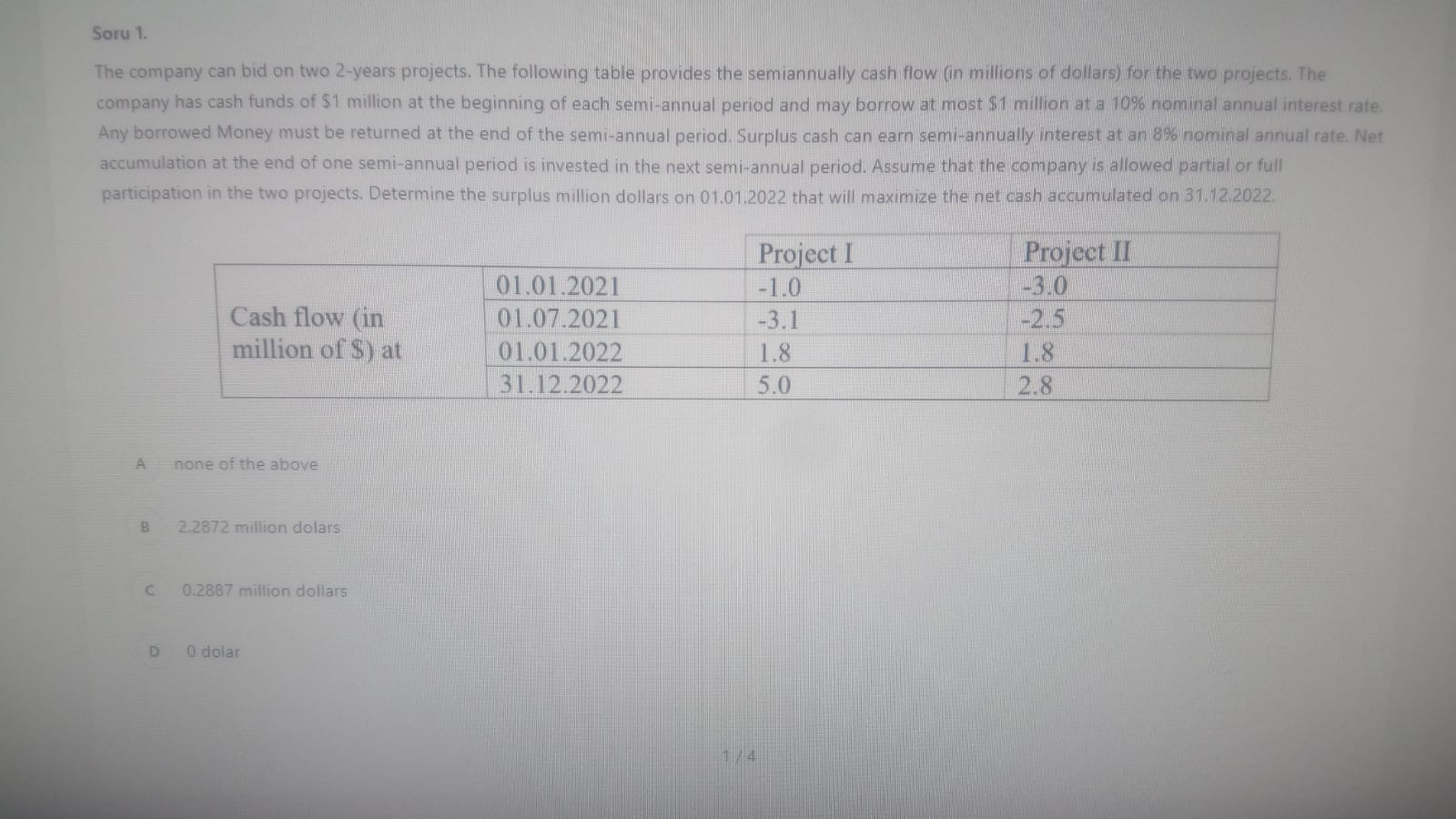

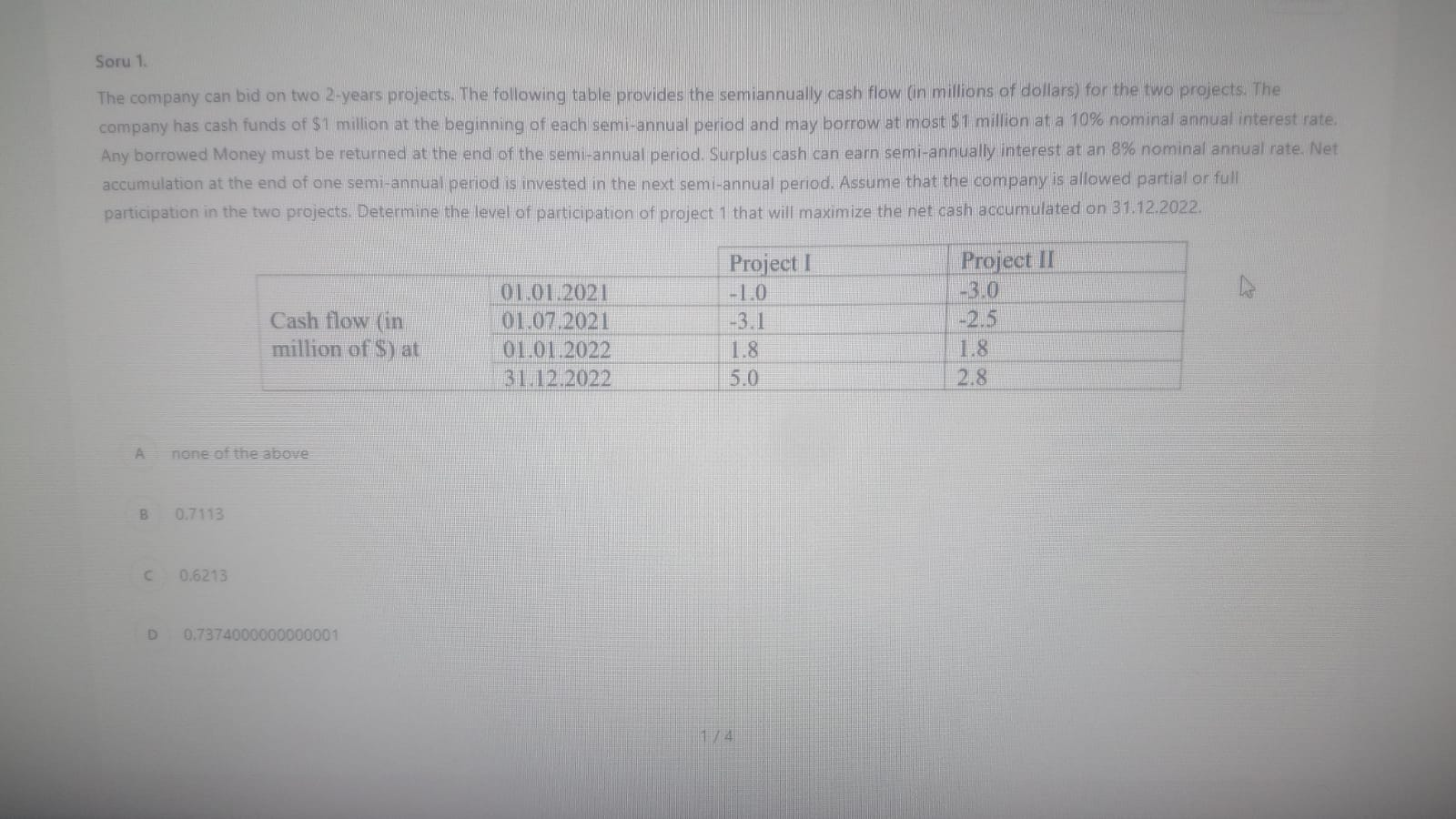

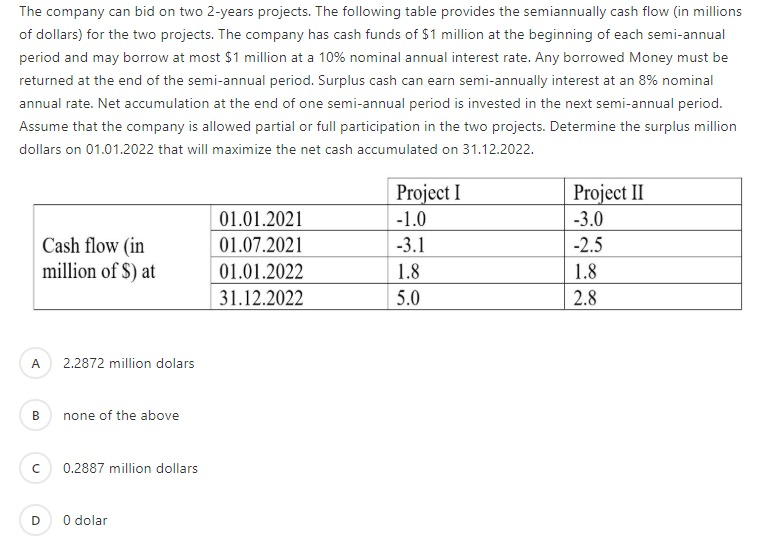

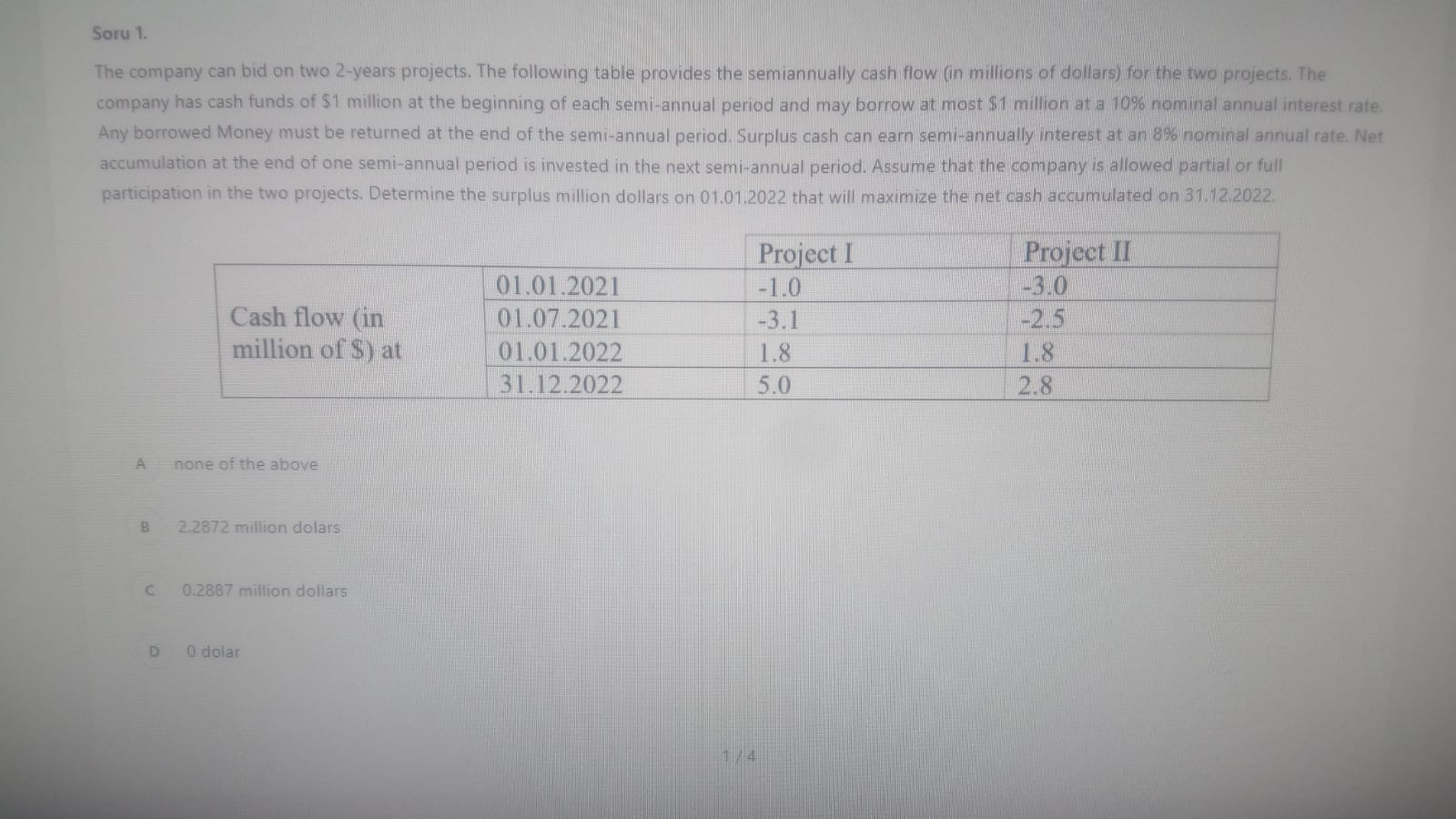

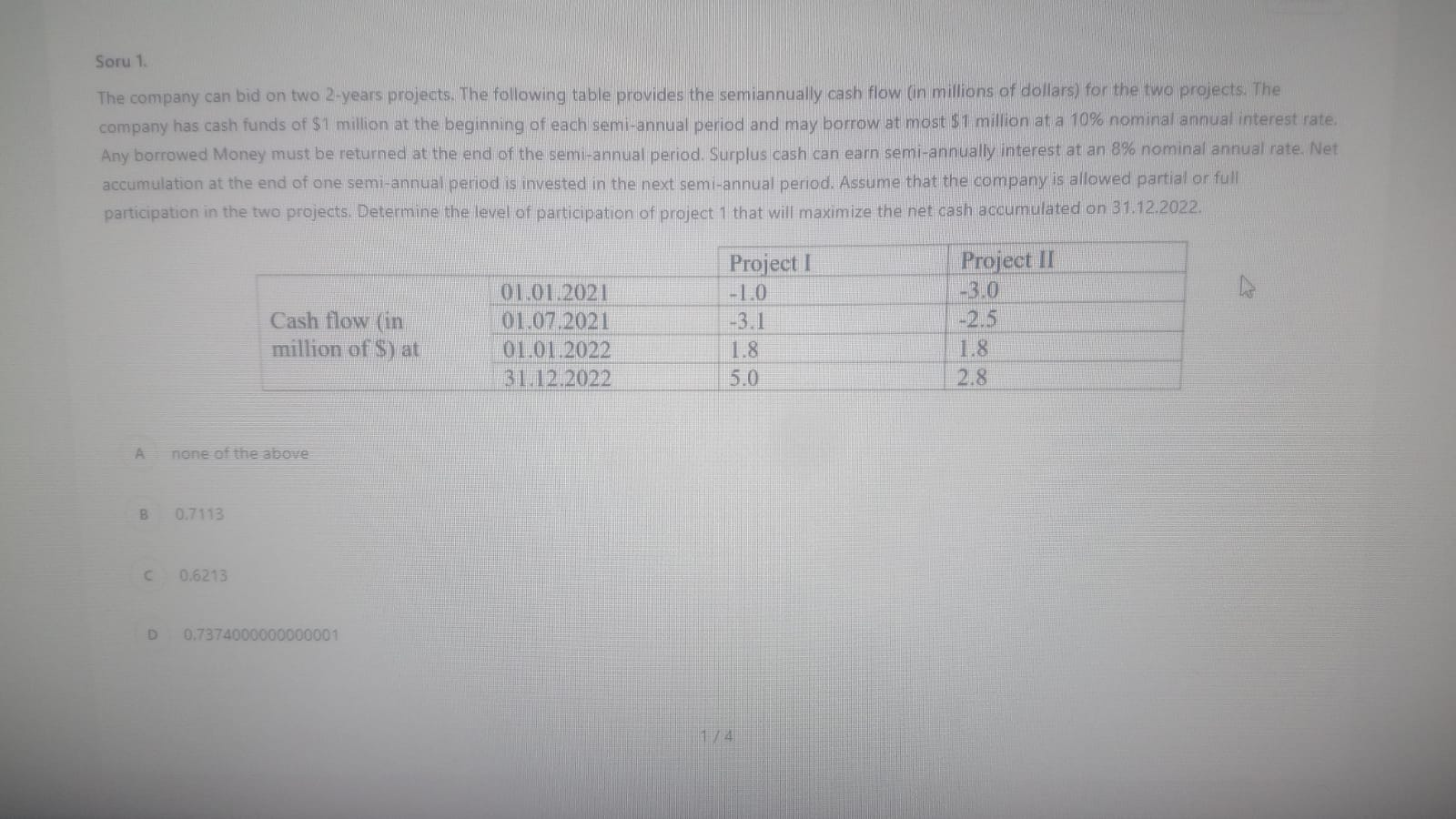

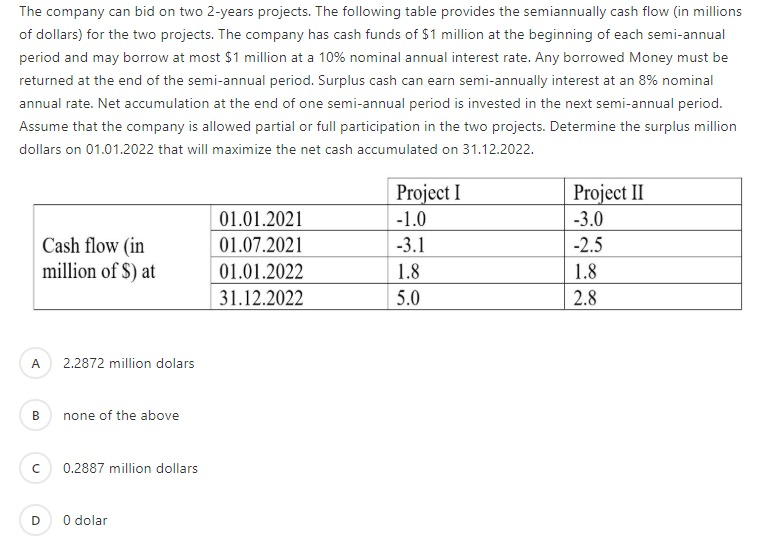

Soru 1. The company can bid on two 2-years projects. The following table provides the semiannually cash flow (in millions of dollars) for the two projects. The company has cash funds of $1 million at the beginning of each semi-annual period and may borrow at most $1 million at a 10% nominal annual interest rate. Any borrowed Money must be returned at the end of the semi-annual period, Surplus cash can earn semi-annually interest at an 8% nominal annual rate. Net accumulation at the end of one semi-annual period is invested in the next semi-annual period. Assume that the company is allowed partial or full participation in the two projects. Determine the surplus million dollars on 01.01.2022 that will maximize the net cash accumulated on 31.12.2022 Cash flow (in million of $) at 01.01.2021 01.07.2021 01.01.2022 31.12.2022 Project I -1.0 -3.1 1.8 5.0 Project II -3.0 -2.5 1.8 2.8 none of the above B 2.2872 million dolars 0.2887 million dollars D 0 dolar Soru 1. The company can bid on two 2-years projects. The following table provides the semiannually cash flow (in millions of dollars) for the two projects. The company has cash funds of $1 million at the beginning of each semi-annual period and may borrow at most $1 million at a 10% nominal annual interest rate, Any borrowed Money must be returned at the end of the semi-annual period. Surplus cash can earn semi-annually interest at an 8% nominal annual rate. Net accumulation at the end of one semi-annual period is invested in the next semi-annual period. Assume that the company is allowed partial or full participation in the two projects. Determine the level of participation of project 1 that will maximize the net cash accumulated on 31.12.2022. Project Project IT -300 -2015 Cash flow (in million of $) at 01.01.2021 01.07.2021 01.01.2022 31.12.2022 -3.1 1.8 5.0 2.8 none of the above B 0.7113 0.6213 0.7374000000000001 174 The company can bid on two 2-years projects. The following table provides the semiannually cash flow (in millions of dollars) for the two projects. The company has cash funds of $1 million at the beginning of each semi-annual period and may borrow at most $1 million at a 10% nominal annual interest rate. Any borrowed Money must be returned at the end of the semi-annual period. Surplus cash can earn semi-annually interest at an 8% nominal annual rate. Net accumulation at the end of one semi-annual period is invested in the next semi-annual period. Assume that the company is allowed partial or full participation in the two projects. Determine the surplus million dollars on 01.01.2022 that will maximize the net cash accumulated on 31.12.2022. Cash flow (in million of S) at 01.01.2021 01.07.2021 01.01.2022 31.12.2022 Project I -1.0 -3.1 1.8 5.0 Project II -3.0 -2.5 1.8 2.8 2.2872 million dolars B none of the above 0.2887 million dollars D 0 dolar Soru 1. The company can bid on two 2-years projects. The following table provides the semiannually cash flow (in millions of dollars) for the two projects. The company has cash funds of $1 million at the beginning of each semi-annual period and may borrow at most $1 million at a 10% nominal annual interest rate. Any borrowed Money must be returned at the end of the semi-annual period, Surplus cash can earn semi-annually interest at an 8% nominal annual rate. Net accumulation at the end of one semi-annual period is invested in the next semi-annual period. Assume that the company is allowed partial or full participation in the two projects. Determine the surplus million dollars on 01.01.2022 that will maximize the net cash accumulated on 31.12.2022 Cash flow (in million of $) at 01.01.2021 01.07.2021 01.01.2022 31.12.2022 Project I -1.0 -3.1 1.8 5.0 Project II -3.0 -2.5 1.8 2.8 none of the above B 2.2872 million dolars 0.2887 million dollars D 0 dolar Soru 1. The company can bid on two 2-years projects. The following table provides the semiannually cash flow (in millions of dollars) for the two projects. The company has cash funds of $1 million at the beginning of each semi-annual period and may borrow at most $1 million at a 10% nominal annual interest rate, Any borrowed Money must be returned at the end of the semi-annual period. Surplus cash can earn semi-annually interest at an 8% nominal annual rate. Net accumulation at the end of one semi-annual period is invested in the next semi-annual period. Assume that the company is allowed partial or full participation in the two projects. Determine the level of participation of project 1 that will maximize the net cash accumulated on 31.12.2022. Project Project IT -300 -2015 Cash flow (in million of $) at 01.01.2021 01.07.2021 01.01.2022 31.12.2022 -3.1 1.8 5.0 2.8 none of the above B 0.7113 0.6213 0.7374000000000001 174 The company can bid on two 2-years projects. The following table provides the semiannually cash flow (in millions of dollars) for the two projects. The company has cash funds of $1 million at the beginning of each semi-annual period and may borrow at most $1 million at a 10% nominal annual interest rate. Any borrowed Money must be returned at the end of the semi-annual period. Surplus cash can earn semi-annually interest at an 8% nominal annual rate. Net accumulation at the end of one semi-annual period is invested in the next semi-annual period. Assume that the company is allowed partial or full participation in the two projects. Determine the surplus million dollars on 01.01.2022 that will maximize the net cash accumulated on 31.12.2022. Cash flow (in million of S) at 01.01.2021 01.07.2021 01.01.2022 31.12.2022 Project I -1.0 -3.1 1.8 5.0 Project II -3.0 -2.5 1.8 2.8 2.2872 million dolars B none of the above 0.2887 million dollars D 0 dolar