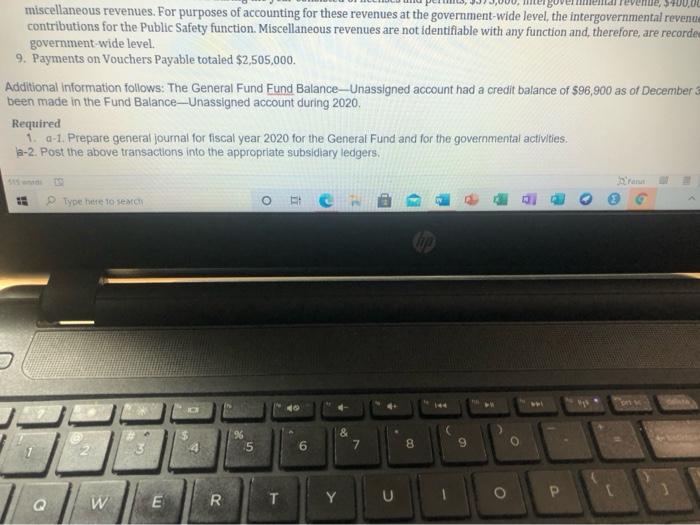

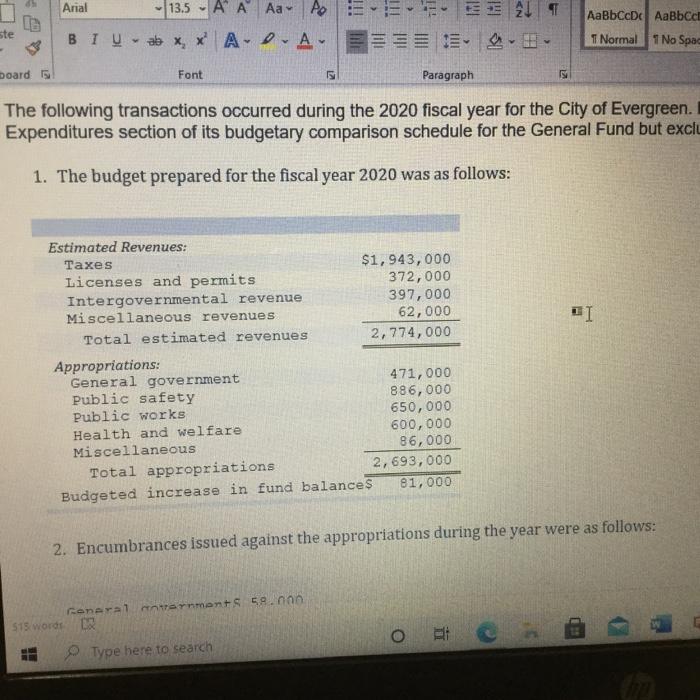

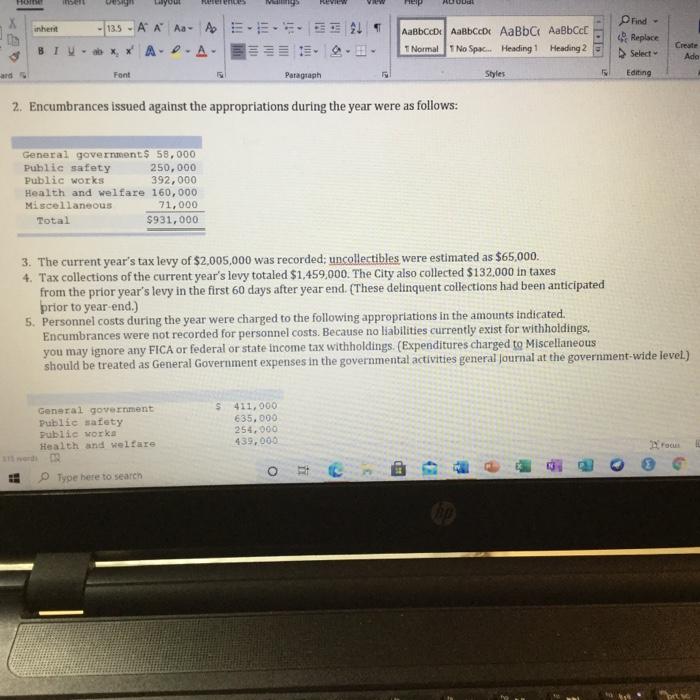

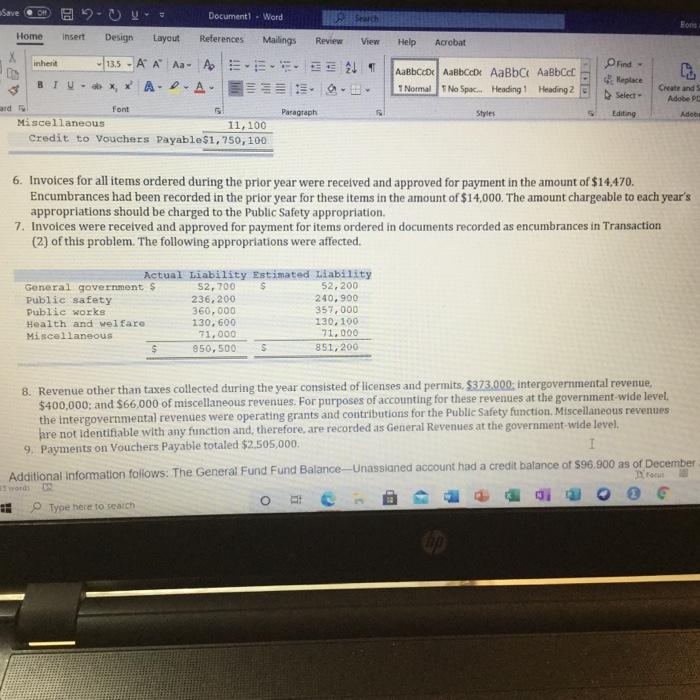

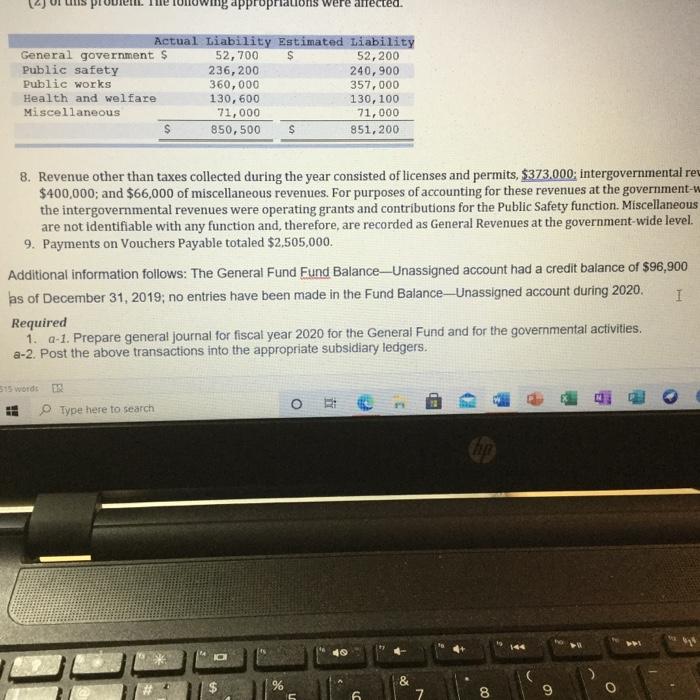

Home Review Acrobat 9 D Documenti Word Boris Adhon Design Layed References Mailings View Help Find Cube Body 1 AN AS A E. 21 Aalbob Alb AaBb Aalbo Replace Create and Shane Neue ** A--A- 5 Nurme No Space Healing Heading Select Adobe PDF Sigrutes pood Paragraph Se Editing Adobe Red The following transactions occurred during the 2020 fiscal year for the City of Evergreen For budgetary purposes, the city reports encumbrances in the Expenditures section of its budgetary comparison schedule for the General Fund but excludes expenditures chargeable to a prior year's appropriation, 1. The budget prepared for the fiscal year 2020 was as follows: Foet Estimated Revenue Taxes 51.543,000 Licons and permite 372,000 Intergovernmental av 397,000 Miscellaneous reyences 62.000 Total estimated tevens 2.774.000 Appropriations General government 471,000 Public safety BB8,000 Public Work 650,000 Health and welfare 600 000 incollane 36.000 Total appropriatione 2,693,000 Thugtad Increato in und balance 2 Encubrincessed against the appropriations during the year were as follows: - E 0 A, T Normal * No Space Heading! Heading 2 Replace Select- Create and Shares Adobe POF Sigruar Ade Art Paragraph Editing General governments 58,000 Dublie safety 250,000 olie work 392,000 Health and welfare 160.000 Miscellaneous 71,000 $931,000 3. The current year's tax levy of $2,00.000 was recorded; uncollectibles were estimated as $65.000, 4. Tax collections of the current year's levy totaled $1.459,000. The City also collected $132,000 in taxes from the prior year's levy in the first 60 days after year and (These delinquent collections had been anticipated prior to year end.) 5. Personnel costs during the year were charged to the following appropriations in the amounts indicated. Encumbrances were not recorded for personnel costs Becaute no liabilities currently exist for withholdings, you may lgnore any FICA or federal or state income tax withholdings {Expenditures charged to Miscellaneous should be treated as General Government expenses in the governmental activities general journal at the government-wide level) Gatineal govern alle safety 5 411,000 35.000 250.000 439.000 11.100 Faith and welfare credit to Voucher Vaynb}****780,100 o da e enue, 400,00 miscellaneous revenues. For purposes of accounting for these revenues at the government-wide level, the intergovernmental revenue contributions for the Public Safety function. Miscellaneous revenues are not identifiable with any function and therefore, are recorde government wide level. 9. Payments on Vouchers Payable totaled $2,505,000 Additional information follows: The General Fund Fund Balance-Unassigned account had a credit balance of $96,900 as of December been made in the Fund Balance-Unassigned account during 2020. Required 1.0-1. Prepare general journal for fiscal year 2020 for the General Fund and for the governmental activities -2. Post the above transactions into the appropriate subsidiary ledgers, Type here to see 96 5 & 7 6 8 P O W U E T Q R Y che 00.00 miscellaneous revenues. For purposes of accounting for these revenues at the government-wide level, the intergovernmental revenue contributions for the Public Safety function. Miscellaneous revenues are not identifiable with any function and therefore, are recorde government wide level. 9. Payments on Vouchers Payable totaled $2,505,000. Additional information follows: The General Fund Fund Balance-Unassigned account had a credit balance of $96,900 as of December been made in the Fund Balance-Unassigned account during 2020. Required 1. 0-1. Prepare general journal for fiscal year 2020 for the General Fund and for the governmental activities 12-2. Post the above transactions into the appropriate subsidiary ledgers, ra Typehe 10 SMC & 7 5 6 8 P C Q W E Y R Arial 13.5 - A A A A E 27 AaBbCcDc AaBbcc 1 Normal 1 No Spac ste BIU-a , * A-D-A- board Font Paragraph The following transactions occurred during the 2020 fiscal year for the City of Evergreen. Expenditures section of its budgetary comparison schedule for the General Fund but exclu 1. The budget prepared for the fiscal year 2020 was as follows: II Estimated Revenues: Taxes $1,943,000 Licenses and permits 372,000 Intergovernmental revenue 397,000 Miscellaneous revenues 62,000 Total estimated revenues 2,774,000 Appropriations: General government 471,000 Public safety 886,000 Public Works 650,000 Health and welfare 600,000 Miscellaneous 86,000 Total appropriations 2,693,000 Budgeted increase in fund balances 81,000 2. Encumbrances issued against the appropriations during the year were as follows: General Ternments 58. non 515 wordtR Type here to search o Home . w Heren ma HEP MODER inherit na 13.5 . A A A- A E21 ab X, * AO-A- AaBbcc Aabbcc AaBb AaBbcc 1 Normal 1 No Spac... Heading 1 Heading 2 Find Replace Select Editing Create Ada Font Paragraph Styles 2. Encumbrances issued against the appropriations during the year were as follows: General government $ 58,000 Public safety 250,000 Public works 392,000 Health and welfare 160,000 Miscellaneous 71,000 Total $931,000 3. The current year's tax levy of $2,005,000 was recorded: uncollectibles were estimated as $65,000. 4. Tax collections of the current year's levy totaled $1,459,000. The City also collected $132,000 in taxes from the prior year's levy in the first 60 days after year end. (These delinquent collections had been anticipated prior to year end.) 5. Personnel costs during the year were charged to the following appropriations in the amounts indicated. Encumbrances were not recorded for personnel costs. Because no liabilities currently exist for withholdings, you may ignore any FICA or federal or state income tax withholdings (Expenditures charged to Miscellaneous should be treated as General Government expenses in the governmental activities general Journal at the government-wide levet.) General government Public safety Public worka Health and welfare $ 411,000 635,000 254,000 439,000 Focus O Type here to search Save - OVH Document - Word Sons Home Insert Design Layout References Mailings Review View Help Acrobat inherit 13.5. A A A A E BLU-X * A-D-A- AaBbcc AaBbccb AaBbc AaBbc 1 Normal No Space Heading Heading 2 Find Replace Select Editing Create and Adobe PE font Paragraph Styles Adobe Miscellaneous 11, 100 Credit to Vouchers Payables1,750, 100 6. Invoices for all items ordered during the prior year were received and approved for payment in the amount of $14,470. Encumbrances had been recorded in the prior year for these items in the amount of $14,000. The amount chargeable to each year's appropriations should be charged to the Public Safety appropriation. 7. Invoices were received and approved for payment for items ordered in documents recorded as encumbrances in Transaction (2) of this problem. The following appropriations were affected. Actual Liability Estimated Liability General government s 52,700 s 52,200 Public safety 236,200 240,900 Public works 360,000 357,000 Health and welfaro 130, 600 130,100 Miscellaneous 71,000 71.000 $ 950, 500 S 851,200 8. Revenue other than taxes collected during the year consisted of licenses and permits, $373.000: Intergovernmental revenue. $400,000; and $66,000 of miscellaneous revenues. For purposes of accounting for these revenues at the government wide level, the intergovernmental revenues were operating grants and contributions for the Public Safety function. Miscellaneous revenues are not identifiable with any function and therefore, are recorded as General Revenues at the government-wide level. 9. Payments on Vouchers Payable totaled $2,505,000. 1 Additional information follows: The General Fund Fund Balance-Unassianed account had a credit balance of 596,900 as of December ro O 1 Type here to search word 1 prou appropriations re arrected Actual Liability Estimated Liability General government S 52,700 S 52,200 Public safety 236,200 240,900 Public works 360,000 357,000 Health and welfare 130, 600 130, 100 Miscellaneous 71,000 71,000 850,500 S 851,200 8. Revenue other than taxes collected during the year consisted of licenses and permits, $373.000; intergovernmental rew $400,000; and $66,000 of miscellaneous revenues. For purposes of accounting for these revenues at the government- the intergovernmental revenues were operating grants and contributions for the Public Safety function. Miscellaneous are not identifiable with any function and therefore, are recorded as General Revenues at the government-wide level. 9. Payments on Vouchers Payable totaled $2,505,000. Additional information follows: The General Fund Fund Balance --Unassigned account had a credit balance of $96,900 as of December 31, 2019; no entries have been made in the Fund Balance-Unassigned account during 2020. I Required 1. 2-1. Prepare general Journal for fiscal year 2020 for the General Fund and for the governmental activities. a-2. Post the above transactions into the appropriate subsidiary ledgers. 515 words Type here to search % 6 0 7 8